- United States

- /

- Semiconductors

- /

- NasdaqGS:MKSI

MKS (MKSI): Exploring Valuation as Analyst Optimism and Upward Forecasts Drive Positive Momentum

Reviewed by Kshitija Bhandaru

Shares of MKS (MKSI) have climbed over 13% in the past week. This increase has caught the attention of investors following several upward earnings estimate revisions and a wave of optimism regarding its momentum in semiconductor equipment and RF power solutions.

See our latest analysis for MKS.

After a stellar run over the past month, MKS shares have gained almost 10% on a 30-day basis, with momentum supported by recent analyst optimism and positive earnings estimate revisions. Looking at the bigger picture, the company’s total shareholder return of nearly 12% over the past year adds to its longer-term gains. Momentum appears to be building as investors grow more confident in MKS’s growth prospects and fundamental strength.

If you’re looking to uncover more companies with exposure to cutting-edge tech, it’s a great moment to check out the See the full list for free.

But as shares surge and analysts continue to revise forecasts upward, the central question for investors now is whether MKS remains undervalued or if its future growth is already reflected in the current share price.

Most Popular Narrative: 4.2% Undervalued

Compared to MKS’s last close at $121.31, the most followed narrative estimates a fair value of $126.69, suggesting modest upside remains based on consensus expectations. This sets up a deeper look at the beliefs fueling this view.

The company's deepening integration of advanced materials and chemistry equipment (including Atotech) positions MKS as a unique provider of both tools and consumables required for the shift to multilayer, high-density AI-related applications. This is enabling cross-selling, leading to superior revenue growth and structural improvements in gross and operating margins.

Curious what kind of aggressive growth assumptions are behind that price? This narrative builds its case on bold projections for profit margins and revenue expansion, plus a risk/reward balance few expect. Discover the surprising levers that justify that consensus price. Will they hold up?

Result: Fair Value of $126.69 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unforeseen demand swings in the semiconductor cycle and pressure from global trade risks could quickly challenge this upbeat outlook for MKS.

Find out about the key risks to this MKS narrative.

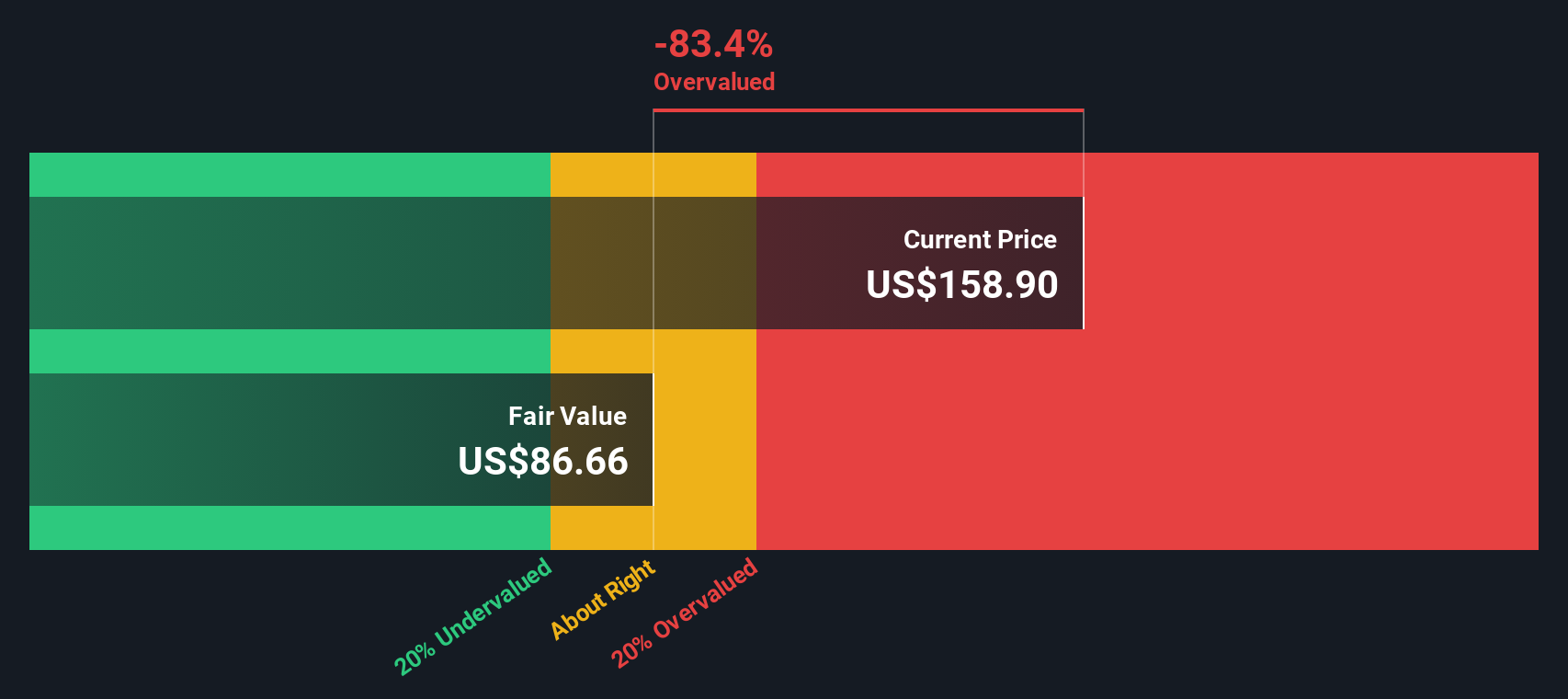

Another View: SWS DCF Model Challenges the Consensus

While analyst forecasts paint an optimistic picture for MKS, our SWS DCF model tells a different story. Using cash flow projections and a standard discount rate, this valuation suggests MKS may actually be overvalued at current prices. Which approach gets closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out MKS for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own MKS Narrative

If you see the story differently or enjoy digging through the numbers yourself, you can easily craft your own narrative in just a few minutes with Do it your way.

A great starting point for your MKS research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let great opportunities slip by. Now is the perfect time to target emerging trends and hidden gems using Simply Wall Street's advanced screeners.

- Tap into fast-moving digital finance by reviewing these 79 cryptocurrency and blockchain stocks and explore advancements in blockchain and decentralized technology.

- Spot reliable income opportunities with these 19 dividend stocks with yields > 3% to find stable yields above 3% and resilience in every market climate.

- Experience the AI revolution firsthand by assessing these 24 AI penny stocks which are leading innovation across machine learning and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MKSI

MKS

Provides foundational technology solutions to semiconductor manufacturing, electronics and packaging, and specialty industrial applications in the United States, China, South Korea, Japan, Taiwan, Singapore, and internationally.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026