- United States

- /

- Semiconductors

- /

- NasdaqGS:MPWR

Did Record Results and Insider Alignment Just Shift Monolithic Power Systems' (MPWR) Investment Narrative?

Reviewed by Sasha Jovanovic

- In recent days, Monolithic Power Systems reported record quarterly revenue and saw analyst upgrades after meetings highlighted strong demand for its power-management products and robust financial growth.

- An interesting aspect is the significant insider ownership valued at US$1.4 billion, signaling closely aligned interests between company leaders and shareholders.

- We'll explore how the combination of record earnings and high insider alignment could reshape the company's investment narrative moving forward.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Monolithic Power Systems Investment Narrative Recap

To be a shareholder in Monolithic Power Systems right now, you need to believe in sustained demand for its power-management products across diverse sectors ranging from data centers to automotive, powered by strong design wins and industry tailwinds like AI adoption. The recent record earnings reinforce this optimism, while analyst upgrades suggest confidence in near-term momentum; however, the biggest current risk, ongoing legal proceedings regarding alleged product quality issues, remains, and the recent news does not materially resolve or exacerbate this concern in the short term.

The most relevant recent announcement is the robust second-quarter results reported in July 2025, with revenue and earnings exceeding expectations and updated guidance calling for continued sales momentum into Q3. These strong fundamentals help support investors' focus on long-term structural catalysts such as AI, automotive content expansion, and the firm's move toward system-level power solutions, even as short-term risks are still present.

But while earnings momentum is fueling optimism, investors should not overlook the unresolved legal claims tied to...

Read the full narrative on Monolithic Power Systems (it's free!)

Monolithic Power Systems' narrative projects $3.9 billion revenue and $1.0 billion earnings by 2028. This requires robust yearly revenue growth and a $0.3 billion earnings increase from current earnings of $0.7 billion.

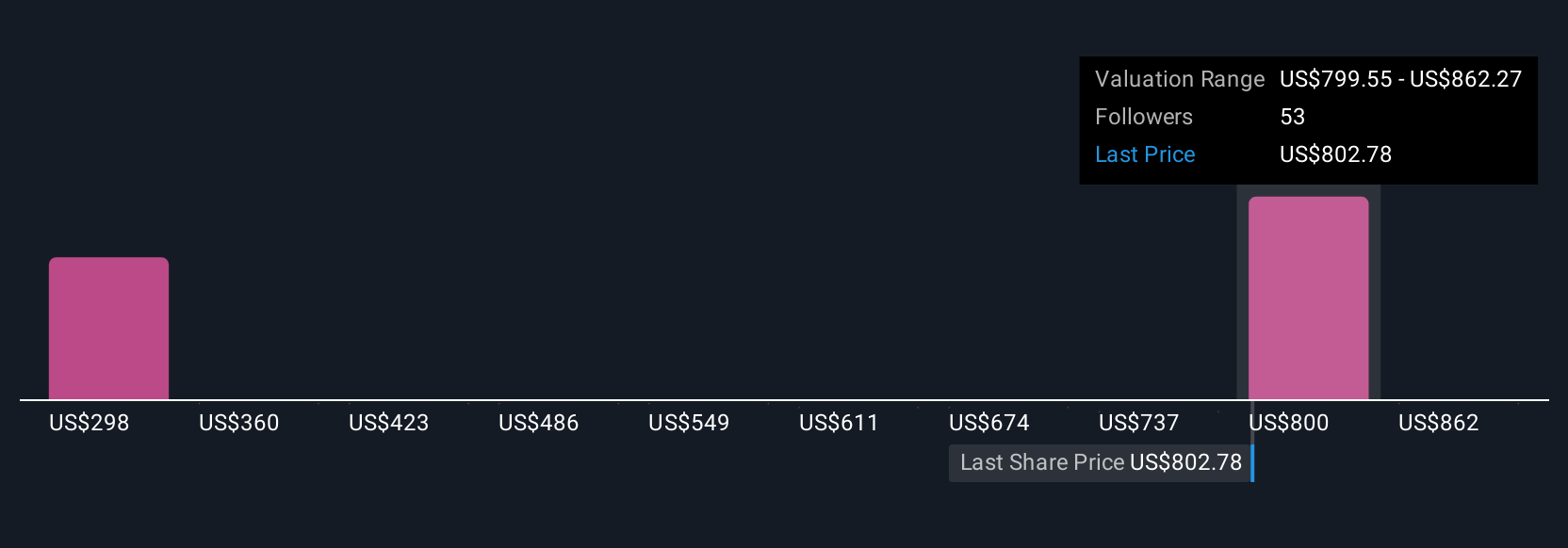

Uncover how Monolithic Power Systems' forecasts yield a $867.46 fair value, a 6% downside to its current price.

Exploring Other Perspectives

Fourteen members of the Simply Wall St Community estimated fair values for Monolithic Power Systems, from US$371,600 to US$925,000. This wide spread of views reflects meaningful debate over risks such as quality-control litigation, highlighting broader questions around the company’s longer-term stability and performance.

Explore 14 other fair value estimates on Monolithic Power Systems - why the stock might be worth less than half the current price!

Build Your Own Monolithic Power Systems Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Monolithic Power Systems research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Monolithic Power Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Monolithic Power Systems' overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MPWR

Monolithic Power Systems

Designs, develops, markets, and sells semiconductor-based power electronics solutions for the storage and computing, automotive, enterprise data, consumer, communications, and industrial markets in the United States, China, Taiwan, South Korea, Europe, Southeast Asia, Japan, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives