- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

How Does AI Demand Shape KLA's (KLAC) Position in the Next Wave of Chip Manufacturing?

Reviewed by Sasha Jovanovic

- In the past week, KLA Corporation and semiconductor peers gained investor attention after Advanced Micro Devices announced a significant multi-year collaboration with OpenAI to deploy its GPUs, spurring optimism across the chip manufacturing sector.

- This wave of positive sentiment coincided with strong demand for advanced packaging solutions tied to AI infrastructure, reinforcing KLA’s position within a rapidly evolving semiconductor landscape.

- We'll explore how the AI-fueled surge in advanced chip deployments strengthens KLA's investment narrative and growth outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

KLA Investment Narrative Recap

To hold KLA Corporation, an investor needs to believe in the sustained increase in process control demand, fueled by advanced chip technologies and the expansion of AI infrastructure. The recent AMD-OpenAI deal sparked broad optimism across the semiconductor sector but has not materially changed KLA’s biggest short-term risk, continued headwinds from a shrinking China market and evolving export controls, which remain a significant constraint on near-term revenue growth.

Among recent company news, KLA’s strong quarterly earnings, with revenue and net income exceeding expectations, stand out as relevant to AI-fueled tailwinds highlighted by the AMD-OpenAI announcement. These results reinforce KLA’s position as a key enabler in the growing semiconductor capital equipment market and strengthen the investment case in connection with the sector’s positive sentiment.

By contrast, investors should be alert to the risk that further China revenue declines or tightening export regulations could...

Read the full narrative on KLA (it's free!)

KLA's outlook anticipates $14.8 billion in revenue and $5.3 billion in earnings by 2028. This is based on a 6.9% annual revenue growth rate and an earnings increase of $1.2 billion from the current $4.1 billion.

Uncover how KLA's forecasts yield a $972.48 fair value, a 8% downside to its current price.

Exploring Other Perspectives

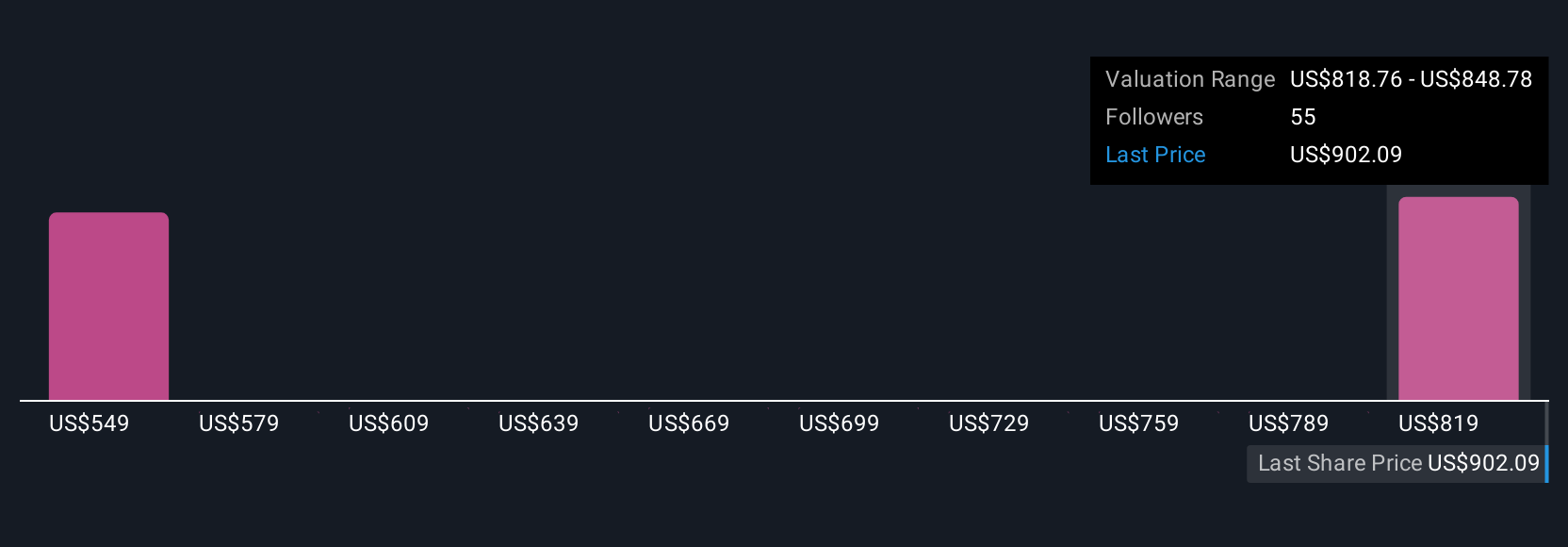

Five recent fair value estimates from the Simply Wall St Community span from US$613 to US$972 per share. While many see AI-driven demand as a catalyst, opinions differ widely and it's worth exploring diverse perspectives on KLA’s future.

Explore 5 other fair value estimates on KLA - why the stock might be worth as much as $972.48!

Build Your Own KLA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KLA research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free KLA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KLA's overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

GOOGL: AI Platform Expansion And Cloud Demand Will Support Durable Performance Amid Competitive Pressures

Trending Discussion