- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

The Bull Case For KLA (KLAC) Could Change Following Strong Q1 Results and Advanced Packaging Growth

Reviewed by Sasha Jovanovic

- KLA Corporation recently reported its first-quarter financial results for the period ended September 30, 2025, posting revenue of US$3.21 billion and net income of US$1.12 billion, both up from the prior year.

- Advanced packaging and AI infrastructure contributed to strong double-digit growth, while KLA also issued supportive guidance for the next quarter despite ongoing risks from China-related regulatory headwinds.

- We'll explore how KLA's better-than-expected results and advanced packaging momentum influence the company's investment narrative going forward.

These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

KLA Investment Narrative Recap

To be a shareholder in KLA today, you need to believe that rising demand for advanced process control solutions, especially in AI and high-performance computing, will continue to support the company’s premium position, even as risks from tariffs and regulatory restrictions in China remain present. The strong Q1 results reinforce the advanced packaging momentum as a key short-term catalyst, while the biggest near-term risk, further export controls affecting China revenue, remains an ongoing concern, though KLA’s latest results do not materially change this exposure.

One of the most relevant recent announcements is KLA’s Q2 guidance, which calls for continued revenue growth and robust earnings per share. This supports the narrative that customer investment in advanced packaging and AI infrastructure, rather than just backlog normalization, remains the primary driver for the company’s performance in the coming quarters.

Yet, in contrast to the earnings optimism, investors should also be mindful of the potential for further regulatory changes impacting KLA’s China business and...

Read the full narrative on KLA (it's free!)

KLA's narrative projects $14.8 billion revenue and $5.3 billion earnings by 2028. This requires 6.9% yearly revenue growth and a $1.2 billion earnings increase from the current $4.1 billion.

Uncover how KLA's forecasts yield a $1272 fair value, a 5% upside to its current price.

Exploring Other Perspectives

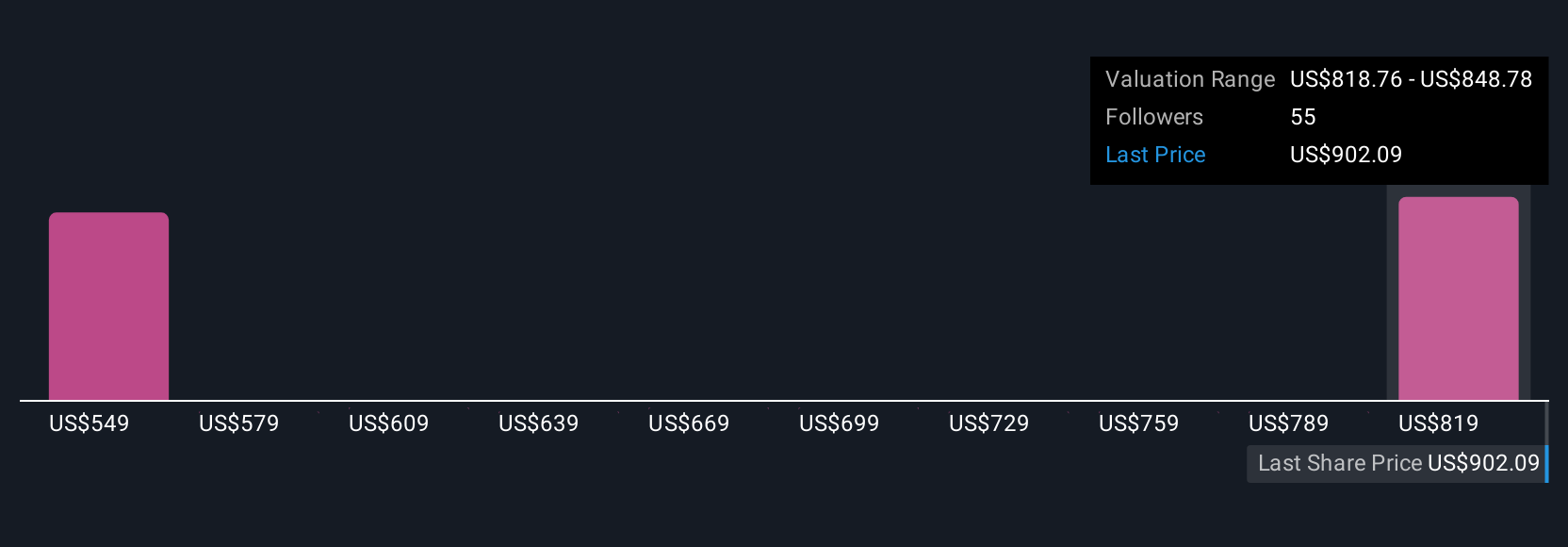

Four members of the Simply Wall St Community estimate KLA’s fair value between US$673.80 and US$1,271.88, reflecting wide differences in outlook. While recent earnings highlight growth drivers, the future effect of China-specific regulatory headwinds remains a critical issue to compare as you review these views.

Explore 4 other fair value estimates on KLA - why the stock might be worth as much as 5% more than the current price!

Build Your Own KLA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KLA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free KLA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KLA's overall financial health at a glance.

No Opportunity In KLA?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026