- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Lam Research (LRCX): Evaluating Valuation Ahead of Q1 Earnings and Surging AI Chip Demand

Reviewed by Simply Wall St

Lam Research (LRCX) is gearing up to report its first-quarter fiscal 2026 results following a period of rising demand for AI and advanced chip equipment. Investors are watching closely for management's take on future orders and profit margins.

See our latest analysis for Lam Research.

Lam Research’s share price has been on a tear this year, up nearly 99% so far. Momentum has accelerated sharply in recent months as demand for AI-related chip equipment took off. Over the past year, total shareholder return stands at just under 100%, rewarding investors who stuck with the story through earlier market volatility and reflecting a renewed appetite for companies capitalizing on next-gen semiconductor trends.

If the surge in chip demand has you rethinking what could be next, you might want to discover See the full list for free.

With expectations running high and shares soaring, the big question now is whether Lam Research remains undervalued or if the rally has already priced in future growth, leaving little room for new buyers to benefit.

Most Popular Narrative: 19.2% Overvalued

Lam Research’s current fair value estimate from the most widely followed narrative sits at $120.82, which is notably below the recent closing price of $144.05. This gap reflects an upbeat outlook, but it signals that shares have pushed beyond what analysts collectively view as justified by the underlying numbers and growth prospects.

Lam's leadership in new process technologies like ALD Moly for metal deposition and advanced packaging solutions (SABRE 3D systems) positions the company to capture an increasing share of spend on next-generation chip manufacturing. This could lead to market share gains, higher average selling prices, and expanding gross margins over the long term.

Curious about what makes this premium price tick? The narrative hinges on bold profit forecasts and market share ambitions tied to advanced technology investments. If you want to know which key financial levers have triggered this valuation call, you’ll want to see the numbers behind the story.

Result: Fair Value of $120.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing geopolitical tensions and heavy customer concentration could quickly undermine the bullish case if global demand weakens or key clients pull back spending.

Find out about the key risks to this Lam Research narrative.

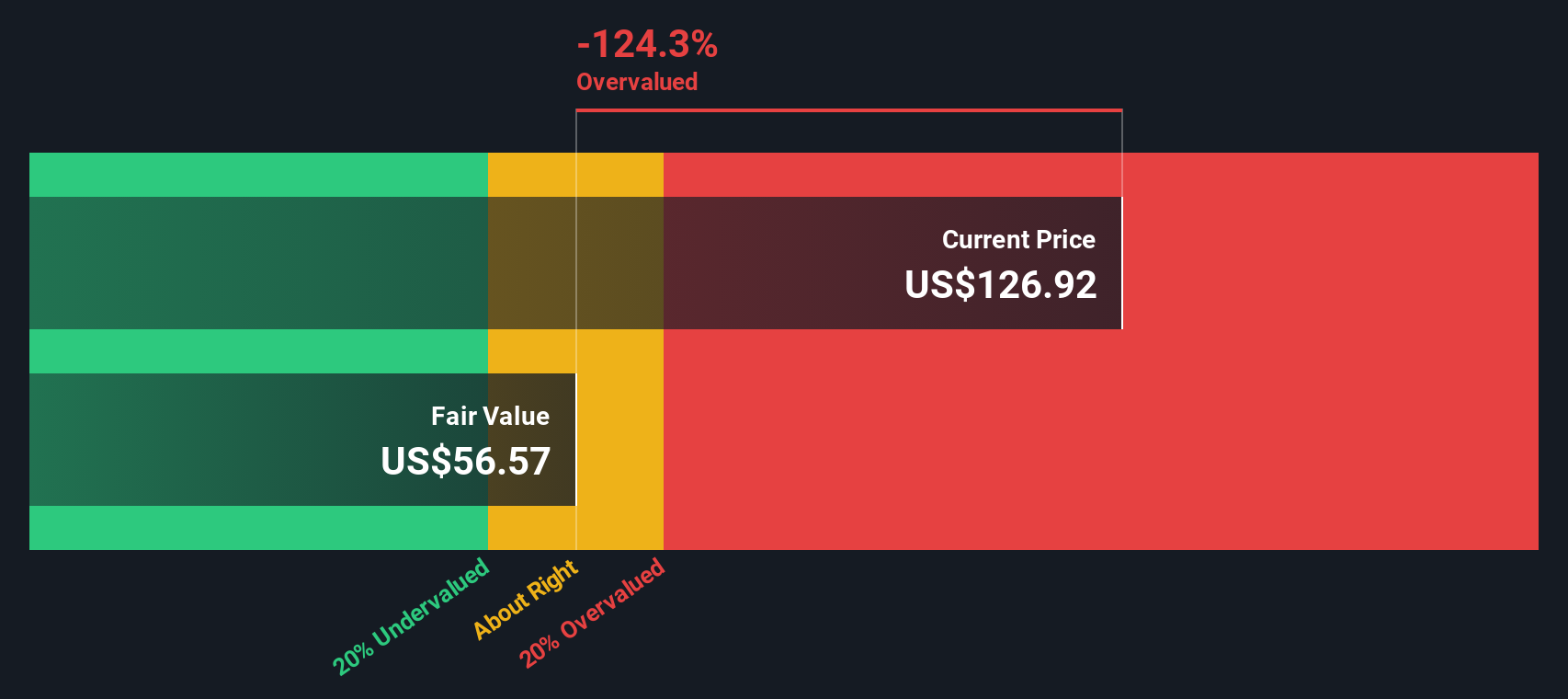

Another View: SWS DCF Model Calls It Highly Overvalued

Looking through the lens of our DCF model, Lam Research's current market price of $144.05 trades well above its estimated fair value of $58.46. This means the DCF approach suggests substantial downside risk compared to the market’s optimism, highlighting how different valuation models can yield very different results. Which scenario makes more sense to you?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Lam Research Narrative

If you see things differently or prefer to dig into the details yourself, you can craft your own view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Lam Research.

Looking for more investment ideas?

Smart investors never settle for just one opportunity. Give yourself the edge by seeing what other top stocks the market is buzzing about right now.

- Unlock potential growth by researching these 24 AI penny stocks. These companies are changing the game with artificial intelligence solutions shaping every major industry.

- Boost your income strategy and spot reliable performers among these 17 dividend stocks with yields > 3%. These stocks deliver attractive yields above 3%.

- Take advantage of rare opportunities in these 873 undervalued stocks based on cash flows, where cash flow fundamentals signal stocks trading below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits in the United States, China, Korea, Taiwan, Japan, Southeast Asia, and Europe.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives