- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Microchip Technology (NasdaqGS:MCHP) 1% Dip With Board Shift As Rango Exits

Reviewed by Simply Wall St

Microchip Technology (NasdaqGS:MCHP) saw a price decline of 0.65% over the past month, amidst a flurry of developments. Recently, the company unveiled the PIC32A family of microcontrollers and a cost-effective in-circuit debugger, signaling a push to strengthen its position in the semiconductor industry. During the same period, the broader market faced challenges, with the S&P 500 entering a correction phase driven by economic uncertainties stemming from policy changes and tariff concerns. Despite experiencing a remarkable rally, major indexes ended on a lower note for the fourth consecutive week. Although individual technology stocks like Nvidia and Palantir led temporary recoveries, market volatility persisted. In contrast to the broader technology sector's gains, reflected in the VanEck Semiconductor ETF's 3% increase, MCHP's relatively minor decline could be attributed to market conditions rather than company-specific developments. Meanwhile, Robert A. Rango’s exit from the board suggests potential shifts within the governance framework.

Evaluate Microchip Technology's prospects by accessing our earnings growth report.

Over the last five years, Microchip Technology's total shareholder return, including share price and dividends, rose 95.82%. This performance underscores significant growth and resilience amidst varied market conditions. While Microchip's earnings have grown by 21.8% annually over this period, recent developments such as the introduction of the PIC32A family of microcontrollers in March 2025 and the PICkit Basic In-Circuit Debugger highlight the company’s commitment to expanding its semiconductor offerings. The release of these innovative products supports applications in automotive, industrial, and data center sectors, potentially enhancing long-term demand.

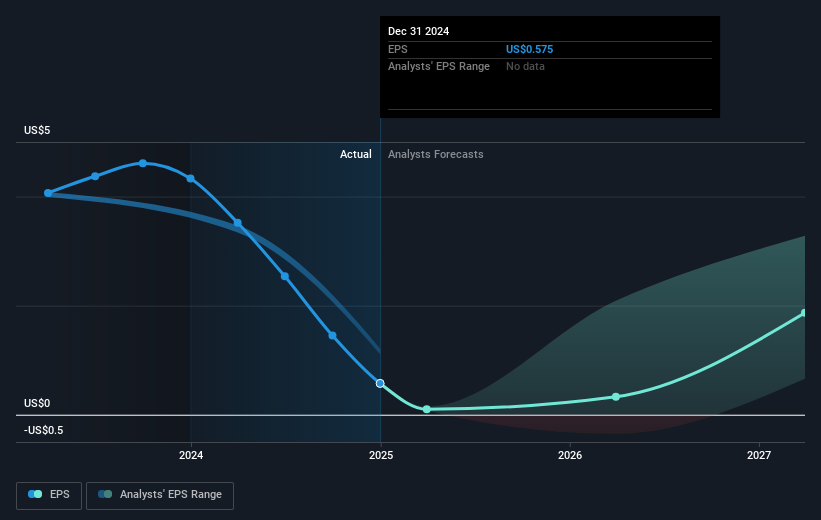

In the most recent year, however, Microchip's performance has lagged, underperforming both the US Semiconductor industry return of 16.5% and the broader market's 9.5% gain. Despite these challenges, earnings are expected to grow at a significant rate of over 42% annually in the coming years, with a forecasted revenue growth higher than that of the US market. However, the company's Price-To-Earnings Ratio remains high, indicating it may be perceived as expensive relative to the industry averages.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives