- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Did New Data Center ACC Launch Just Shift Marvell Technology's (MRVL) AI Investment Narrative?

Reviewed by Sasha Jovanovic

- In October 2025, Marvell Technology introduced active copper cable (ACC) linear equalizers and showcased cutting-edge data center infrastructure solutions at the OCP Global Summit in San Jose, California, addressing growing bandwidth and efficiency demands for AI-driven workloads.

- The announcement highlights Marvell's approach to enhancing data center connectivity performance, with new products leveraging its proprietary PAM4 technology to support next-generation 800G and 1.6T interconnects while improving cost and energy efficiency.

- We'll explore how Marvell's ACC innovation strengthens its position in AI-centric data center markets and could impact its investment outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Marvell Technology Investment Narrative Recap

Owning Marvell Technology means believing in robust, long-term growth for AI-focused data center infrastructure and custom silicon solutions, driven by surging cloud and artificial intelligence workloads. The recent launch of active copper cable (ACC) linear equalizers underscores Marvell's focus on energy-efficient, high-bandwidth connectivity, but has little direct effect on the central short-term catalyst: Marvell’s ability to consistently win and ramp large, multi-generational design projects with hyperscale customers. However, the biggest risk, revenue volatility tied to concentrated hyperscale cloud exposure, remains unchanged in the near term.

Among recent announcements, Marvell’s debut of ACC linear equalizers at the OCP Global Summit stands out for its potential alignment with ongoing AI and data center bandwidth demand. These new cables, leveraging Marvell’s PAM4 technology, are engineered to deliver longer reach and higher energy efficiency in next-gen, high-volume server deployments, further supporting the company’s ambitions in hyperscale and AI data center markets, both key short-term catalysts.

On the other hand, investors should be aware that heavy reliance on a handful of cloud customers means even a single shift in orders could...

Read the full narrative on Marvell Technology (it's free!)

Marvell Technology's narrative projects $12.1 billion revenue and $2.9 billion earnings by 2028. This requires 18.7% yearly revenue growth and a $3.0 billion increase in earnings from -$103.4 million today.

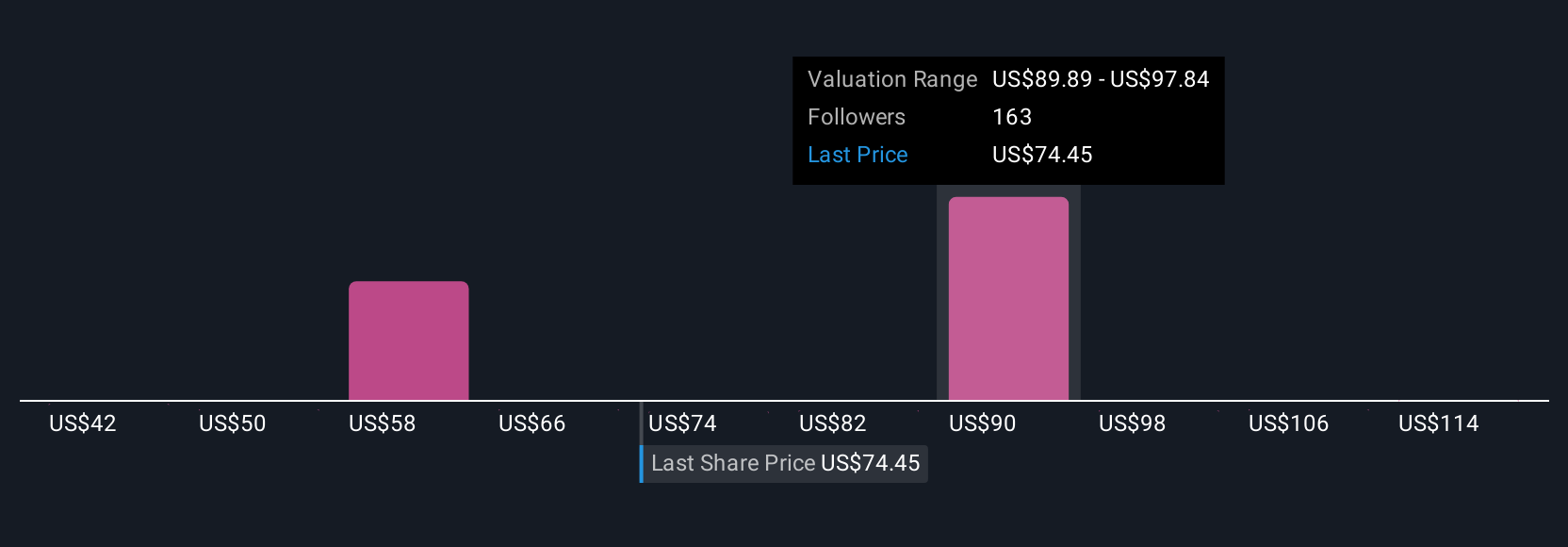

Uncover how Marvell Technology's forecasts yield a $89.67 fair value, in line with its current price.

Exploring Other Perspectives

Simply Wall St Community members set fair values for Marvell between US$35.38 and US$112.78, with 25 opinions featured. Strong reliance on large hyperscalers as buyers means shifts in customer priorities could ripple broadly across Marvell’s future revenue and earnings, consider a range of viewpoints before deciding for yourself.

Explore 25 other fair value estimates on Marvell Technology - why the stock might be worth less than half the current price!

Build Your Own Marvell Technology Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Marvell Technology research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free Marvell Technology research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Marvell Technology's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives