- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (LRCX) Is Up 14.7% After Strong Earnings Beat and VECTOR TEOS 3D Launch—Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- In September 2025, Lam Research reported strong quarterly financial results that surpassed consensus estimates, alongside the commercial launch of VECTOR® TEOS 3D, a new deposition system designed for advanced chip packaging in AI and high-performance computing applications.

- This wave of innovation and financial momentum is being driven further by growing industry demand for wafer fabrication equipment, underpinned by major memory supply deals and expanded partnerships across the semiconductor supply chain.

- We'll explore how Lam Research's successful rollout of VECTOR® TEOS 3D and recent record earnings reinforce its long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Lam Research Investment Narrative Recap

Owning Lam Research means believing in a future where next-generation chip technologies, from AI to advanced packaging, drive long-term demand for wafer fabrication equipment. The recent proxy proposal to limit officer liability and the shareholder push for more flexible governance do not appear to materially affect Lam’s most important catalyst: rising orders from major memory and logic customers amid an industry-wide capex upswing. Conversely, the biggest immediate risk remains any abrupt slowdown in spending or regulation tied to global trade tensions, particularly in China.

Among Lam’s recent announcements, the launch of VECTOR TEOS 3D stands out, with the new deposition platform already attracting attention for its potential to enhance high-volume chip packaging for AI and high-performance applications. The rollout supports the company’s near-term momentum, especially as customer investments in advanced chip architecture continue to rise, even as concerns about cyclical demand and customer concentration linger in the background.

Yet investors should also be mindful that, if China demand unexpectedly softens or tariffs rise sharply, margin pressures could...

Read the full narrative on Lam Research (it's free!)

Lam Research's narrative projects $23.6 billion in revenue and $6.7 billion in earnings by 2028. This requires 8.5% annual revenue growth and a $1.3 billion increase in earnings from $5.4 billion today.

Uncover how Lam Research's forecasts yield a $110.53 fair value, a 25% downside to its current price.

Exploring Other Perspectives

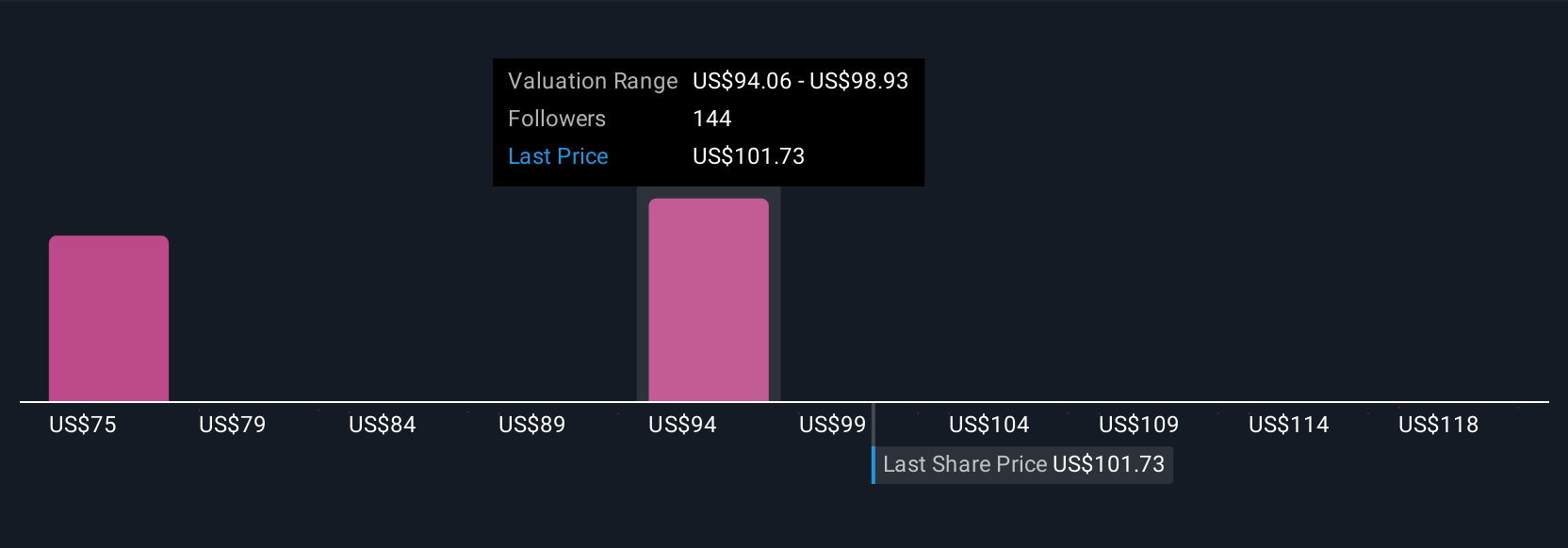

The Simply Wall St Community produced 19 fair value estimates for Lam Research ranging from US$58.30 to US$135 per share. While industry demand is strengthening, investors continue to weigh the risk of cyclicality and exposure to major regional markets, highlighting the importance of comparing multiple viewpoints.

Explore 19 other fair value estimates on Lam Research - why the stock might be worth less than half the current price!

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Looking For Alternative Opportunities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives