- United States

- /

- Semiconductors

- /

- NasdaqGS:MU

Is It Too Late to Consider Micron After a 10.5% Surge This Week?

Reviewed by Bailey Pemberton

Wondering whether now is the right moment to jump into Micron Technology stock, add to your position, or sit out? You are certainly not alone. With the share price recently closing at $206.77, there has been a lot to talk about, especially after watching Micron surge 10.5% in just the last week, not to mention a jaw-dropping 136.8% return since the start of the year. That kind of move can be both exciting and nerve-wracking for investors.

What is fueling this momentum? Lately, Micron’s prospects have been buoyed by brisk demand for artificial intelligence and next-generation memory chips. Industry-wide enthusiasm for AI infrastructure continues to ramp up, which has directly benefited leading memory suppliers like Micron. News of expanded semiconductor alliances and breakthroughs in chip technologies are drawing the spotlight to the sector, and investors are clearly paying attention. You might also notice that Micron’s stock hasn’t just been a star recently; its 3-year return stands at 276.2% and its 5-year gain is 307.7%, underscoring just how persistent this upward trend has been.

But with such rapid gains, many investors are wondering if the price still offers good value, or if the best days are already behind us. Based on our multi-point valuation score, where each of six checks can add a point if Micron is undervalued, Micron earns a 3 out of 6, suggesting the stock could have room to run, but there are some caveats. So, how does Micron stack up under different valuation methods, and is there a smarter way still to think about its true worth? Let’s dive in and find out.

Approach 1: Micron Technology Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its future cash flows and discounting them back to today's dollars. In Micron Technology's case, analysts and financial models forecast how much cash Micron will generate in the coming years and calculate the present value of those billions in future earnings.

Currently, Micron's Free Cash Flow sits at $2.22 Billion. According to analyst forecasts, by 2030 this figure could climb to roughly $10.60 Billion based on continued demand for advanced memory chips. While analysts offer forecasts for the next five years, projections beyond that are extended by Simply Wall St. The ten-year outlook sees Free Cash Flow estimates rising steadily, reflecting optimism about Micron's role in AI and next-generation technology.

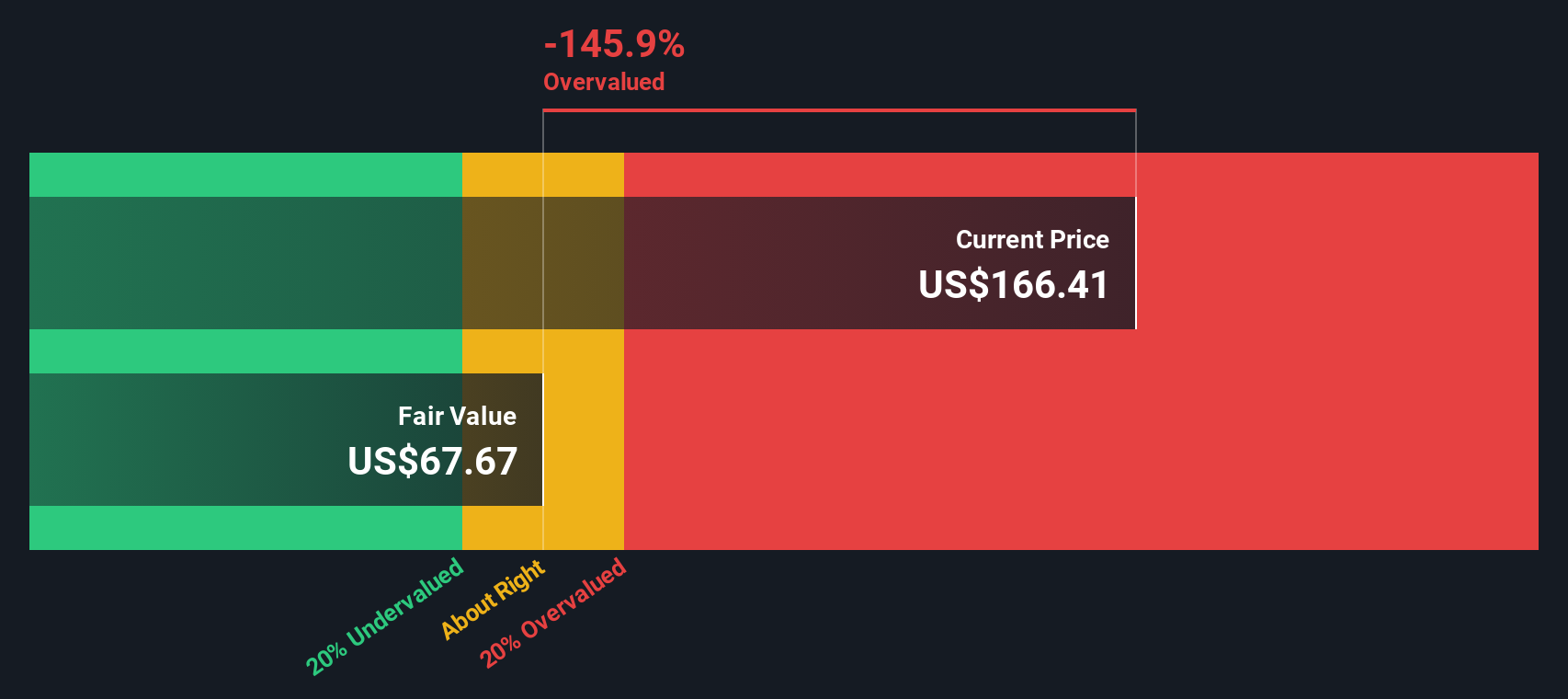

Despite these strong growth prospects, the DCF model places Micron's fair value at $107.65 per share. Compared to the recent market price of $206.77, this implies the shares are trading at a 92.1% premium to their estimated intrinsic value. Put simply, based on discounted cash flow, Micron appears significantly overvalued right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Micron Technology may be overvalued by 92.1%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Micron Technology Price vs Earnings

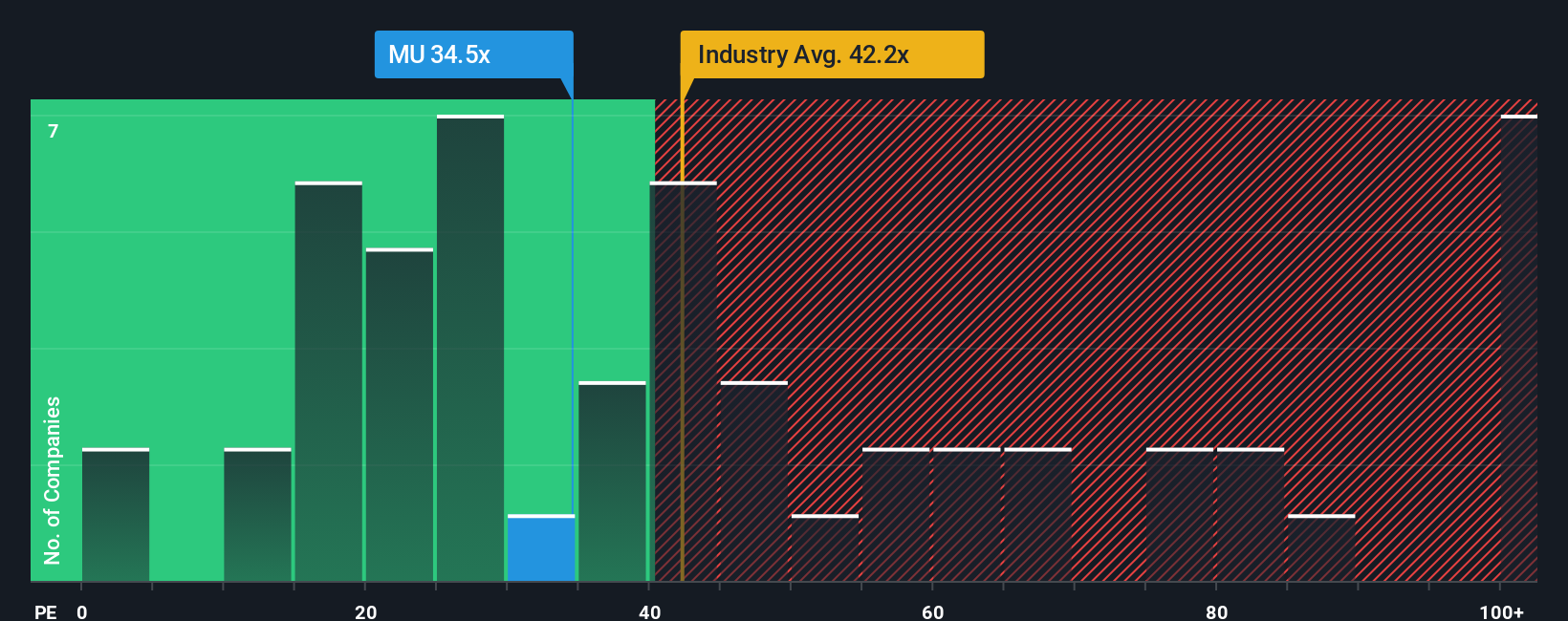

For profitable companies like Micron Technology, the price-to-earnings (PE) ratio is often the preferred metric for investors who want a direct sense of how much they are paying for each dollar of profits. This measure becomes especially valuable when a company has established earnings, as it provides insight into how the market is valuing its profitability compared to others in the sector.

It is important to note that a company's "normal" or "fair" PE ratio depends on factors such as its expected growth rate, the risk level of the business, and the stability of its earnings. Generally, faster-growing and less volatile companies have a higher PE, while slower or riskier businesses trade on lower multiples. Currently, Micron is trading at a PE of 27.18x. This is below both the industry average of 37.38x and the average of its peers at 63.23x, which may lead some to view it as undervalued at first glance.

The concept of a “Fair PE Ratio” from Simply Wall St provides further perspective. Instead of relying solely on broad industry averages or benchmarks that may not reflect Micron’s unique characteristics, this proprietary metric incorporates the company’s growth outlook, profit margins, size, and risk profile. For Micron, the Fair Ratio is 40.83x. While this is above its current 27.18x multiple, the Fair Ratio offers a more nuanced view of what investors might expect to pay given Micron's strengths and challenges.

By comparing its current PE to the Fair Ratio, Micron appears undervalued using this approach and may offer potential upside if the market comes to appreciate its underlying quality and prospects.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Micron Technology Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story for the company, a way to frame not just the numbers but also your assumptions and outlook about Micron’s future, including its fair value, growth expectations, and the risks you see ahead.

This approach links the company’s story and context to your financial forecast, resulting in a fair value that’s explicitly tied to what you believe will happen rather than just historical numbers or generic industry multiples. Narratives are designed to be accessible and easy to use. On Simply Wall St’s Community page, millions of investors have already created Narratives to document their views, debate assumptions, and transparently track how their beliefs change as new information emerges.

By building your own Narrative, you can compare your estimated fair value to the market price, which can help you decide if now is the time to buy, hold, or sell based on what you believe is realistically achievable for Micron. Narratives are dynamic and update automatically as new earnings data, news, or shifts in the industry occur, keeping your story fresh and relevant.

For example, some investors estimate Micron’s fair value as high as $203 per share if they believe aggressive AI growth will drive margins toward 30%. Others, factoring in intense industry competition, settle on a fair value close to $95 per share.

Do you think there's more to the story for Micron Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MU

Micron Technology

Designs, develops, manufactures, and sells memory and storage products in the United States, Taiwan, Singapore, Japan, Malaysia, China, India, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives