- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (NasdaqGS:MCHP) Raises Sales Guidance for Fiscal Q1 2026

Reviewed by Simply Wall St

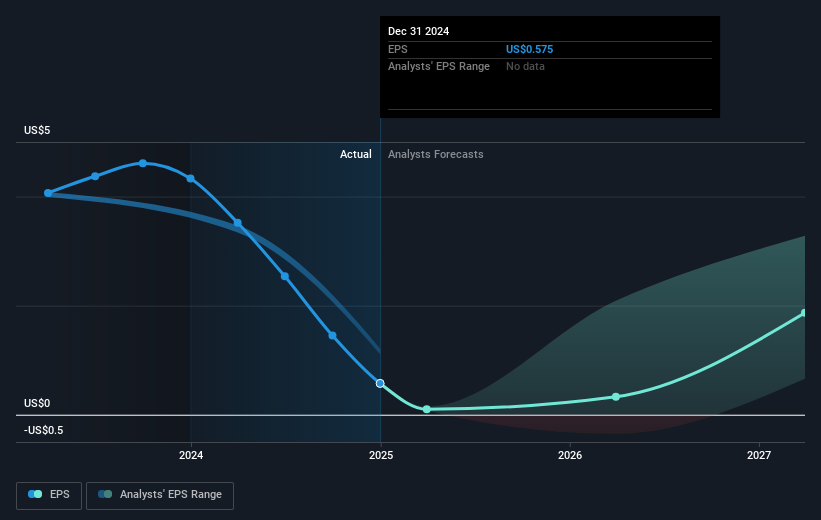

Microchip Technology (NasdaqGS:MCHP) has raised its earnings guidance for the fiscal first quarter of 2026, signaling anticipated improved performance, which may have added positive momentum to its stock price during a month where it climbed 27%. This optimistic revision reflects a healthier forecast for consolidated net sales and a reduced expected loss per share, aligning with broader positive market trends. Despite recent market volatility due to geopolitical tensions and tariff discussions, Microchip's proactive stance in financial guidance stood out, possibly contributing to investor confidence against a backdrop of favorable broader market performance where the Nasdaq rose nearly 10%.

The recent upward revision in Microchip Technology’s earnings guidance for fiscal Q1 2026 may bolster the company's ongoing transformation efforts. Implementing a broad 9-point efficiency plan, including facility closures and inventory strategies, positions Microchip to capitalize on revenue growth in emergent sectors. However, the challenges of restructuring and high inventory levels present hurdles that could impact short-term operational efficiency and revenue consistency.

Over the past five years, Microchip’s total shareholder return, including both share price and dividends, was 19.14%. Despite its recent monthly climb, the company’s one-year performance lagged the broader US market and the semiconductor industry. Analysts forecast an optimistic outlook, with revenue anticipated to grow annually by 10.7% in the next three years, potentially elevating earnings to US$1.4 billion by May 2028. However, variations in analyst consensus, particularly in price targets, highlight differing expectations for Microchip’s capacity to meet these targets consistently.

The current share price is US$47.24, translating to a 19.7% discount to the consensus price target of US$58.82. The revised economic outlook and anticipated improved performance may positively influence investor sentiment, aligning more closely with the optimistic analyst forecasts. Nonetheless, reliance on future earnings trajectory amidst operational restructuring suggests careful evaluation of potential risks and impacts on cash flow flexibility. Investors are encouraged to continually scrutinize these dynamics in light of the company’s strategic actions and market positions.

Learn about Microchip Technology's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives