- United States

- /

- Semiconductors

- /

- NasdaqGS:LSCC

Can Lattice Semiconductor’s AI Momentum Justify Its 2025 Share Price Surge?

Reviewed by Bailey Pemberton

- Thinking about whether Lattice Semiconductor stock is a smart buy right now? Let’s dig into the value behind the share price and see what’s really under the hood.

- The stock recently climbed 1.1% this past week, after dropping 10.0% in the last month. It remains up 14.7% year-to-date and has gained an impressive 30.4% over the past year.

- Lattice has grabbed headlines lately for its growing presence in edge computing and artificial intelligence solutions. Several industry partnerships are helping to fuel long-term optimism. These developments provide useful context for the recent swings in share price as investors reevaluate growth prospects and market position.

- When it comes to valuation, the company checks in with a score of 1 out of 6 for undervalued metrics, so there is definitely more to uncover. We will go through each valuation approach in detail, and if you stick around to the end, you will get a look at a smarter way to judge value that goes beyond the usual numbers.

Lattice Semiconductor scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lattice Semiconductor Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a fundamental valuation method that estimates the intrinsic value of a stock by projecting its future free cash flows and then discounting those projections back to today's value. This approach aims to calculate what the entire future cash flow stream is worth, expressed in present-day dollars.

For Lattice Semiconductor, the most recent trailing twelve months of Free Cash Flow (FCF) amount to $128.42 million. Analysts have forecast continued growth, estimating that FCF could reach $235.9 million by the year ending 2027. Beyond the five-year analyst window, future cash flows are extrapolated, with projections indicating a potential FCF of roughly $355.71 million by 2035, growing at gradually slowing estimated rates each year.

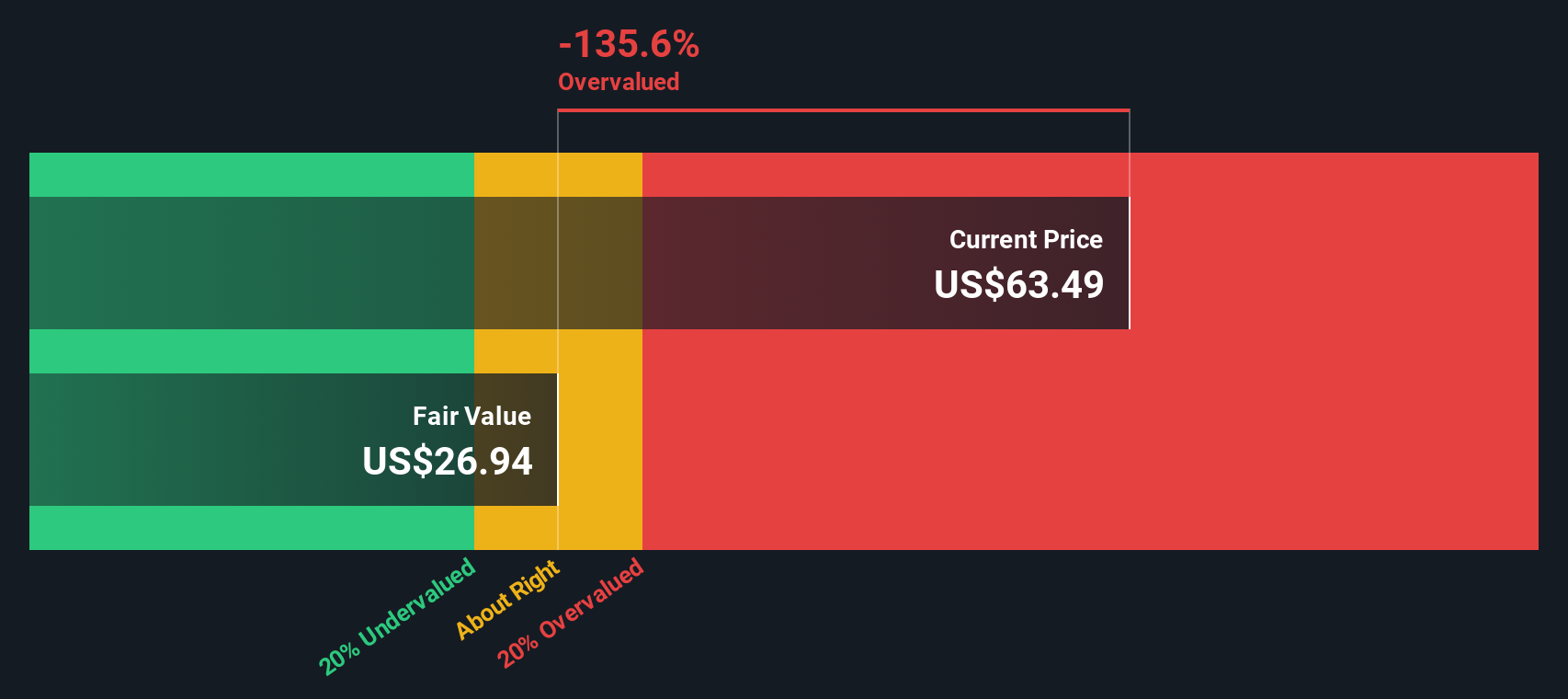

The DCF model in this analysis uses a "2 Stage Free Cash Flow to Equity" approach, factoring in both the near-term analyst estimates and long-term extrapolations. Based on these cash flow projections and discount rates, the calculated intrinsic value of Lattice Semiconductor stock comes out to $25.92 per share.

Comparing this figure to the current market price, the DCF result suggests the stock is trading at a 147.6% premium to its intrinsic value. This means, according to the DCF methodology, Lattice Semiconductor shares are considerably overvalued at present levels.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Lattice Semiconductor may be overvalued by 147.6%. Discover 879 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Lattice Semiconductor Price vs Sales

Price-to-Sales (P/S) is often the preferred valuation multiple for companies like Lattice Semiconductor. This is because the P/S ratio offers a clear view of valuation for profitable businesses in dynamic industries, where revenue growth is a strong signal but earnings may be impacted by investments in innovation or scaling up new opportunities.

Growth expectations and risk play a key role in what is considered a fair P/S multiple. Higher anticipated sales growth and lower perceived risks typically justify a premium multiple, while slow growth or uncertainty tend to drive it lower.

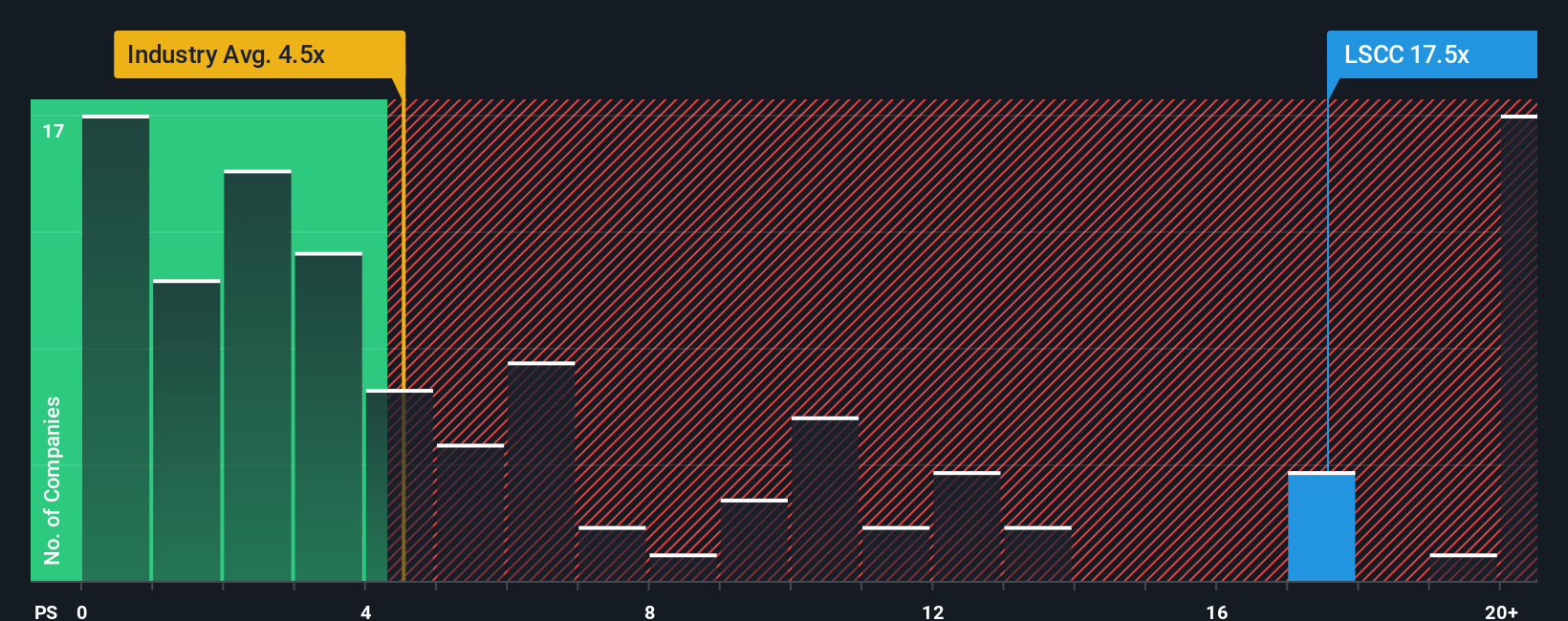

Lattice Semiconductor currently trades at a 17.74x P/S ratio. In comparison, the semiconductor industry average is 4.95x, and its peer group averages 9.53x. This means the market is attaching a healthy premium to Lattice compared to both the broader industry and its closest competitors.

Simply Wall St's proprietary “Fair Ratio” offers a more nuanced benchmark by factoring in elements like growth prospects, risk profile, profit margins, and company size. For Lattice Semiconductor, the Fair Ratio stands at 9.43x. Since this is well below the actual multiple of 17.74x, the data suggests the stock is overvalued using this approach.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Lattice Semiconductor Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple way to connect your own view of a company's story with its financial future. You combine what you believe about Lattice Semiconductor’s business, such as revenue growth and margins, with your fair value calculation, all in one place.

Unlike static valuation methods, Narratives let you capture why you think a company is undervalued or overvalued by directly linking what’s happening in the industry, new technology trends, or company strategy to your own assumptions about future performance.

Using a Narrative, you clarify why you expect Lattice’s fair value to be higher or lower by recording your reasoning, forecasts, and risks. You can then instantly compare your fair value to the current price, making it much easier to spot buy or sell signals.

Simply Wall St’s Community page makes this tool accessible to millions of investors, letting you publish and update your Narrative as news, earnings, or forecasts change. This helps your investment decisions adapt dynamically to the latest information.

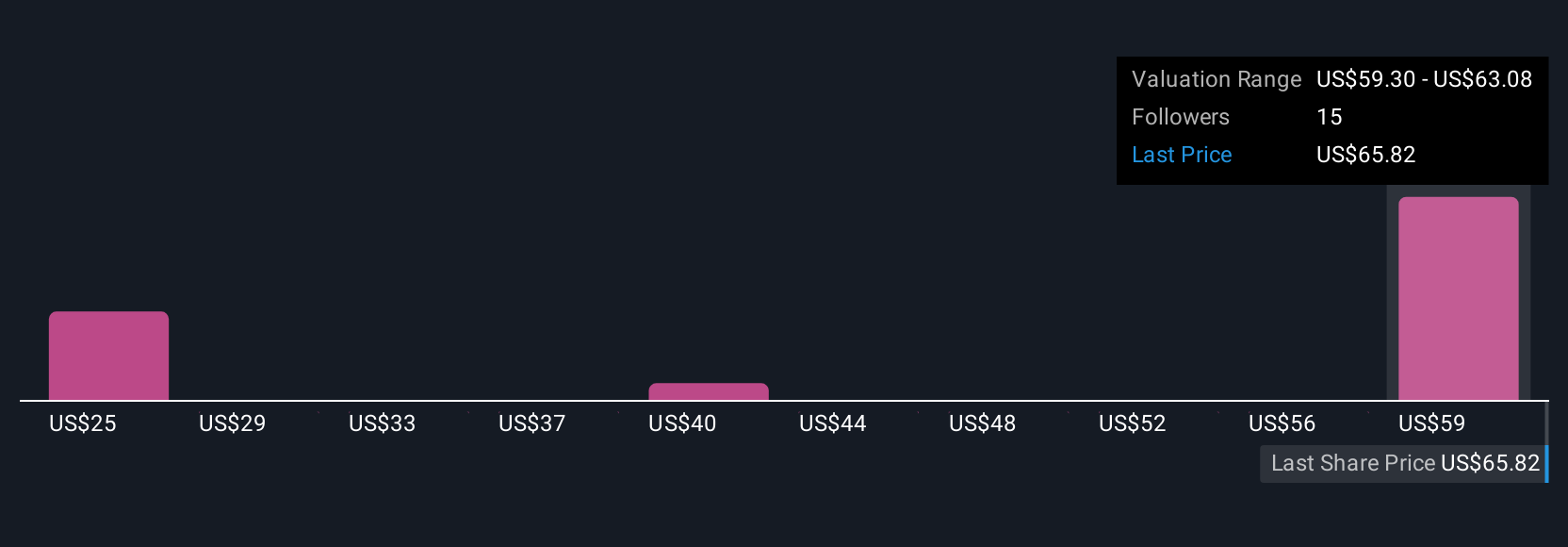

For example, some investors think rising AI demand could push Lattice’s fair value up toward $78.77 per share, while others see risks that could justify a much lower target of $52.00. This shows how Narratives make it easy to compare perspectives and decide which story you believe most.

Do you think there's more to the story for Lattice Semiconductor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LSCC

Lattice Semiconductor

Develops and sells semiconductor, silicon-based and silicon-enabling, evaluation boards, and development hardware products in Asia, Europe, and the Americas.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives