- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

KLA (KLAC): Assessing Valuation After 19% Three-Month Share Price Surge

Reviewed by Kshitija Bhandaru

KLA (KLAC) shares have seen steady gains recently, rising almost 19% over the past 3 months. Investors have been paying attention to the company’s consistent revenue and net income growth, which reflects KLA’s solid position in the semiconductor industry.

See our latest analysis for KLA.

This run of strong results for KLA comes after a period of growing optimism in the semiconductor space, with recent market enthusiasm driving the share price up 18.85% over the last quarter. In the bigger picture, KLA’s upward momentum is clear, with a one-year total shareholder return of nearly 65% and mid-term gains that have outpaced many industry peers. This points to both confidence in its long-term outlook and excitement around near-term performance.

If you want to see what else is trending as investor interest in chips heats up, check out the latest opportunities in tech and AI with our screener: See the full list for free.

With shares surging and results beating expectations, the key question now is whether KLA’s impressive run leaves it undervalued or if markets have already accounted for all the potential for further gains. Is there truly a buying opportunity here, or has the market priced in future growth?

Most Popular Narrative: 7.8% Overvalued

Right now, KLA trades at $1,106.66, well above the most popular narrative’s fair value estimate of $1,026.32. This perspective draws on forward-looking assumptions around margin expansion, growth in advanced packaging, and the impact of global market shifts, creating a dynamic backdrop.

The advanced packaging market is experiencing early-stage, secular growth fueled by adoption of 2.5D/3D architectures and HBM, driving KLA's advanced packaging revenue target for 2025 up nearly 80% year-over-year with expectations that this trend is "closer to the beginning than the end". This directly expands KLA's addressable market and should provide multi-year upside to revenue.

Can you spot the key financial lever that could turn today’s valuation into tomorrow’s opportunity? Behind this narrative are surprise assumptions about multi-year earnings power and future profit margins that most investors might not suspect. Craving the full playbook on where analysts think KLA is headed? Dive into the detailed forecast to see what could really move the needle next.

Result: Fair Value of $1,026.32 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing U.S.–China trade tensions and potentially slower wafer fab equipment spending could quickly shift the outlook for KLA’s future growth trajectory.

Find out about the key risks to this KLA narrative.

Another View: What the Numbers Say

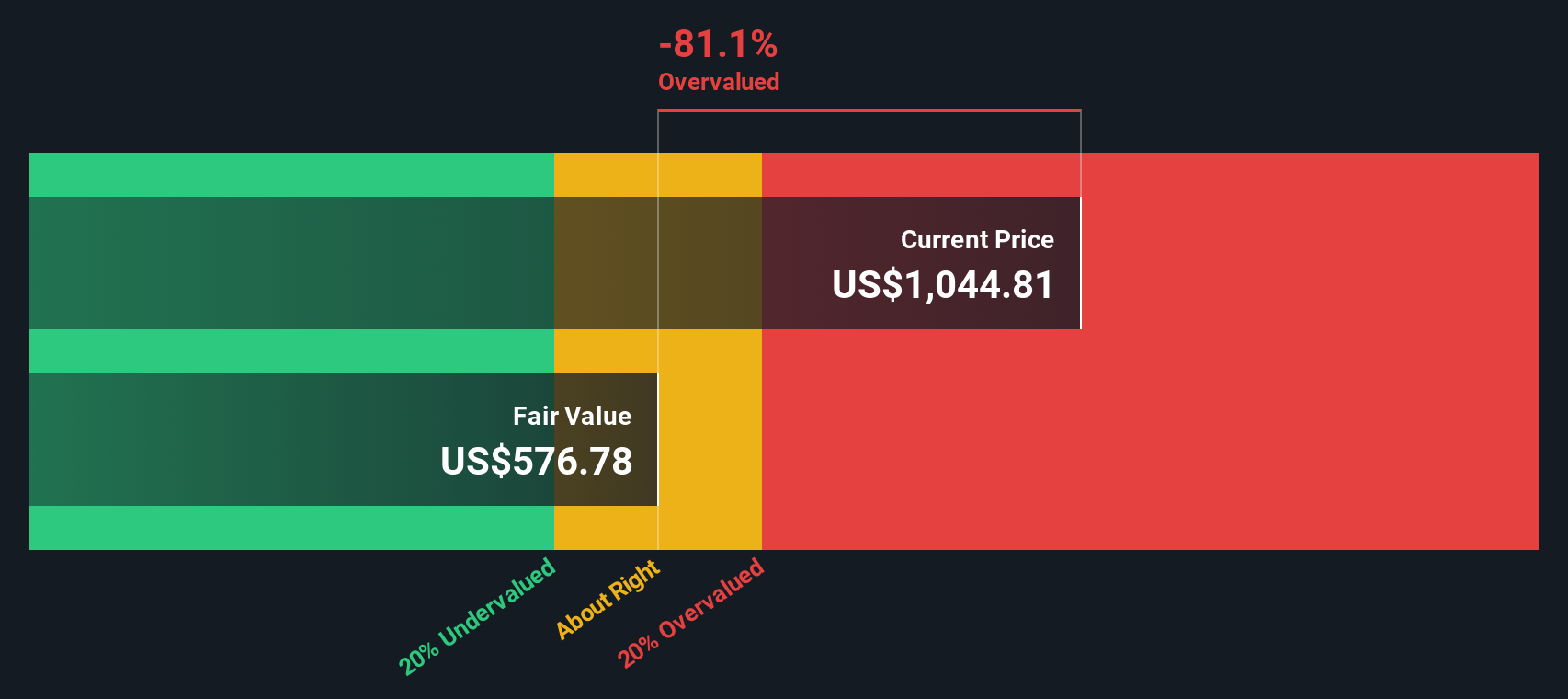

While the analyst consensus points to KLA’s shares being overvalued, our DCF model tells a similar but even starker story. By discounting future cash flows, the SWS DCF model values KLA shares at $617.48, noticeably below the current price. This could indicate that the market is too optimistic, or there may be hidden drivers that the models are missing.

Look into how the SWS DCF model arrives at its fair value.

Build Your Own KLA Narrative

If you think there’s more to the story or want to test your own ideas, you can build a customized narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding KLA.

Looking for more investment ideas?

Unlock new opportunities and get ahead of the crowd by checking out cutting-edge stocks and emerging sectors. The next big move could be just one smart screen away, so don’t miss out on what’s taking off now.

- Tap into tomorrow’s top performers in artificial intelligence by browsing these 24 AI penny stocks for companies driving innovation and reshaping digital technology.

- Spot value plays before the market catches on by viewing these 878 undervalued stocks based on cash flows that look attractive based on strong cash flow fundamentals.

- Secure consistent portfolio income with these 18 dividend stocks with yields > 3% featuring reliable stocks offering yields above 3% for steady long-term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion