- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (MU): Evaluating Valuation After Record Results and Strong AI-Driven Outlook

Reviewed by Kshitija Bhandaru

Micron Technology (MU) is making headlines after delivering record-setting fiscal 2025 results, with substantial year-over-year gains in both revenue and net income. The upbeat outlook for the next quarter is fueled by ongoing demand for high-bandwidth memory driven by AI. This is boosting optimism among investors as the company continues to outpace industry trends.

See our latest analysis for Micron Technology.

Micron Technology’s shares have enjoyed a surge to all-time highs in recent months, powered by record-setting results and a wave of upbeat news, including new dividend affirmations and high-profile conference appearances. While the shares saw a brief post-earnings dip, investor confidence remains solid. Micron’s 1-year total shareholder return is up a healthy 0.8%, and multi-year returns continue to build momentum as AI-driven memory demand accelerates.

If you’re looking to spot the next movers in the semiconductor and AI tech space, now is an ideal moment to explore See the full list for free.

With shares trading near record highs and guidance beating expectations, investors now face a pivotal question: does Micron’s steep rally leave room for even more upside, or has the market already priced in all the good news?

Most Popular Narrative: 14.9% Overvalued

Micron Technology’s most widely followed narrative places its fair value significantly below the current share price. This is an important perspective to weigh as expectations run high following earnings. Analyst consensus factors in robust AI-driven demand, but even so, a gap remains between market pricing and this narrative’s fair value target.

“Strategic investments in technology leadership and scaling capacity in HBM and advanced nodes (e.g., 1-beta, HBM4, HBM4E) enhance Micron's ability to capture premium pricing and deliver operational cost leverage, driving margin expansion and sustainable earnings growth. Strong balance sheet and prudent capital allocation allow Micron to continue investing through market cycles, ensuring competitive leadership, while providing enhanced capacity for shareholder returns as free cash flow increases.”

Want to see what’s fueling this elevated valuation? There’s a bold set of assumptions hidden in the forecasts, touching future market share, margins, and product mix. Curious what’s behind these ambitious projections and how they stack up to industry expectations? Read the full narrative and see what’s driving the analysts’ case for Micron.

Result: Fair Value of $159.91 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from major Asian memory makers and ongoing geopolitical tensions could quickly undermine the bullish outlook for Micron’s future growth.

Find out about the key risks to this Micron Technology narrative.

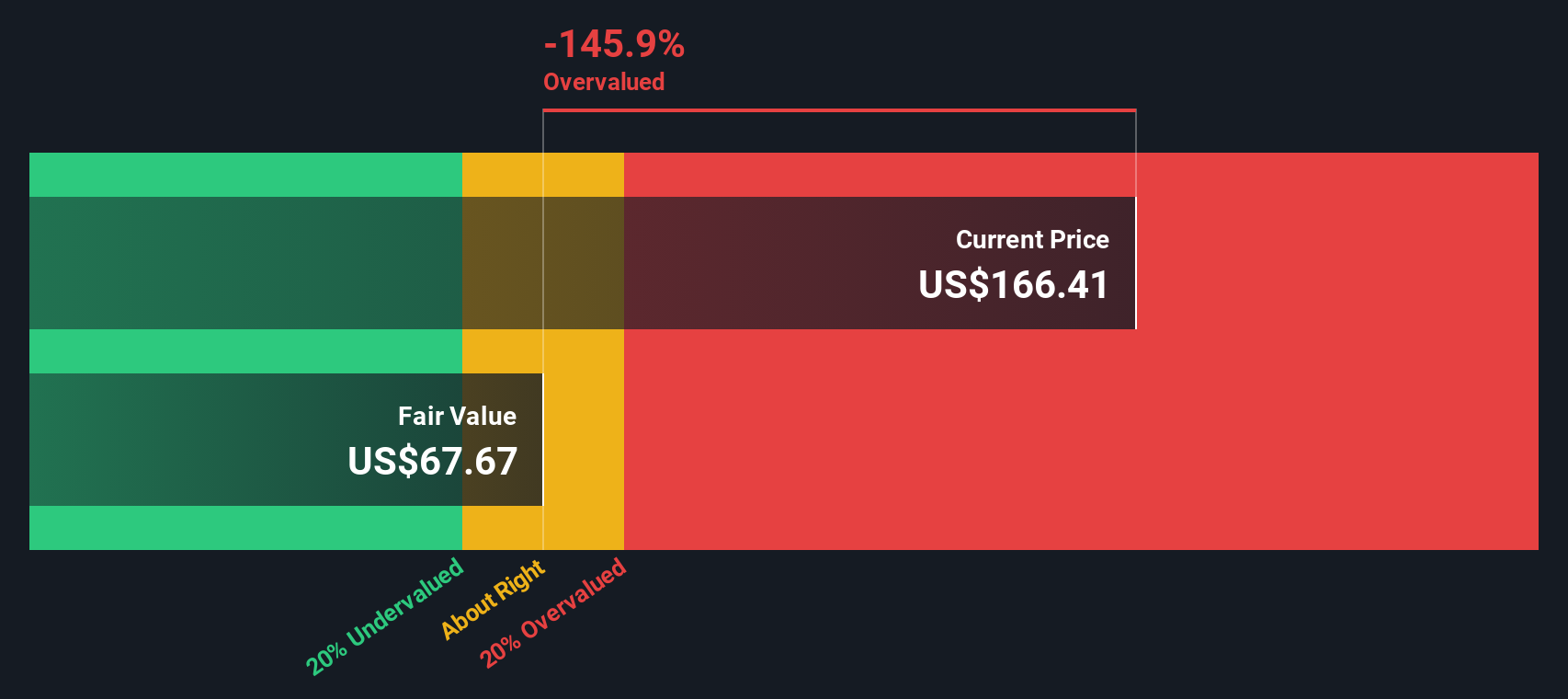

Another View: SWS DCF Model Paints a Different Picture

While the current narrative argues that Micron’s shares are overvalued on a fair value basis, our DCF model arrives at a much more conservative estimate. According to this approach, Micron’s shares are trading well above our intrinsic value. This raises fresh questions about how much of the future growth is already baked into today’s price. Does this highlight hidden downside risk, or might the market still be factoring in upside from growth opportunities that are hard to quantify?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Micron Technology Narrative

Prefer a different take or want to analyze the details yourself? You can build your own view in under three minutes. See for yourself: Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Micron Technology.

Looking for more investment ideas?

Seeking your next smart investment? Don’t limit yourself to just one story. Scan handpicked opportunities in booming sectors before the crowd seizes them.

- Capitalize on breakthrough medical innovation by checking out these 31 healthcare AI stocks making waves in advanced diagnostics and patient care.

- Unlock high-yield income streams with these 19 dividend stocks with yields > 3% designed for consistent returns and stable growth.

- Ride the wave of disruptive financial technology through these 78 cryptocurrency and blockchain stocks at the forefront of secure payments and digital transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives