- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

Is Now the Moment to Reconsider NVIDIA After H20 Chip Demand Spike?

Reviewed by Simply Wall St

If you’re keeping an eye on NVIDIA, you’re not alone. Investors everywhere are asking whether it’s too late to jump in, time to cash out, or smart to simply hold on. With AI dominating headlines and NVIDIA at the center of the semiconductor world, the stock has been anything but quiet lately. Over the past three months alone, NVIDIA shares have soared more than 60%, outpacing both the US market and its own industry peers. One-year returns top 53%, an eye-popping figure that reflects a market rewarding the company’s rapid growth and seemingly boundless potential.

Several news stories have stirred investor excitement recently. NVIDIA’s supply deals for its H20 chips point to strong ongoing demand, particularly out of China. Meanwhile, startups like Cerebras and Fireworks AI are racing to carve out a share of the AI chip and server market, relying (in part) on NVIDIA’s technology. Geopolitical moves, such as the current pause on US tech export curbs, have also added fuel to the fire. This has eased some of the risks previously weighing on shares.

Of course, eye-watering returns and headlines are only part of the story. With a current valuation score of 2 out of 6 (meaning the company appears undervalued in just 2 areas by our metrics), the real question is whether NVIDIA’s rapid growth is enough to justify its high price tag. Next, let’s break down the valuation checks one by one and see what they reveal about where NVIDIA stands today.

Is NVIDIA financially strong enough to weather the next crisis?

Approach 1: NVIDIA Cash Flows

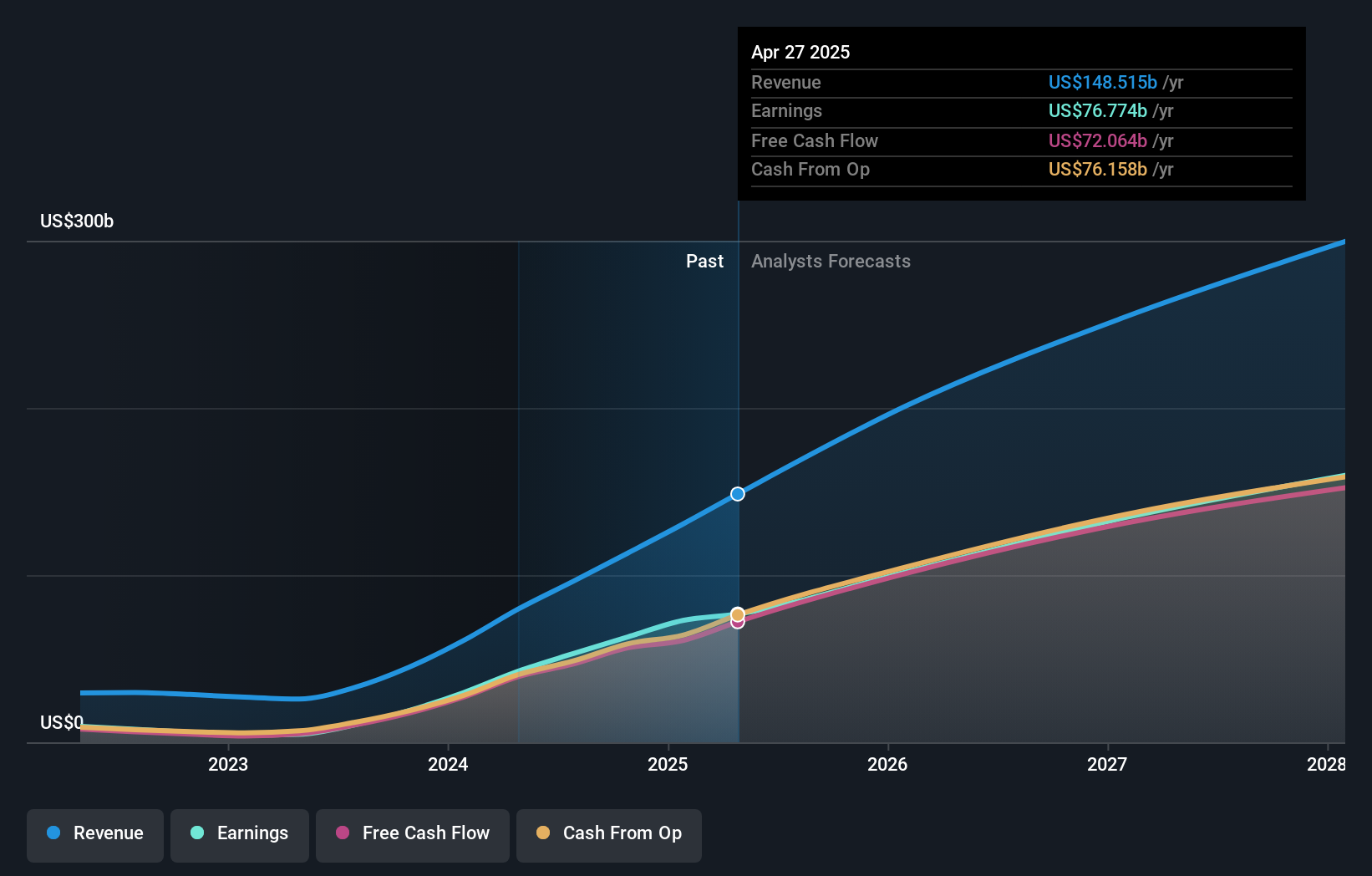

A Discounted Cash Flow, or DCF, model projects a company’s future free cash flows and then discounts them back to today’s value. The goal is to estimate what the business should be worth now if all goes according to plan. For NVIDIA, the latest twelve months’ free cash flow is $72 billion, with analysts forecasting robust growth in the years ahead. By 2030, estimates have NVIDIA generating over $210 billion in free cash flow, supporting expectations of substantial expansion as AI demand continues to surge.

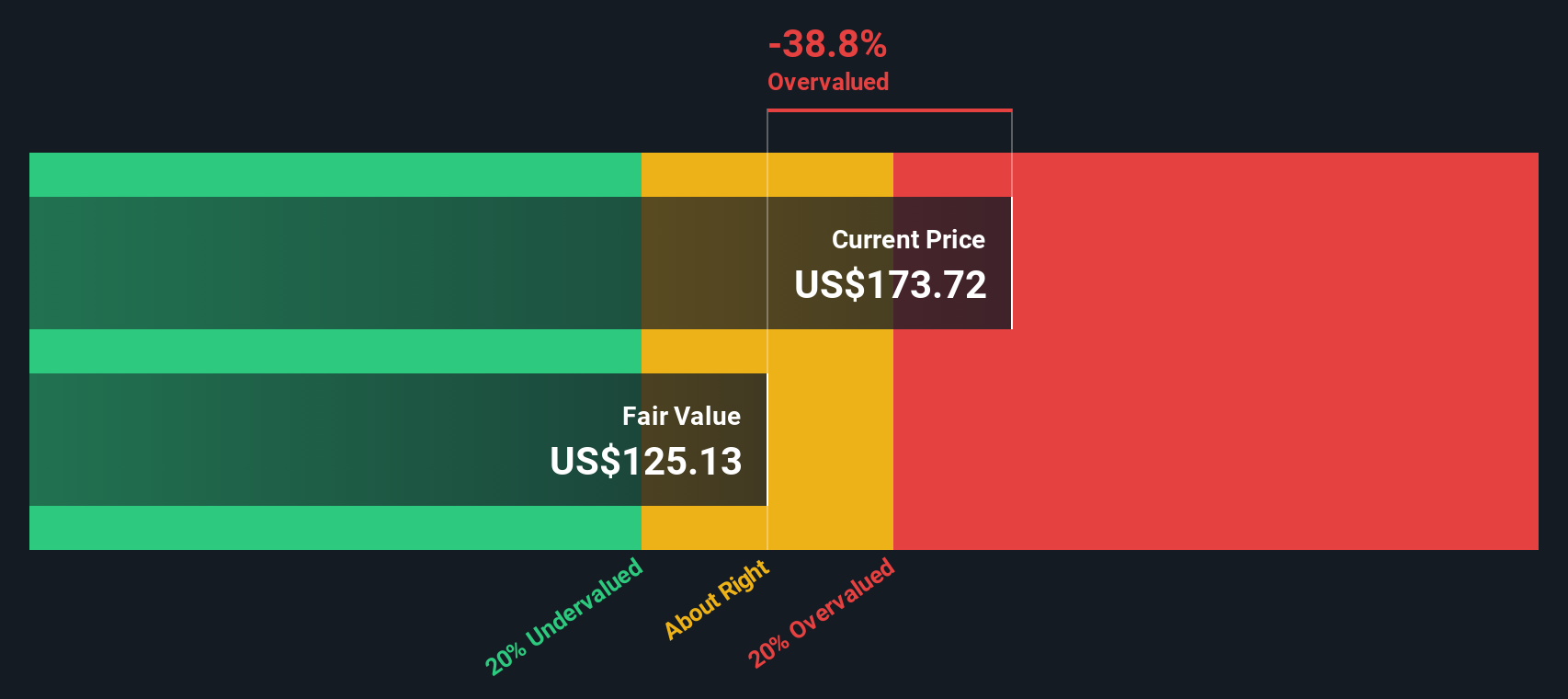

Using these projections and discounting each future year appropriately, the DCF model calculates an intrinsic value of $130.28 per share. Given NVIDIA’s current price, this suggests the stock is trading at roughly 37.6% above its intrinsic value by this measure, indicating the stock is more expensive than what the cash flow math alone might justify.

Result: OVERVALUED

Approach 2: NVIDIA Price vs Earnings

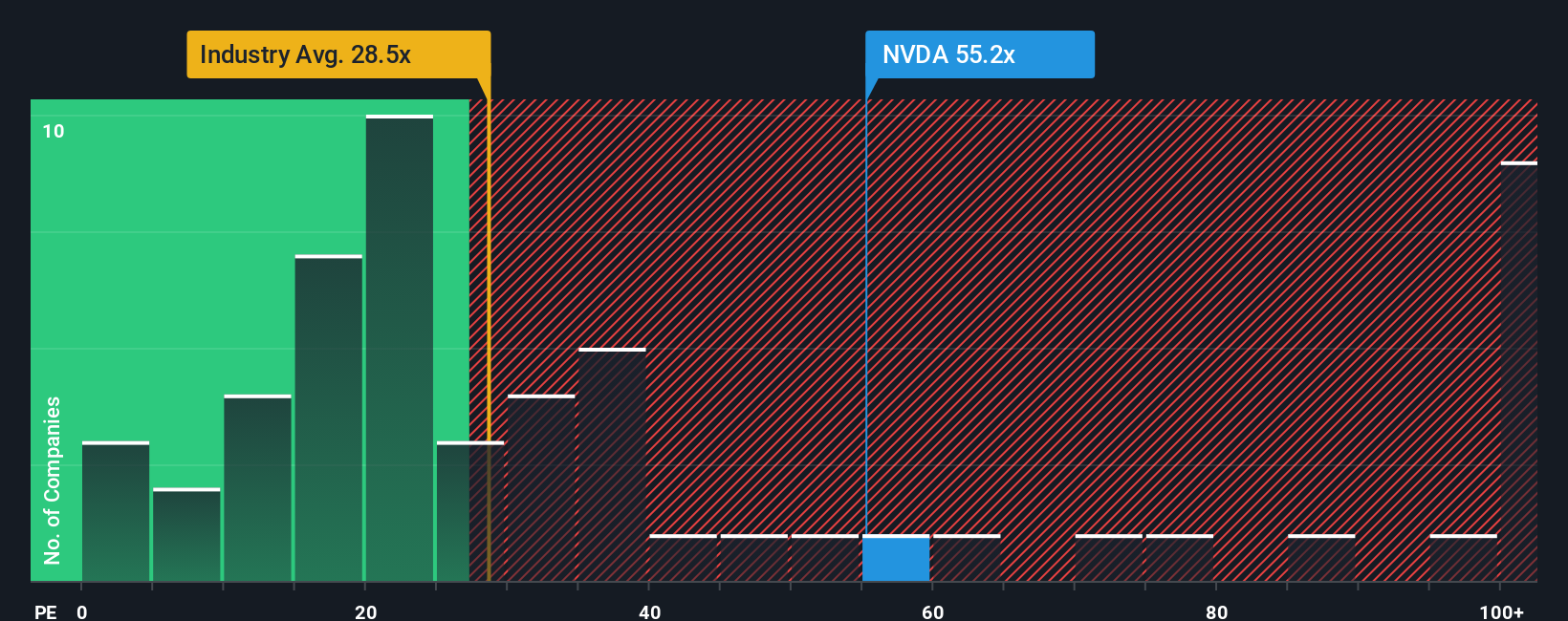

The price-to-earnings (PE) ratio is often the go-to metric for valuing profitable technology companies like NVIDIA because it ties the company’s stock price directly to its earnings. Investors use this ratio to gauge how much they are paying for each dollar of current profit, which can be especially revealing for companies with established track records and clear growth trajectories.

A "normal" or "fair" PE ratio is shaped by future earnings growth and perceived risk. High-growth companies tend to justify higher PE multiples, as investors are willing to pay now in anticipation of bigger profits in the future. At the same time, riskier business models or uncertain markets can limit how high that number should go.

NVIDIA currently trades at a PE ratio of 57x. For context, the average PE for its US semiconductor peers is 72x, while the broader industry average is 29.7x. Based on earnings expectations and growth potential, NVIDIA’s fair ratio is calculated at 62.4x. Notably, NVIDIA’s actual PE is slightly below this benchmark, indicating that the stock’s price is well aligned with its earnings growth outlook.

Result: ABOUT RIGHT

Does NVIDIA's recent performance justify the CEO's compensation?

Upgrade Your Decision Making: Choose your NVIDIA Narrative

While numbers like fair value and PE ratio offer a snapshot of what a stock is “worth,” they don’t tell the whole story. That’s where Narratives come in: a Narrative is your own investment story, linking what you believe about a company’s future (its revenue, earnings, and margins) with a financial forecast and estimated fair value, all grounded in your perspective, not just the consensus.

This approach, used by the Simply Wall St community, makes it easy to tie your view of NVIDIA’s business to concrete financial outcomes. This helps you decide if it’s a buy, sell, or hold by comparing your Fair Value to the current Price. Narratives are updated automatically as new news or earnings are reported, so your story evolves with the facts.

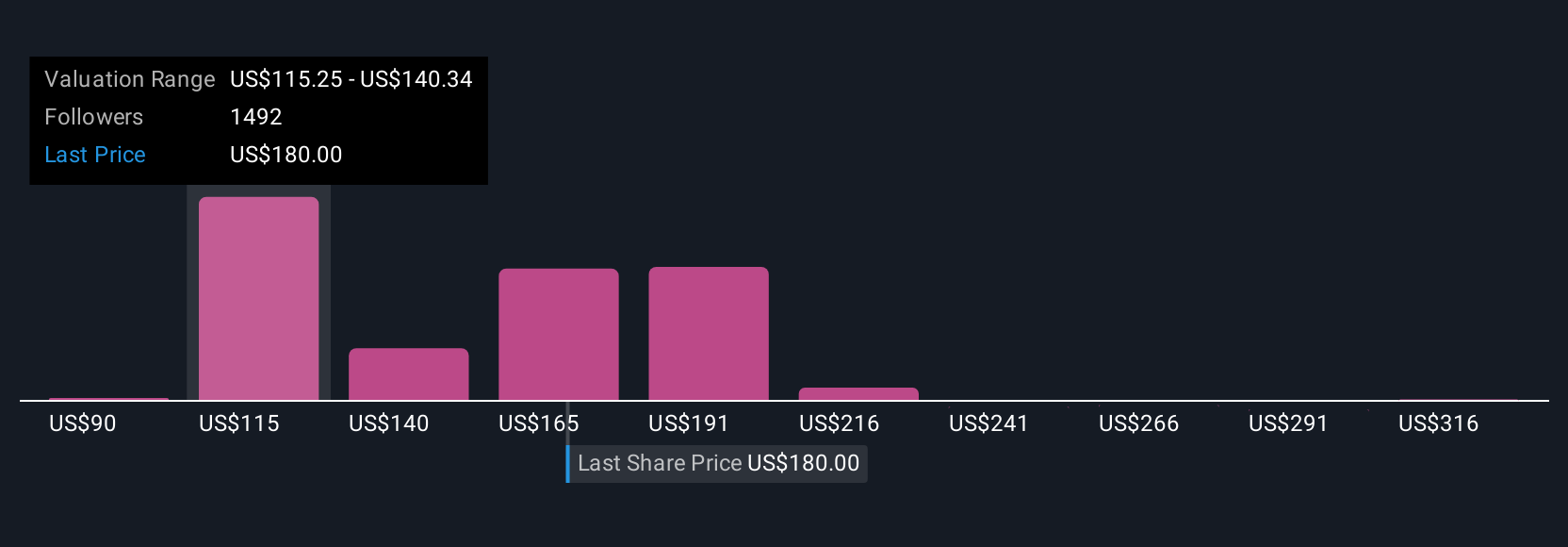

For example, some investors see NVIDIA rising to $341 per share by 2028, fueled by dominant data center growth and industry innovation. Others take a more cautious view, suggesting fair value is closer to $67 if competition and supply pressures undercut margins. Narratives help you test and refine your own view, making smarter investing more accessible than ever.

See our AI narrative and valuation for NVIDIA.

For NVIDIA, we’ll make it really easy for you with previews of two leading NVIDIA Narratives:

Netflix Bull Case

Fair Value: $1,350.32Undervalued by: 14.2%

Revenue growth (3y): 12.5%

- Ad tech and global partnerships are driving higher monetization and subscriber growth.

- AI-powered features and a diverse content library are improving engagement, retention, and margins.

- Major risks include competition, rising content costs, and global regulatory pressures.

Netflix Bear Case

Fair Value: $797.74Overvalued by: 45.2%

Revenue growth (5y): 13.0%

- Streaming market consolidation is giving Netflix greater negotiating power and content scale.

- Ad-supported plans, paid sharing, and price increases are expected to support future user and revenue growth.

- Rising costs, increased competition, and execution risks may limit profit margins and overall growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives