- United States

- /

- Semiconductors

- /

- NasdaqGS:MTSI

MACOM Technology Solutions (MTSI): How Do New Optical Product Launches Shape Its Valuation?

Reviewed by Kshitija Bhandaru

MACOM Technology Solutions (MTSI) is drawing attention after unveiling next-generation analog connectivity products at the European Conference on Optical Communication in Copenhagen. The company’s live demonstrations highlight its ongoing push into high-speed data and AI/ML applications.

See our latest analysis for MACOM Technology Solutions Holdings.

Momentum around MACOM Technology Solutions Holdings is picking up, supported by headline-grabbing innovations in high-speed connectivity and a robust track record in optical and AI/ML infrastructure. While the share price has held steady recently, the company’s 1-year total shareholder return of 15.6% highlights a trend of solid longer-term wealth creation despite broader tech sector volatility.

On the hunt for more companies shaping data center and AI technologies? Now is a great time to discover See the full list for free.

With impressive innovation and a five-year total return exceeding 250%, is MACOM Technology Solutions still trading below its true value, or is the recent optimism already reflected in the current share price?

Most Popular Narrative: 14.7% Undervalued

MACOM Technology Solutions’ latest share price of $127.41 trails the widely followed consensus fair value estimate of $149.29, signaling room for further upside by this narrative’s math. A closer look at why this gap exists reveals bold expectations for future growth, profitability, and strategic execution as key catalysts for the valuation debate.

Full operational control of the RTP fab enables increased capacity (up to 30% boost within 12-15 months), improved yields, and cost efficiencies. This is expected to shift the fab from a short-term gross margin headwind to a meaningful margin tailwind by late 2026, leading to expansion of company-wide gross and operating margins.

Curious about what’s driving this bullish fair value? The real story isn’t just about new products or industry hype. The narrative hinges on confident projections for top-line growth and a dramatic swing in margins, setting up a future earnings profile that could surprise even seasoned investors. Want to see just how aggressive these assumptions are? Find out what’s fueling the optimism inside.

Result: Fair Value of $149.29 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing margin headwinds and the unpredictability of data center growth could temper the bullish outlook if these challenges persist longer than expected.

Find out about the key risks to this MACOM Technology Solutions Holdings narrative.

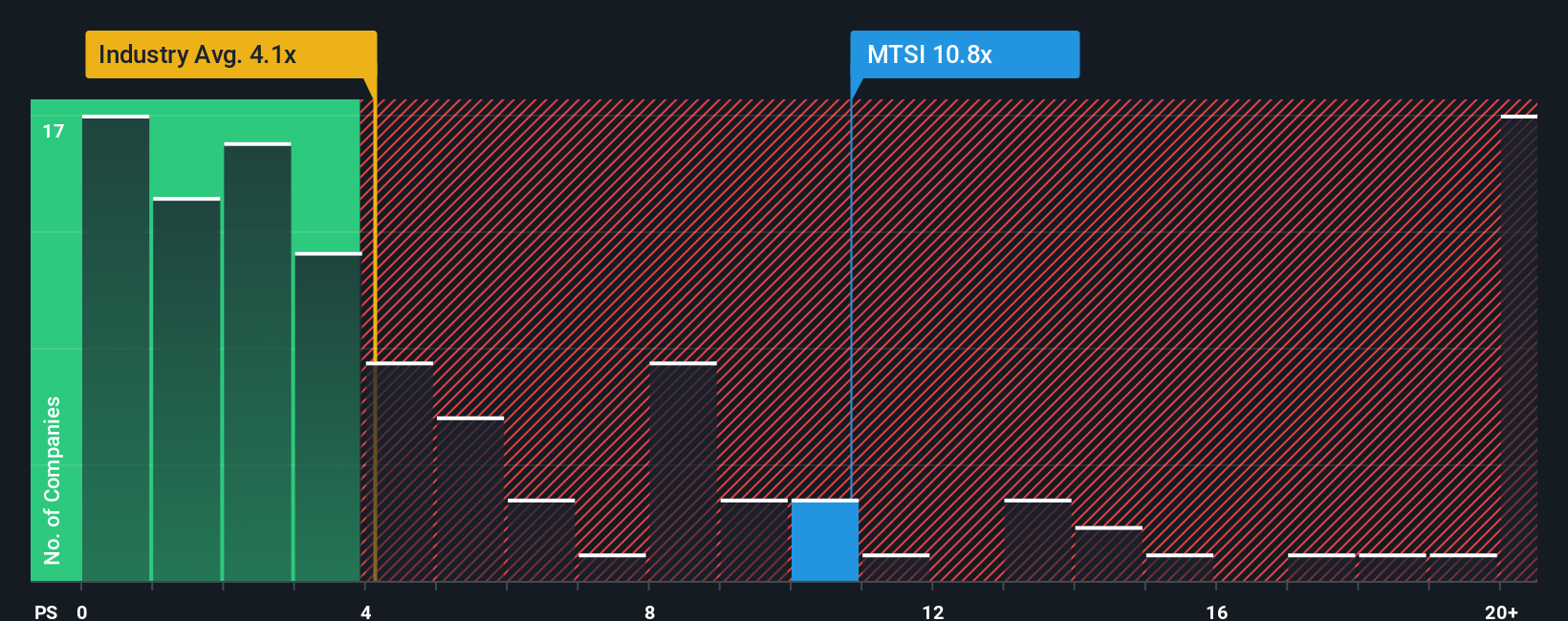

Another View: Peer and Industry Multiples Tell a Different Story

While the consensus fair value narrative paints MACOM Technology Solutions as undervalued, our look at the company’s price-to-sales ratio suggests caution. Trading at 10.5 times sales, it sits well above both the industry average of 4.9x and its fair ratio of 5.3x. This premium leaves less margin for error if growth does not accelerate as the consensus expects. Could the share price be running ahead of fundamentals?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own MACOM Technology Solutions Holdings Narrative

If you want a fresh angle or prefer hands-on research, it’s easy to build your personal thesis using the data provided. Often, this can be done in just a few minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding MACOM Technology Solutions Holdings.

Looking for More Investment Ideas?

Take advantage of today’s market by checking out smart investment opportunities curated with the Simply Wall Street Screener. Don’t let your next breakout idea slip away while others move ahead.

- Grow long-term wealth by tapping into steady income streams. Unlock promising yields through these 19 dividend stocks with yields > 3%.

- Get ahead of the tech curve and target the next wave of innovation when you check out these 24 AI penny stocks.

- Spot hidden value before the crowd and seize strong potential in the market by using these 896 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MTSI

MACOM Technology Solutions Holdings

Provides analog semiconductor solutions for use in wireless and wireline applications across the radio frequency (RF), microwave, millimeter wave, and lightwave spectrum.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives