- United States

- /

- Semiconductors

- /

- NasdaqGS:LRCX

Is Lam Research’s US$1.2 Billion India Expansion Reshaping the LRCX Investment Case?

Reviewed by Simply Wall St

- Earlier this month, Lam Research announced plans to invest over US$1.2 billion to build a new manufacturing facility in India, aiming to diversify its global manufacturing network and bolster supply chain resilience.

- This marks a significant move for the company, enabling greater flexibility in responding to geopolitical uncertainties and enhancing support for future R&D initiatives.

- We'll explore how Lam Research's substantial India expansion underpins its investment case with increased supply chain flexibility and R&D capabilities.

Lam Research Investment Narrative Recap

To be a shareholder in Lam Research, you need to believe in the continued expansion of leading-edge semiconductor manufacturing and the company's capacity to capture new opportunities through innovation and global supply chain flexibility. The recent plan to invest over US$1.2 billion in a new manufacturing facility in India may enhance operational resilience but does not materially change the immediate earnings catalyst tied to advanced chip demand or reduce the main risk from export restrictions targeting specific customers in China.

Among recent announcements, Lam Research's April 2025 launch of two advanced manufacturing tools, ALTUS® Halo and Akara®, stands out in context of these catalysts. These product innovations support Lam’s strategy of increasing market share at significant technology inflections, helping offset persistent risks like customer concentration and global trade friction.

Yet, despite these moves, investors should also consider the ongoing impact of regulatory restrictions on Lam’s ability to serve China-based customers...

Read the full narrative on Lam Research (it's free!)

Lam Research's narrative projects $21.8 billion revenue and $6.2 billion earnings by 2028. This requires 8.4% yearly revenue growth and a $1.5 billion earnings increase from $4.7 billion today.

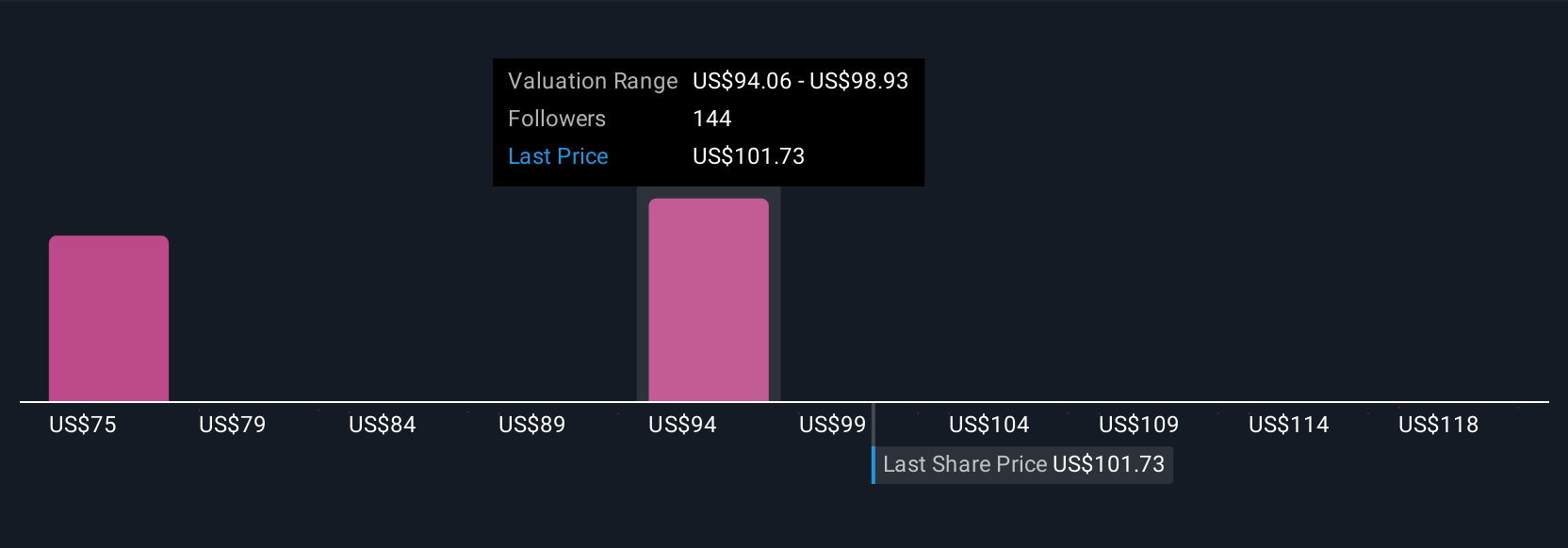

Uncover how Lam Research's forecasts yield a $94.81 fair value, a 7% downside to its current price.

Exploring Other Perspectives

Fair value estimates from 9 members of the Simply Wall St Community for Lam Research range from US$74.55 to US$120.86 per share. With global supply chain flexibility as a growing catalyst, it’s clear opinions on future performance differ, explore several perspectives to inform your view.

Build Your Own Lam Research Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Lam Research research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Lam Research research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Lam Research's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:LRCX

Lam Research

Designs, manufactures, markets, refurbishes, and services semiconductor processing equipment used in the fabrication of integrated circuits.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives