- United States

- /

- Semiconductors

- /

- NasdaqGS:MCHP

Assessing Microchip Technology (MCHP) Valuation After New Networking and Power Module Launches

Reviewed by Kshitija Bhandaru

If you have been following Microchip Technology (MCHP) lately, the headlines might have caught your eye. The company just unveiled a set of new products, including next-generation LAN9645x Ethernet switches built for maximum reliability and flexibility, and advanced DualPack 3 power modules aimed at bumping up efficiency in power conversion. For investors, these launches are more than routine. They showcase a push into specialized, high-demand segments like industrial automation and energy management, where reliability and performance are crucial.

These product rollouts come as Microchip Technology continues to deliver a mixed performance story. Over the past five years, its shares have risen roughly 45%, though this has trailed broader market gains. The annual upswing in revenue and net income points to operational improvements, yet the share price has dipped over the last year, and recent quarterly trading shows a subtle downtrend. Still, momentum from long-term innovation is undeniable, with dividend payments sweetening the deal for patient shareholders.

Is this period of muted stock action opening up a value opportunity in MCHP, or has the market already factored in the upside from its latest innovations?

Most Popular Narrative: 14.3% Undervalued

The prevailing narrative suggests Microchip Technology is currently undervalued by a significant margin, based on forward-looking assumptions about its earnings recovery, margin expansion, and sector positioning.

Operational leverage is set to improve as inventory write-offs and factory underutilization charges decline. Management is targeting a return to 65% non-GAAP gross margins. As factory utilization ramps beginning in the December quarter and charges subside, incremental profits are expected to flow disproportionately to operating income and earnings.

Curious what is powering the double-digit upside call for Microchip Technology? The narrative is betting on a major profitability turnaround and a sharp increase in future earnings. But what is the real story behind those headline numbers, and could a sea change be on the horizon? Find out which bold financial assumptions drive the fair value, and see why some believe Microchip is primed for a comeback.

Result: Fair Value of $76 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistently high inventory and ongoing debt repayments could weigh on Microchip Technology's profitability, which may challenge the speed or scale of any turnaround.

Find out about the key risks to this Microchip Technology narrative.Another View: Value Questioned by Industry Comparison

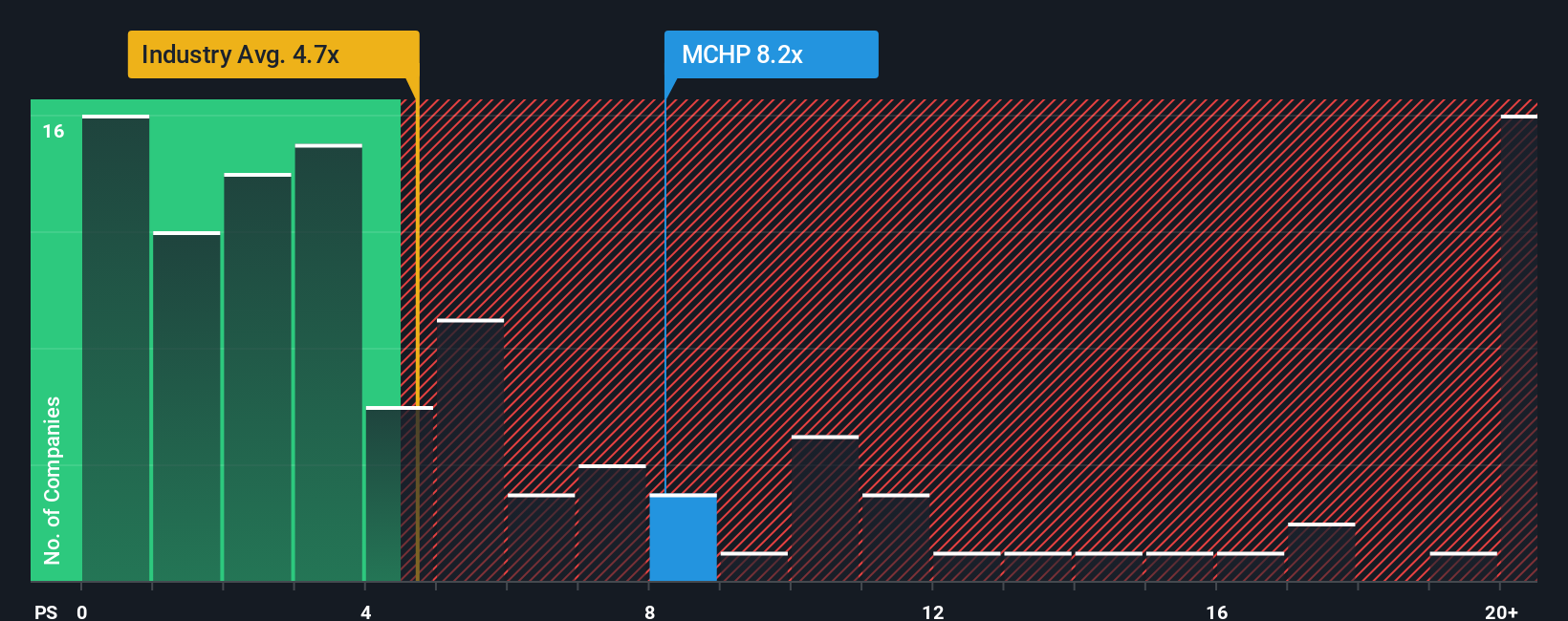

Looking through a different lens, an industry-standard ratio suggests Microchip Technology’s shares could be trading higher than similar companies. This challenges the optimistic fair value story. Could the truth fall somewhere in between?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Microchip Technology to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Microchip Technology Narrative

If your take on Microchip Technology differs, or you want to dig into the numbers yourself, you have the tools to build a narrative in just a few minutes. Do it your way

A great starting point for your Microchip Technology research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for More Ways to Supercharge Your Portfolio?

Waiting on just one stock could mean missing out on tomorrow’s winners. Take smart action now and let Simply Wall Street help guide your next investment move.

- Unlock reliable income streams when you target steady returns and see which companies make the cut for dividend stocks with yields > 3%.

- Ride the AI revolution by scouting innovative businesses that stand out with game-changing tech. Start with AI penny stocks.

- Seize overlooked opportunities and pinpoint undervalued gems that most investors ignore by searching through undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MCHP

Microchip Technology

Develops, manufactures, and sells smart, connected, and secure embedded control solutions in the Americas, Europe, and Asia.

High growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives