- United States

- /

- Semiconductors

- /

- NasdaqGS:KLAC

Analyst Endorsements Highlight KLA (KLAC) Resilience as AI Demand Reshapes Semiconductor Equipment Industry

Reviewed by Sasha Jovanovic

- Earlier this week, KLA Corporation received fresh analyst endorsements, citing the company's resilience during industry downturns and growing demand driven by advancements in chip manufacturing technologies. The updates occurred as renewed optimism around AI infrastructure and expanding investment in data centers boosted industry expectations for semiconductor equipment suppliers like KLA.

- Analysts pointed out that KLA’s adaptive strength in a cyclical sector is attracting attention as competition intensifies among chipmakers adopting advanced manufacturing technologies.

- We'll examine how analyst recognition of KLA's resilience amid AI-driven semiconductor demand could impact its investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

KLA Investment Narrative Recap

To be a KLA shareholder, you must believe in the company’s ability to maintain leadership in advanced process control as AI and high-performance computing drive more complex chip manufacturing. The recent analyst endorsements reinforce the narrative of resilience, but they do not materially change the biggest risk right now, exposure to China and global tariffs, or the main short-term catalyst, which remains increasing AI-related semiconductor investments.

KLA’s board refresh, with key director retirements and new appointments this year, is the most relevant recent announcement for this news event. Strong and experienced corporate governance is crucial as KLA navigates a period of heightened industry competition and shifting geopolitical risks fueled by AI expansion and semiconductor demand.

However, even as optimism rises, investors should be alert to the growing impact of tariffs and weakening demand in KLA’s China business...

Read the full narrative on KLA (it's free!)

KLA's narrative projects $14.8 billion in revenue and $5.3 billion in earnings by 2028. This requires 6.9% yearly revenue growth and a $1.2 billion earnings increase from the current $4.1 billion.

Uncover how KLA's forecasts yield a $972.48 fair value, a 11% downside to its current price.

Exploring Other Perspectives

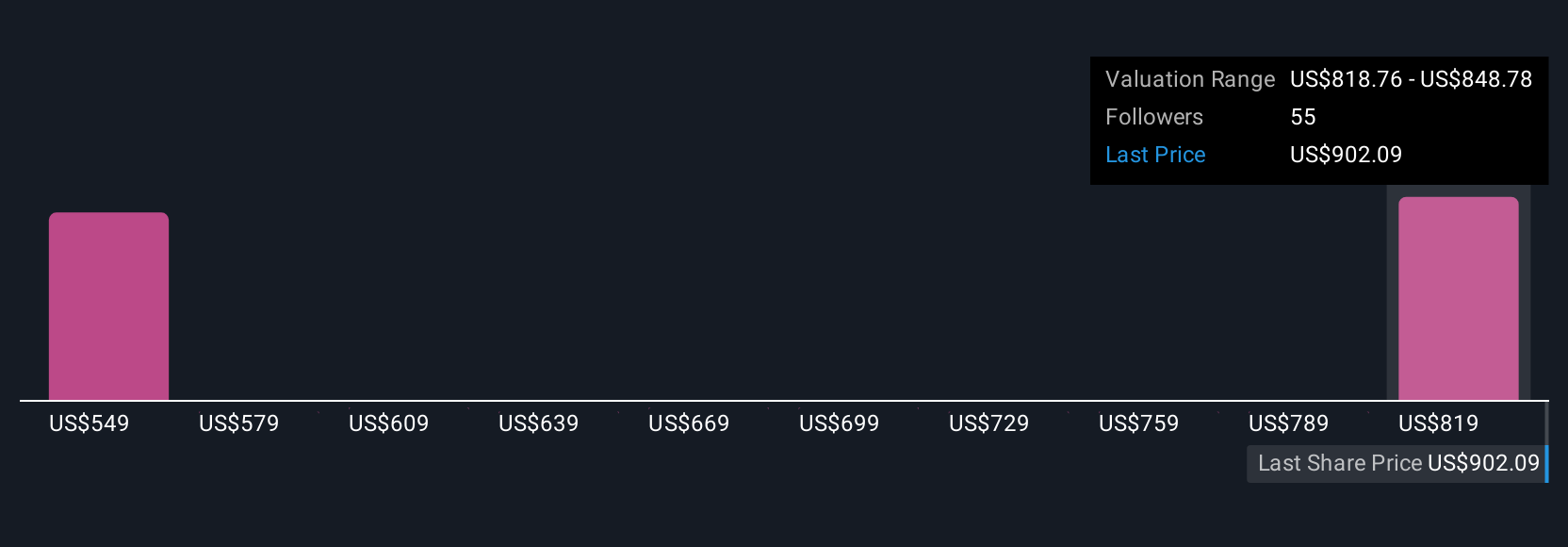

Five fair value estimates from the Simply Wall St Community currently span US$617 to US$972 per share. While many see opportunity in KLA’s AI-driven catalysts, you should weigh this against tariffs and China headwinds, as market opinions differ sharply, explore other perspectives here.

Explore 5 other fair value estimates on KLA - why the stock might be worth 44% less than the current price!

Build Your Own KLA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your KLA research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free KLA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate KLA's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 37 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if KLA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:KLAC

KLA

Designs, manufactures, and markets process control, process-enabling, and yield management solutions for the semiconductor and related electronics industries worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026