- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (NasdaqGS:MCHP) Surges 19% Despite Decline In Sales And Net Income

Reviewed by Simply Wall St

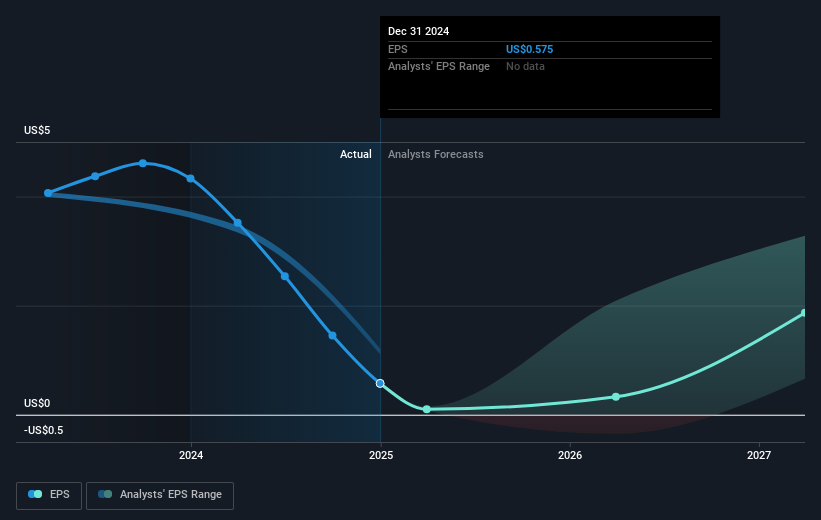

Microchip Technology (NasdaqGS:MCHP) saw its share price increase by 19% last week despite challenging financial results. The company reported a significant decline in both sales and net income for the third quarter compared to the previous year, alongside a disheartening earnings forecast. Nonetheless, Microchip's decision to maintain its quarterly dividend of $0.46 per share could have supported investor confidence. Meanwhile, the introduction of a new Low-Noise Chip-Scale Atomic Clock aimed at enhancing product offerings may have also positively influenced market sentiment. Additionally, the announcement of Victor Peng's upcoming involvement in the Board of Directors provided an optimistic view of potential future leadership contributions. Surprisingly, in the context of a challenging week for the broader market, with major indexes like the Dow Jones and Nasdaq down and technology stocks generally underperforming, Microchip's stock bucked the trend, indicating faith in its long-term strategy amid short-term hurdles.

Take a closer look at Microchip Technology's potential here.

The past five years have seen Microchip Technology Incorporated (NasdaqGS:MCHP) achieve a total return of 55.01%, bolstered by various factors including significant earnings growth at an average rate of 21.8% annually. However, more recently, the company has faced challenges such as a considerable profit margin decrease and a high Price-To-Earnings ratio of 112, which is expensive compared to industry norms. Despite these hurdles, strategic developments like the release of the PCI100x family of PCIe Gen 4.0 switches and successful executive changes, including interim CEO Steve Sanghi’s leadership, have played a role in maintaining market interest and investor confidence.

Throughout 2020, Microchip adapted with innovations such as the introduction of SiC power modules and multiple technological collaborations. The alliance with Sequans Communications to enhance IoT connectivity in early 2020 showcased Microchip's focus on expanding its technological repertoire. The company also entered into a US$615 million credit agreement, strengthening its financial positioning for future ventures. These initiatives have combined to project stability and potential for growth, factors that may have contributed to the stock's performance over the long term.

- Unlock the insights behind Microchip Technology's valuation and discover its true investment potential

- Uncover the uncertainties that could impact Microchip Technology's future growth—read our risk evaluation here.

- Hold shares in Microchip Technology? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Engages in the development, manufacture, and sale of smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives