- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (NasdaqGS:MU) Surges 14% After Launching 4600 PCIe Gen5 NVMe SSD

Reviewed by Simply Wall St

Micron Technology (NasdaqGS:MU) recently launched the Micron 4600 PCIe Gen5 NVMe SSD, boasting significant performance improvements and energy efficiency, targeting gamers and professionals. This product announcement could have been a driver behind the company's share price increase of 14% over the past week, as it underscores Micron's innovation in the tech sector. At the same time, the general technology market has seen a slight decline, with indices like the Nasdaq Composite dropping 0.9%, showing that Micron's performance was somewhat detached from the broader market trend. Additionally, Micron's financial moves, such as its substantial $1.68 billion term loan agreement, highlight its robust financial strategy in a competitive tech landscape. Despite Walmart's weak outlook impacting the Dow Jones, Micron's emphasis on cutting-edge products and strong financial planning could have helped the company stand out during a period of market fluctuations.

Unlock comprehensive insights into our analysis of Micron Technology stock here.

Micron Technology has achieved a remarkable total shareholder return of 103.57% over the last five years. While recent product launches have infused short-term momentum, a few factors have shaped its longer-term performance. The completion of a significant US$7.20 billion share buyback program increased shareholder value profoundly, demonstrating a commitment to returning capital. Concurrently, the company's ventures into new areas, like the groundbreaking of a US$7 billion high-bandwidth memory facility in Singapore, showcase its drive for expansion and innovation.

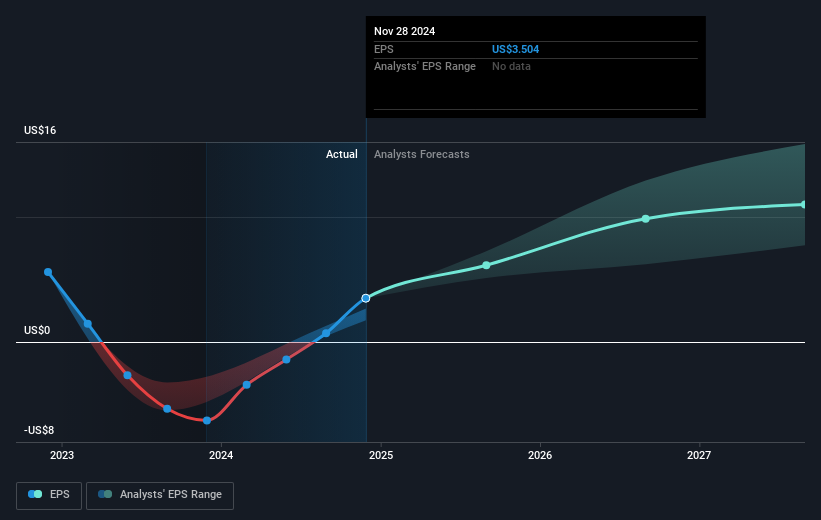

Micron’s profitability turned around in recent years, contributing majorly to overall returns. Key earnings reports include the Q1 2024 results, where net income transitioned from a loss to a substantial profit, hinting at effective financial management. Moreover, recent earnings guidance suggests sustained revenue and earnings momentum, indicating continued investor confidence, even amid broader market challenges. These dynamic steps reflect pivotal movements that influenced long-term shareholder returns positively.

- Analyze Micron Technology's fair value against its market price in our detailed valuation report—access it here.

- Assess the potential risks impacting Micron Technology's growth trajectory—explore our risk evaluation report.

- Invested in Micron Technology? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Mainland China, rest of the Asia Pacific, Hong Kong, Japan, Europe, and internationally.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives