- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (NasdaqGS:MRVL) Sees 5% Price Dip After Net Loss Reported

Reviewed by Simply Wall St

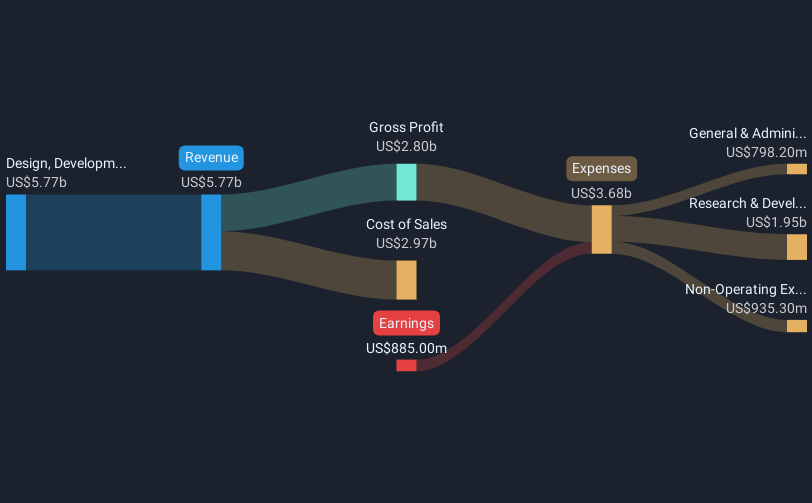

Marvell Technology (NasdaqGS:MRVL) saw a price decline of 5% over the last quarter, potentially driven by mixed financial results and macroeconomic trends. Despite affirming its quarterly dividend, the company reported a significant net loss for the third quarter, reflecting challenges in managing profitability amid rising sales. Further, while Marvell announced strategic innovations like new chipsets and a partnership with Amazon Web Services, broader market pressures prevailed. Notably, tech stocks have been under stress, with the Nasdaq declining around 4% in February, influenced by macro-level concerns and fluctuating investor sentiment linked to inflation and geopolitical developments. Additionally, Marvell's buyback initiative did not fully counter negative investor sentiment. Amidst a market where key indices like the S&P 500 and Nasdaq have shown diverse performance, the company's strategic moves were insufficient to shield its share value from broader technology sector volatility.

Click to explore a detailed breakdown of our findings on Marvell Technology.

The last five years have seen Marvell Technology's total returns, including share price and dividends, soar by 290.32%. This significant growth reflects several key developments, such as substantial product innovations. For example, in December 2024, the company launched a 200G optimized transimpedance amplifier and custom HBM compute architecture, enhancing data rate capabilities. Additionally, Marvell's collaboration with Amazon Web Services, cemented in late 2024, aimed to advance semiconductor solutions for data centers.

Marvell's proactive approach in share buybacks also played a role, with millions of shares repurchased during 2024 alone. Despite current challenges with profitability, indicated by continuing net losses reported in earnings for the latest quarter, these losses have not derailed investor confidence over the longer term. Marvell's performance has remained impressive, especially within the U.S. Semiconductor industry, outpacing the broader market's one-year return of 15.4% during the past year.

- See how Marvell Technology measures up with our analysis of its intrinsic value versus market price.

- Assess the potential risks impacting Marvell Technology's growth trajectory—explore our risk evaluation report.

- Are you invested in Marvell Technology already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Marvell Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives