- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Micron Technology (MU): Assessing Valuation as Analyst Optimism Rises Ahead of AI-Driven Earnings Report

Reviewed by Kshitija Bhandaru

If you follow the semiconductor space, it’s tough to ignore the sudden surge of optimism around Micron Technology (MU) as its fourth-quarter earnings report approaches. In just the past few weeks, analysts have lined up to boost their ratings and price targets, with many highlighting Micron’s rising profile in the AI arms race and the corresponding wave of demand for DRAM and High Bandwidth Memory. This renewed excitement is more than just the usual pre-earnings hype. Investors are taking notice of robust end-market demand, supply constraints, and Micron’s increasingly strategic partnerships, especially with Nvidia’s latest AI platforms.

It’s not just analyst sentiment propelling the stock. Micron has outpaced both its peers and the market, returning 86% year-to-date and 75% over the past twelve months. Upward revisions to earnings and revenue estimates have been backed by rising sales, underpinned by support from governments like Japan and clear signals of AI-driven growth. While Samsung’s competitive advances make headlines, most of the current focus remains on Micron’s ability to ride this semiconductor cycle, which has fueled strong momentum through the year.

The real question now is, after such a run, is Micron still undervalued, or is the market already taking future growth for granted?

Most Popular Narrative: Fairly Valued

According to the most widely followed narrative, Micron Technology’s current valuation sits just about in line with the company's projected fair value, with a minor 1.8% premium.

Analysts are assuming Micron Technology's revenue will grow by 16.6% annually over the next 3 years. Analysts assume that profit margins will increase from 18.4% today to 25.4% in 3 years time.

If you think Micron’s story is just about AI hype, think again. This narrative is built on bold growth expectations, surging margin forecasts, and a future valuation multiple that signals ambition. Want to see which key assumptions drive this razor-thin fair value call, and the surprising numbers behind Micron’s price target? Read on to uncover the underlying blueprint powering this narrative.

Result: Fair Value of $159.91 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.However, intensifying competition from Asian rivals and volatile DRAM and NAND markets could quickly disrupt Micron’s current trajectory and alter these bullish projections.

Find out about the key risks to this Micron Technology narrative.Another View: SWS DCF Model Puts a Different Spin on Value

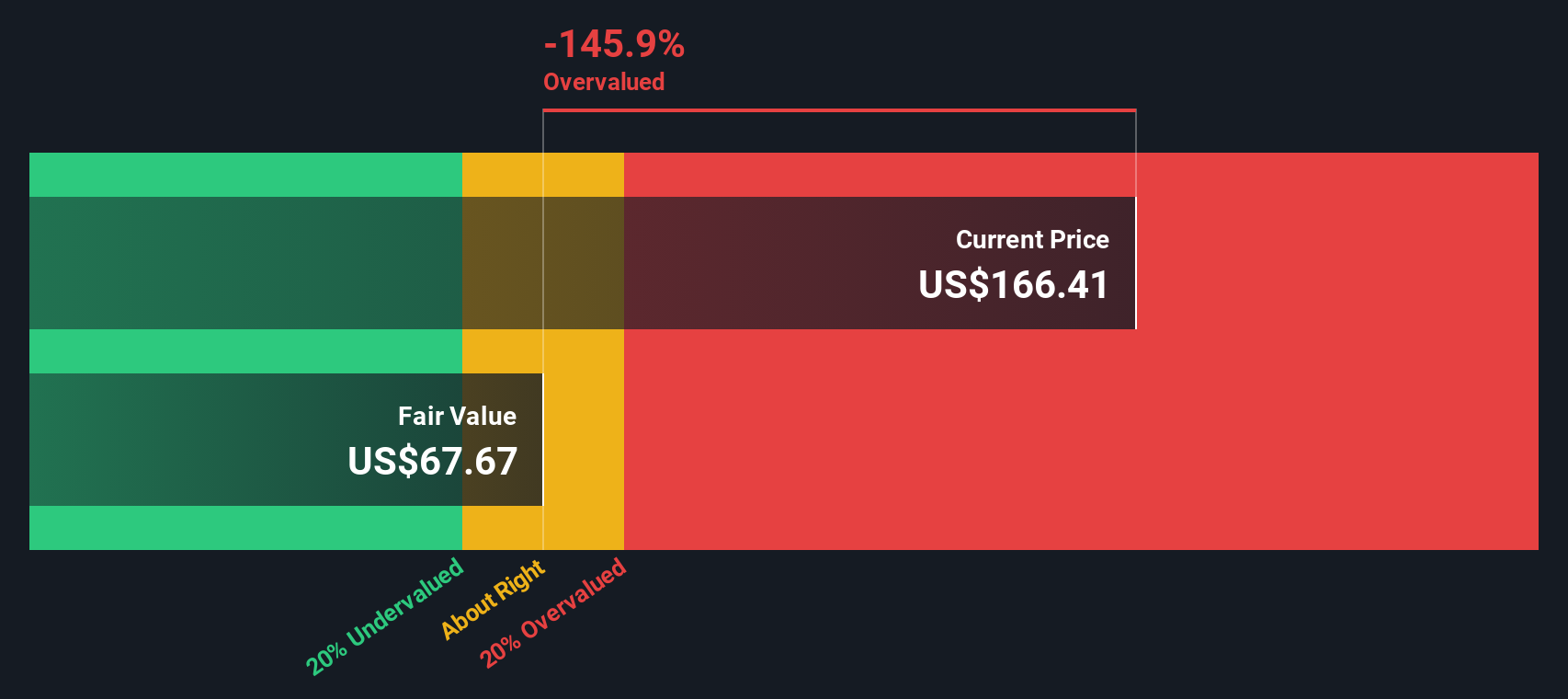

While the market’s chosen valuation approach suggests Micron is about fairly priced, our SWS DCF model sees things differently. It indicates the shares may be overvalued given future cash flow projections. Are analysts too optimistic, or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Stay updated when valuation signals shift by adding Micron Technology to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Micron Technology Narrative

If these conclusions do not match your own outlook, or if you want to take a hands-on approach with the data, you can shape your own Micron story in just a few minutes. Do it your way

A great starting point for your Micron Technology research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Winning Opportunities?

Smart investors never limit their options. Amplify your edge by seeing which stocks are making moves in exciting spaces you might have overlooked.

- Boost your income strategy by targeting stable companies offering attractive yields within our selection of dividend stocks with yields > 3%.

- Catch the next breakthrough as artificial intelligence reshapes entire industries with innovations highlighted in our curated AI penny stocks.

- Act on value plays before the crowd by uncovering gems trading below their intrinsic worth through our exclusive undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives