- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Is Micron Still a Smart Bet After $3.6B Japan Investment and Recent 43% Surge?

Reviewed by Bailey Pemberton

If you have been watching semiconductor stocks or have Micron Technology in your portfolio, you are probably asking yourself, what next? The stock caught fire recently, rocketing up 14.6% this past week and an incredible 43.0% over the last month. Year-to-date, Micron has soared 115.1%, and if you zoom out, the last five years have delivered a remarkable 279.7% return. That level of performance puts Micron on the radar for just about anyone considering growth stories or value opportunities, especially with big headlines shifting how investors interpret the company’s outlook and risk.

A chunk of this momentum is no doubt tied to global chip supply chain headlines. Policy makers in the U.S. and abroad are pushing for more domestic manufacturing, with the U.S. advocating for at least half of the chips it consumes to be made locally and Japan stepping up with billions in support for Micron’s R&D. Of course, political rumbles from China and potential tariff threats are part of the mix, reminding us that the semiconductor world is ultimately linked to international grandstanding as much as to innovation.

But what about Micron’s price—does it still offer value? According to our analysis, Micron scores a 3 out of 6 on our undervaluation checks, meaning it appears undervalued in half of the key areas we look at. Those are good signals, but they do not tell the whole story. So, let’s dig into the details of what is driving that value score, and then I will show you a smarter way to think about Micron’s true worth.

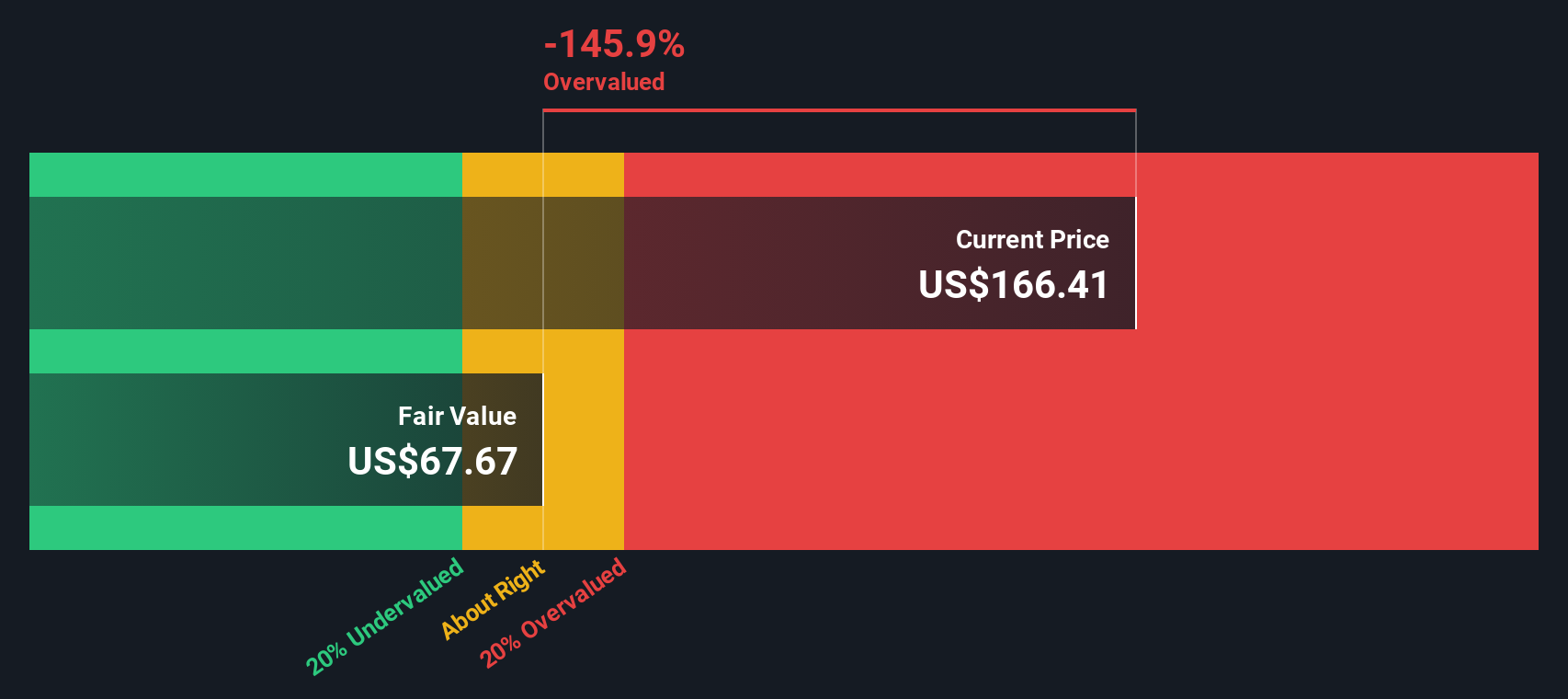

Approach 1: Micron Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them to today's dollars, reflecting both expected growth and uncertainty. For Micron Technology, the DCF analysis starts with its latest trailing twelve months Free Cash Flow, which totaled approximately $2.2 Billion. Analysts forecast these cash flows to increase sharply over the next few years, with projected Free Cash Flow reaching about $8.1 Billion by 2026. Simply Wall St extrapolates these figures out to 2030, where estimates hit $10.6 Billion.

This DCF uses a two-stage Free Cash Flow to Equity approach. Cash flows are broken into an explicit forecast period where analyst data is available, and a long-term period relying on growth extrapolation. The sum of all discounted cash flows gives us an intrinsic value per share of $106.78.

When we compare this to the current Micron share price, the result shows the stock is trading at a 75.9% premium to its intrinsic value calculated from the DCF. In other words, Micron appears significantly overvalued relative to this cash flow model.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Micron Technology may be overvalued by 75.9%. Find undervalued stocks or create your own screener to find better value opportunities.

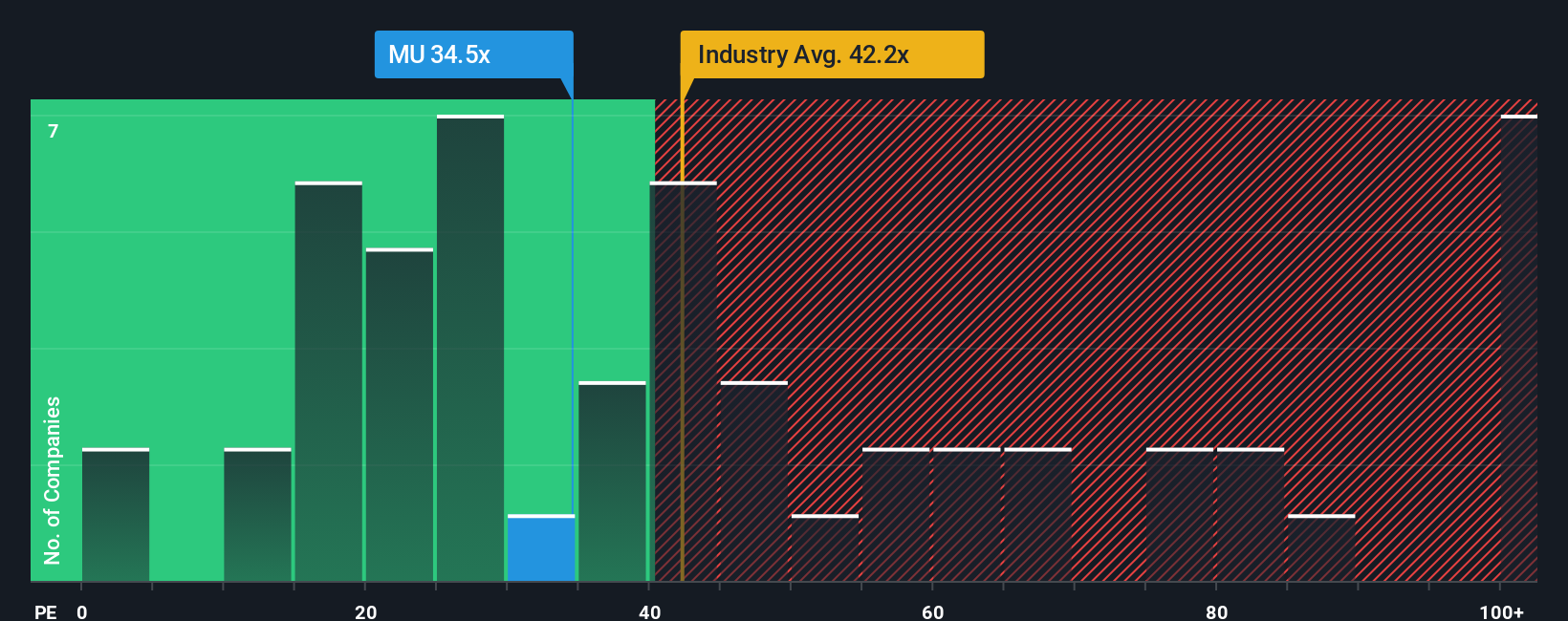

Approach 2: Micron Technology Price vs Earnings

For profitable companies, the Price-to-Earnings (PE) ratio is one of the most widely used metrics to assess whether a stock is fairly valued. This is because the PE ratio directly compares the price investors are paying to the company’s reported profits, giving a quick sense of how much growth the market is pricing in.

Growth expectations and risk play a huge role in what counts as a “normal” or “fair” PE ratio. Rapidly growing companies and those with stable, reliable earnings can justify higher PE ratios, while cyclical or higher risk companies often do not.

Micron Technology currently trades at a PE ratio of 24.7x, which is well below the semiconductor industry average of 37.0x and even further below peers, which average 51.8x. At first glance, this might suggest Micron is undervalued relative to its sector.

The "Fair Ratio" is Simply Wall St’s proprietary benchmark for the right PE ratio a company deserves, tailored to its growth prospects, profit margins, risks, and even its market cap. This tailored Fair Ratio for Micron is 40.2x, reflecting both its opportunities and unique risk factors. Because this metric weighs those company-specific factors, it is a much better yardstick than the raw industry average or peer numbers.

Comparing Micron’s actual PE ratio of 24.7x to the Fair Ratio of 40.2x suggests the market is giving the stock less credit than it probably deserves based on its fundamentals and outlook. This points to a potential undervaluation.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Micron Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative takes your perspective on a company and turns it into a story-backed forecast, connecting what you believe about Micron Technology’s future with the key numbers that drive its fair value, such as growth rates, margins, and earnings estimates.

Rather than just looking at past performance or typical ratios, Narratives help you blend what you know with what you expect, resulting in a fair value that truly reflects your outlook. Available right now for millions of investors on Simply Wall St’s Community page, Narratives give anyone the power to build and compare their own valuation stories, with no spreadsheets or advanced math required.

The real advantage is that Narratives update automatically as news, earnings, or forecasts change, so your fair value stays aligned with the latest developments. This means you can quickly see if your unique view suggests Micron is a buy, hold, or sell, simply by comparing your calculated Fair Value to the current market price.

For example, while some investors expect Micron’s robust AI and data center demand to push shares toward $200, others remain cautious about cyclicality and assign a value closer to $95. This demonstrates how Narratives can differ widely but empower you to invest with conviction and clarity.

Do you think there's more to the story for Micron Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives