- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Assessing Marvell After a 9% Weekly Drop and Fresh Data Center Momentum in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Marvell Technology stock lately, you are probably wondering whether now is the time to jump in, hang tight, or look elsewhere. The share price has been anything but dull recently, with a dip of almost 9% over the past week after a strong run earlier in the month. For the year so far, Marvell has slid nearly 29%, but zoom out a bit and the bigger picture looks quite different, with the stock doubling in value over the past three years.

So what is driving these ups and downs? Lately, industry chatter has focused on Marvell’s momentum in the data center and networking markets, where recent partnership announcements and technology launches have sparked renewed optimism, even as some investors weigh concerns over competition and the pace of customer spending. In the broader chip sector, strategic shifts towards cloud and AI have altered how investors are assessing risk and potential, giving Marvell a fresh spotlight among tech peers.

The big question is, does Marvell offer real value at current prices? Strictly by the numbers, the company scores a 2 out of 6 on our undervaluation checklist, meaning that it is undervalued in only two of the six key areas we track. That is not a screaming bargain, but it is not the full story either. In the next section, we will dig into the valuation techniques you need to know, plus reveal a perspective that might give you an even smarter edge as you evaluate Marvell’s potential.

Marvell Technology scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Marvell Technology Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental tool in valuation that estimates a company’s intrinsic value by projecting its future cash flows and then discounting those amounts back to their present value. This approach helps investors understand what a stock is truly worth today, based on the cash it can generate in the years to come.

For Marvell Technology, the current Free Cash Flow stands at $1.48 Billion. Analyst estimates guide the next five years of projections, and additional years are extrapolated to reach a 10-year view. By 2030, Marvell’s Free Cash Flow is forecasted to reach $4.23 Billion according to these projections, highlighting expectations for robust business growth over the coming decade.

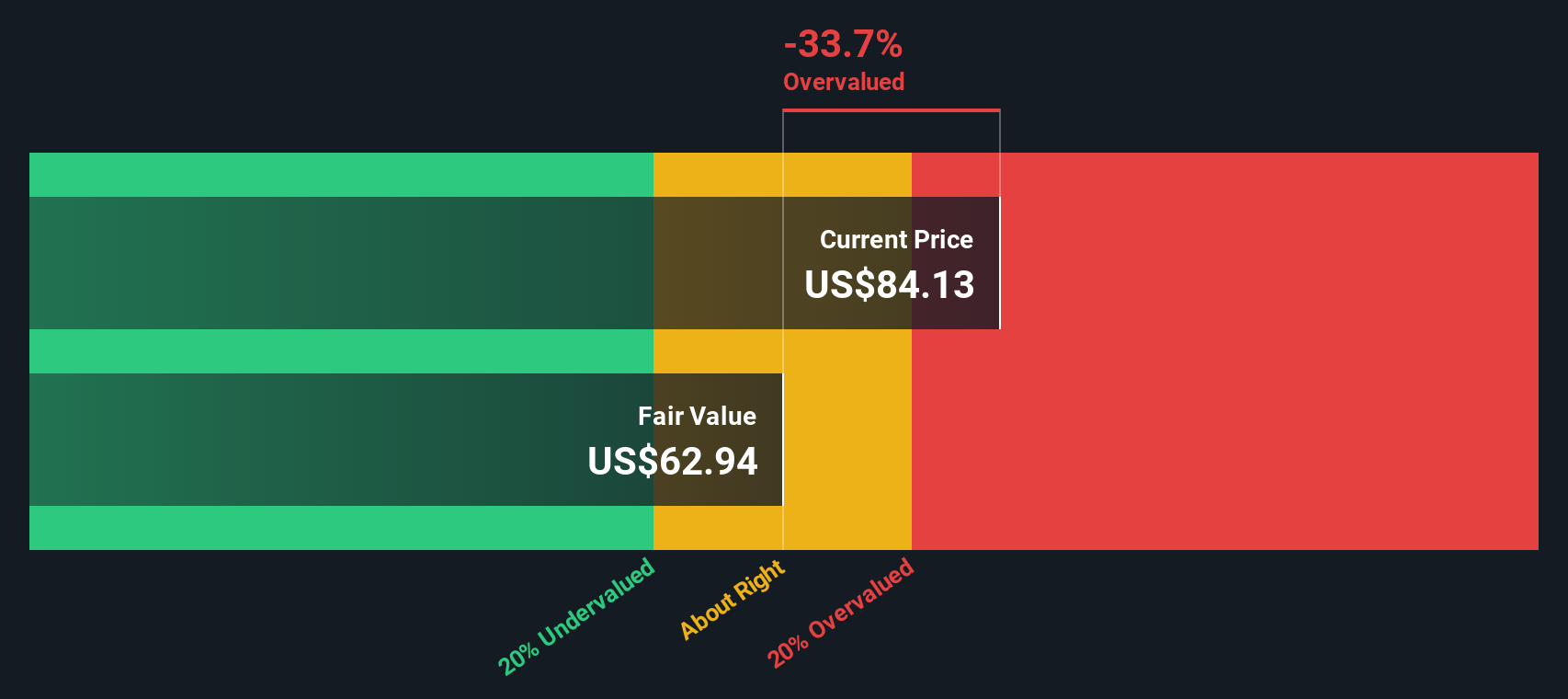

Based on the DCF model, Marvell’s intrinsic value per share is calculated at $63.03. Comparing this to the current share price, the analysis reveals that the stock is about 28.6% more expensive than what the cash flow projections would justify. In other words, the market is currently pricing in more optimism than what the future cash flows alone can support.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Marvell Technology may be overvalued by 28.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Marvell Technology Price vs Sales

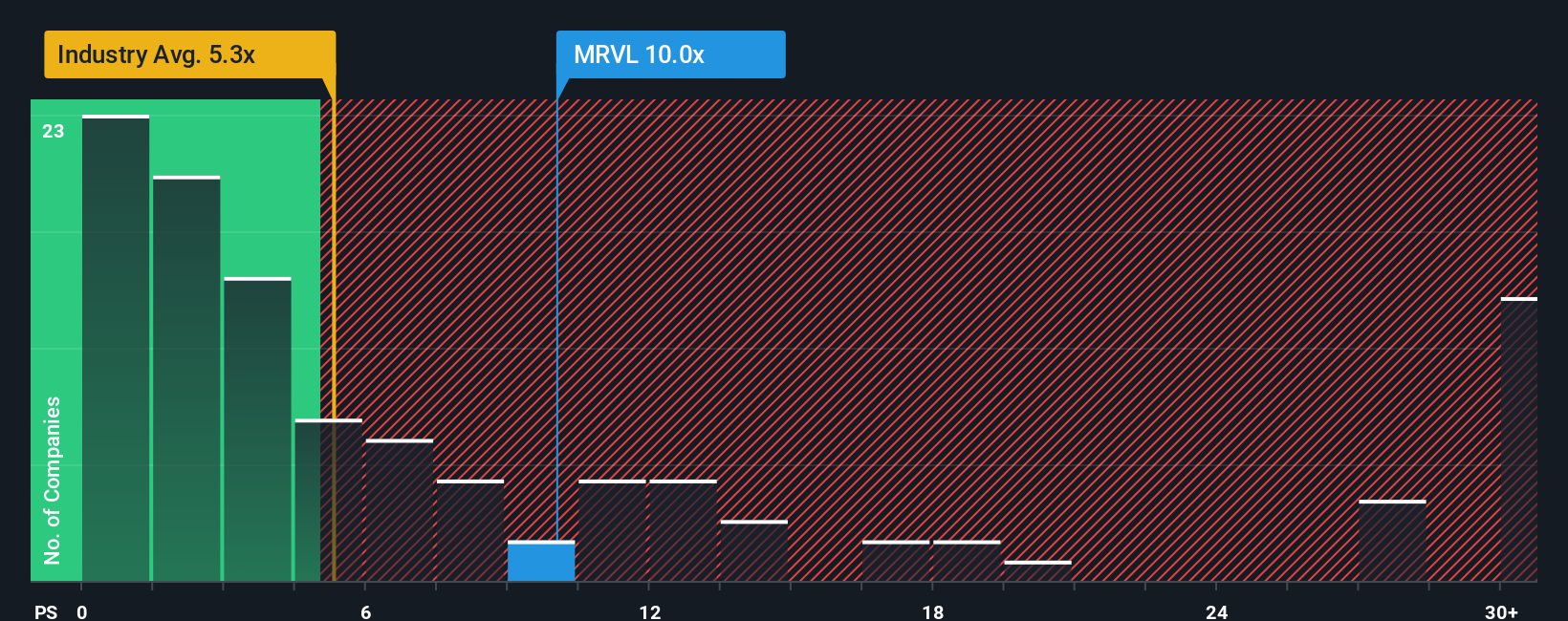

The Price-to-Sales (P/S) ratio is a favored valuation metric for companies like Marvell Technology, particularly in the fast-evolving semiconductor space where consistent profits can be overshadowed by growth investments. The P/S ratio offers a clear lens for investors to assess how the market values each dollar of revenue, especially when near-term earnings may not reflect the underlying growth potential.

Generally, a “fair” P/S ratio depends on how quickly a company is expected to grow and the degree of risk investors associate with its business. Higher growth expectations or stronger positioning can justify a premium P/S, while heightened risks or stagnation would usually mean a lower multiple is warranted.

Currently, Marvell trades at a P/S ratio of 9.66x. For context, this is close to the peer group average of 9.74x and considerably higher than the broader semiconductor industry average of 5.13x. However, Simply Wall St’s proprietary “Fair Ratio” offers a more tailored benchmark, in Marvell’s case, 10.50x. This figure weighs its growth prospects, profit margins, market size, and company-specific risks to deliver a more meaningful yardstick than industry comparisons alone. Because Marvell’s actual P/S is very close to this fair value, the evidence suggests the stock is priced about right by this measure.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Marvell Technology Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story, your perspective on a company, which combines the facts and numbers with your own beliefs about how the business will perform in the future. Rather than relying solely on fixed targets or recent headlines, Narratives let you connect Marvell Technology's business momentum, growth drivers, and industry shifts to a financial forecast and a resulting fair value. This makes your investment decisions smarter and more personal.

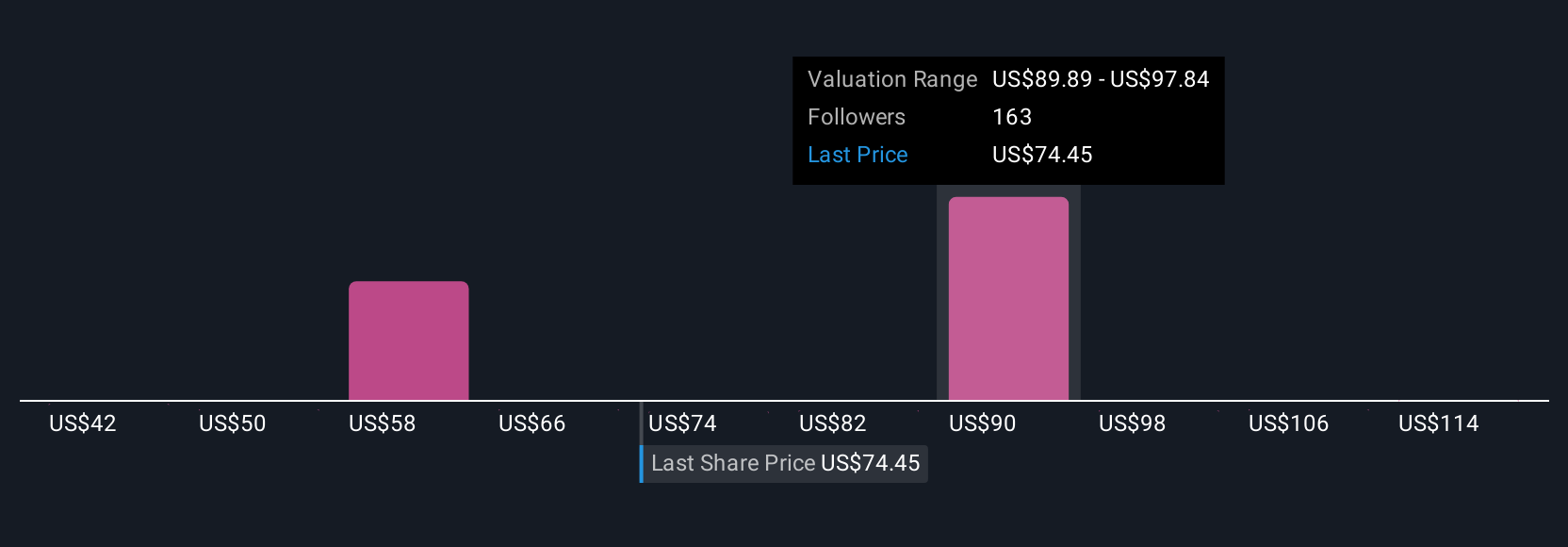

This approach is easy to use and available for every stock in the Community page on Simply Wall St’s platform, where millions of investors already shape and compare Narratives in real time. Narratives help you cut through the noise by showing how your view influences whether Marvell is a buy, hold, or sell, based on the difference between its fair value and current share price. Plus, as new information comes in such as earnings, news, or analyst updates, your Narrative updates instantly, so your investment thesis is always grounded in the latest facts.

For example, some investors see Marvell’s leadership in AI infrastructure and strong custom silicon pipeline as catalysts for explosive growth, assigning a fair value as high as $122 per share. Others are more cautious, anticipating challenges from customer concentration or margin pressure, resulting in fair values as low as $58 per share. With Narratives, you can easily explore both sides for a more informed decision.

Do you think there's more to the story for Marvell Technology? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives