- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Why Intel (INTC) Is Up 8.9% After Strong Q3 Earnings and New AI Partnership

Reviewed by Sasha Jovanovic

- In the past week, Intel reported third-quarter 2025 earnings that exceeded expectations, with net income of US$4.06 billion reversing a prior-year loss and revenue rising to US$13.65 billion.

- TurinTech announced a collaboration with Intel, aiming to bring AI engineering platform Artemis to Intel systems, underscoring Intel's increasing focus on AI solutions and workload optimization.

- We'll explore how Intel's recent AI-focused partnerships, like the TurinTech collaboration, could influence its investment narrative going forward.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Intel Investment Narrative Recap

For investors to own Intel shares, you have to believe the company can successfully execute on its turnaround, streamlining operations and capturing growth in AI and foundry services. While the recent Q3 earnings beat and AI partnership announcements add confidence, the near-term outlook is challenged by forecasted Q4 losses and persistent manufacturing and execution risks. As such, the most important short-term catalyst remains visible progress in AI and foundry revenue, with execution delays and margin pressure still the biggest risk.

Among recent announcements, the new TurinTech collaboration is especially relevant, as it highlights Intel’s efforts to leverage its hardware platform for real-world AI workloads. This partnership aims to make AI more accessible and efficient at the edge, which directly aligns with Intel’s push to differentiate its products in the competitive AI market and supports the turnaround narrative investors are watching closely.

However, investors should be aware that, despite these positive steps, risks around Intel’s ability to deliver consistent revenue growth and improve profitability still…

Read the full narrative on Intel (it's free!)

Intel's outlook anticipates $58.1 billion in revenue and $5.2 billion in earnings by 2028. This scenario assumes annual revenue growth of 3.1% and an earnings increase of $25.7 billion from the current -$20.5 billion level.

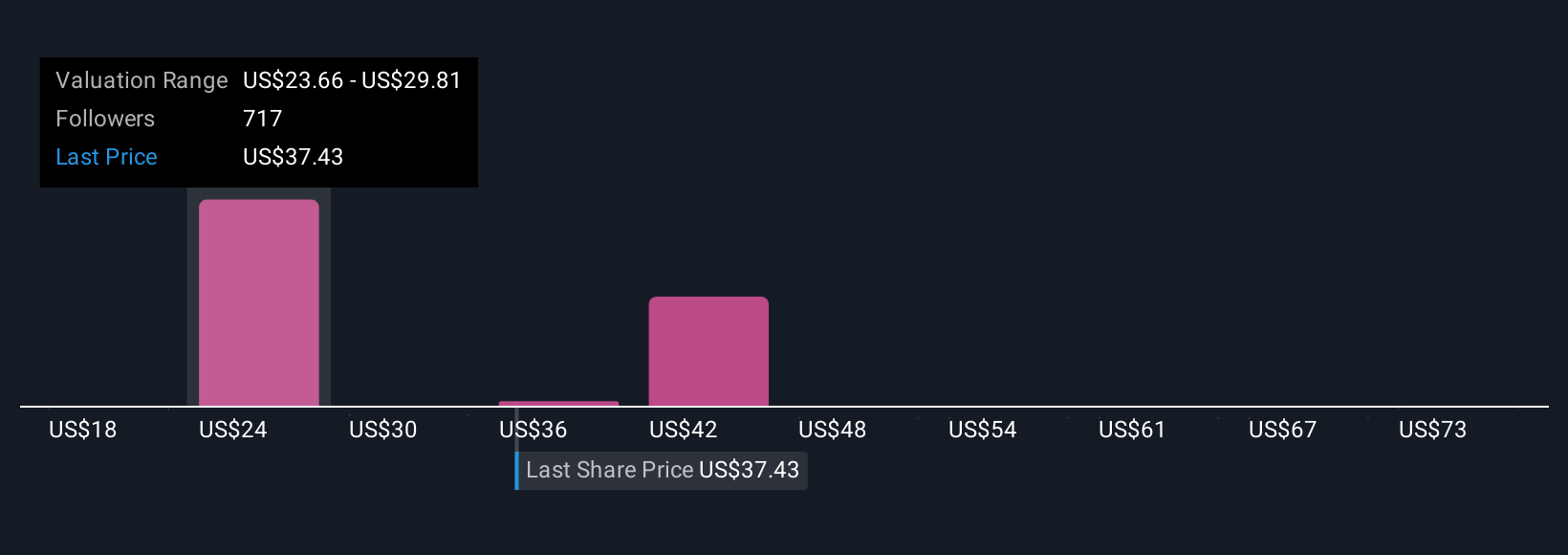

Uncover how Intel's forecasts yield a $28.42 fair value, a 32% downside to its current price.

Exploring Other Perspectives

While consensus analysts previously expected Intel earnings to reach US$2.2 billion by 2028, the most pessimistic forecasts warned about ongoing revenue stagnation and high costs reducing profits. Some believe Intel’s operational complexity or slow product ramp could pull results well below the headlines. It is important to recognize opinions can vary widely and these new developments may challenge or validate the more bearish outlook, so be sure to explore several viewpoints before deciding for yourself.

Explore 28 other fair value estimates on Intel - why the stock might be worth less than half the current price!

Build Your Own Intel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intel research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Intel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intel's overall financial health at a glance.

No Opportunity In Intel?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion