- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Is Now the Right Moment to Reassess Intel’s Value After 87% Share Price Surge?

Reviewed by Bailey Pemberton

- Wondering if Intel is a bargain right now? You are not alone, as plenty of investors are looking for clues about whether the current price offers solid value.

- Intel’s share price has climbed by 87.4% year to date and is up 52.0% over the past year, showing investors are recalibrating their expectations for the company’s future.

- Recent headlines have focused on Intel’s ambitious efforts to expand its foundry business and secure major government funding. These developments have brought renewed attention to its growth strategy and what that could mean for its market position.

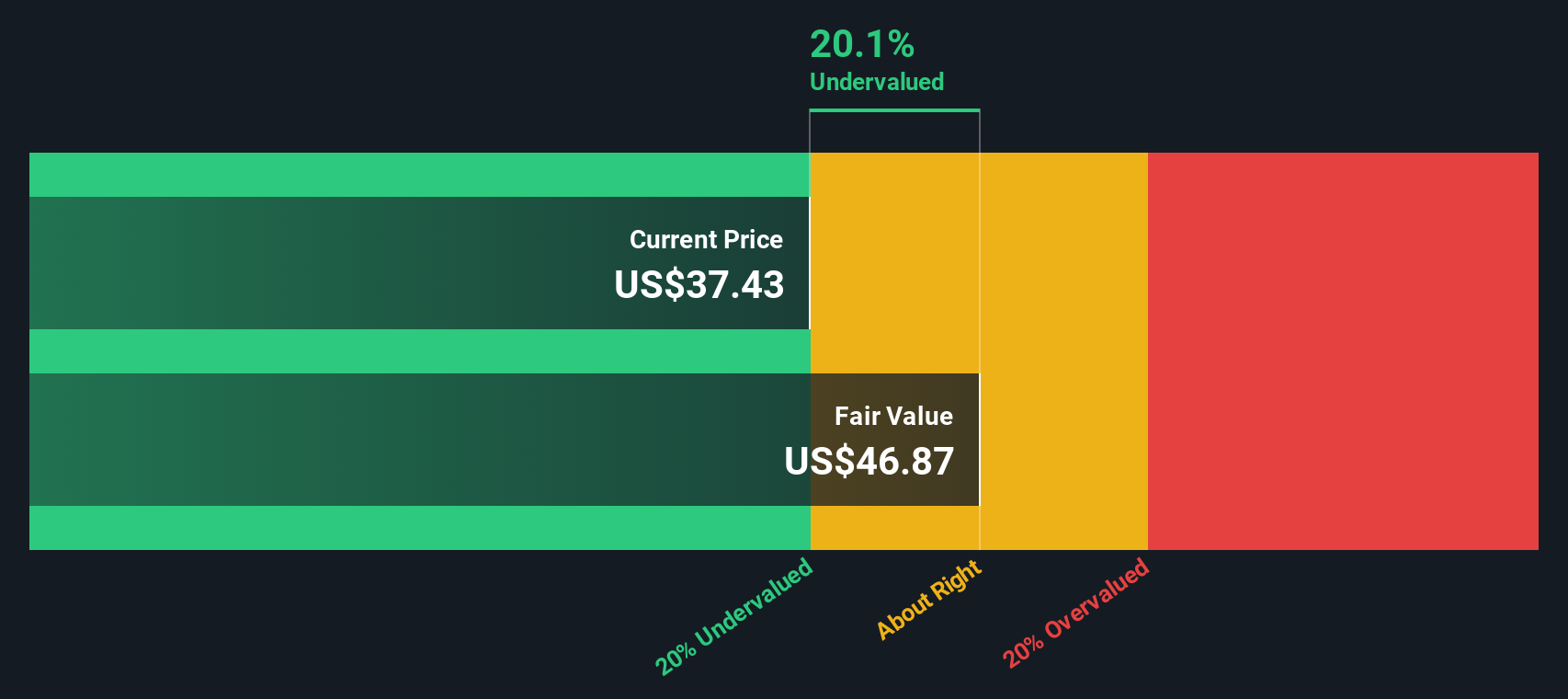

- Intel scores a 3 out of 6 on our valuation checks, suggesting there is both opportunity and room for caution. Next, let's break down the valuation story from every angle, including a method that could change how you look at the stock’s worth.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today's dollars. This approach helps to determine what Intel should be worth based on its ability to generate cash in years to come, rather than relying solely on current profits.

Currently, Intel’s latest twelve-month Free Cash Flow stands at a negative $13.65 billion, reflecting recent investments and operational challenges. Looking ahead, analysts project incremental improvements, with cash flows turning positive and reaching $4.32 billion by 2029. However, since direct analyst estimates typically cover only the next five years, further projections are extrapolated. By 2035, Intel’s Free Cash Flow is forecasted by Simply Wall St to climb as high as $10.95 billion.

After summing and discounting these future cash flows, the DCF model arrives at an estimated intrinsic value of $14.69 per share for Intel. When compared to the current share price, this implies the stock is trading at a 158% premium to its DCF-based value, signaling a significant overvaluation by this measure.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel may be overvalued by 158.0%. Discover 865 undervalued stocks or create your own screener to find better value opportunities.

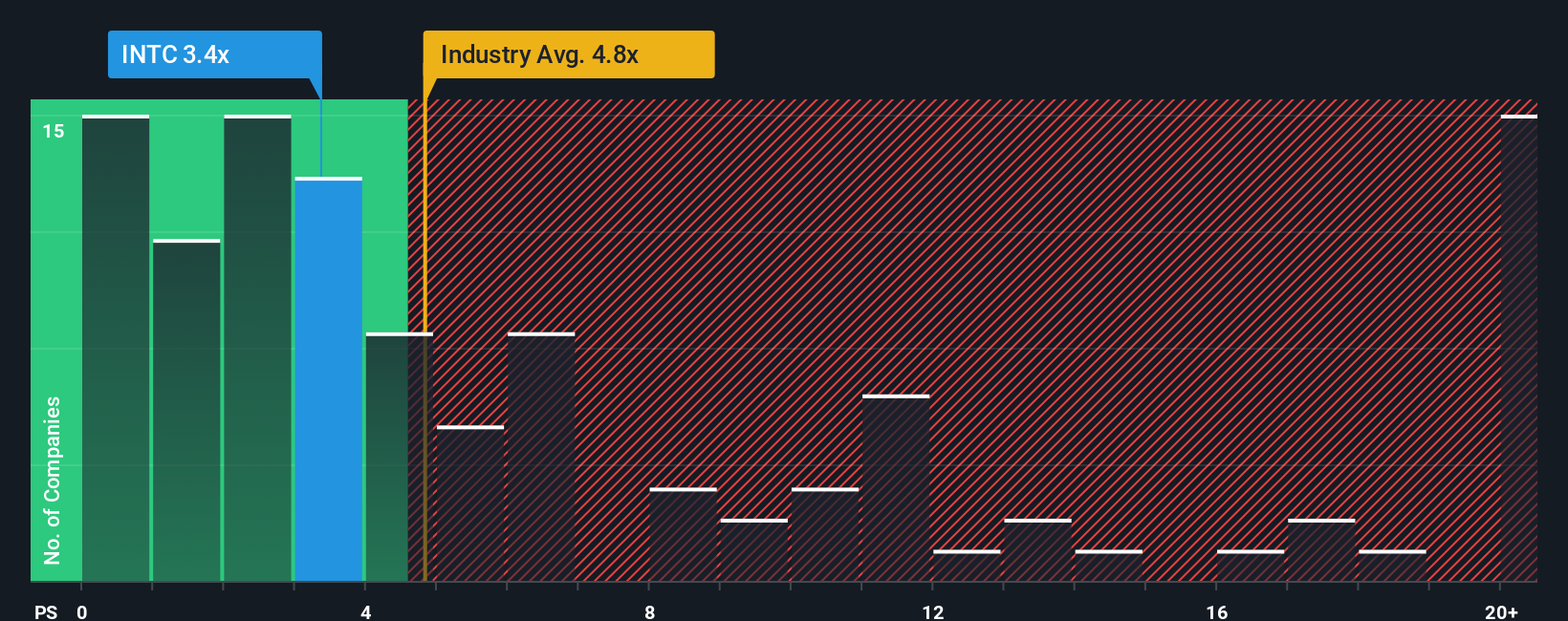

Approach 2: Intel Price vs Sales

The Price-to-Sales (P/S) ratio is often a preferred valuation metric for companies like Intel because it focuses on revenue, which can provide a steady baseline even when profits are volatile. This is especially useful for tech firms undergoing major investment cycles, as is the case with Intel. In such instances, earnings may not fully reflect underlying business momentum.

It is important to remember that growth prospects and risk play a big role in what counts as a "normal" or "fair" P/S ratio. Companies expected to grow rapidly or those with stable income often command higher multiples. Conversely, lower growth or increased uncertainty can weigh a ratio down.

Currently, Intel trades at a P/S ratio of 3.38x. For context, the semiconductor industry average sits at 4.73x, while peers average roughly 15.01x. Looking at the “Fair Ratio” calculated by Simply Wall St, which incorporates factors like Intel’s company-specific growth, profit margin, risk profile, size, and sector, a value of 5.65x is suggested. The benefit of the Fair Ratio is that it gives a more precise measure than simply comparing to industry or peers, as it accounts for Intel’s unique characteristics and future outlook.

Comparing Intel’s actual P/S ratio of 3.38x to the Fair Ratio of 5.65x, the stock appears undervalued on this basis, as the current market multiple is comfortably below what would be expected based on its prospects and risk profile.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1370 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intel Narrative

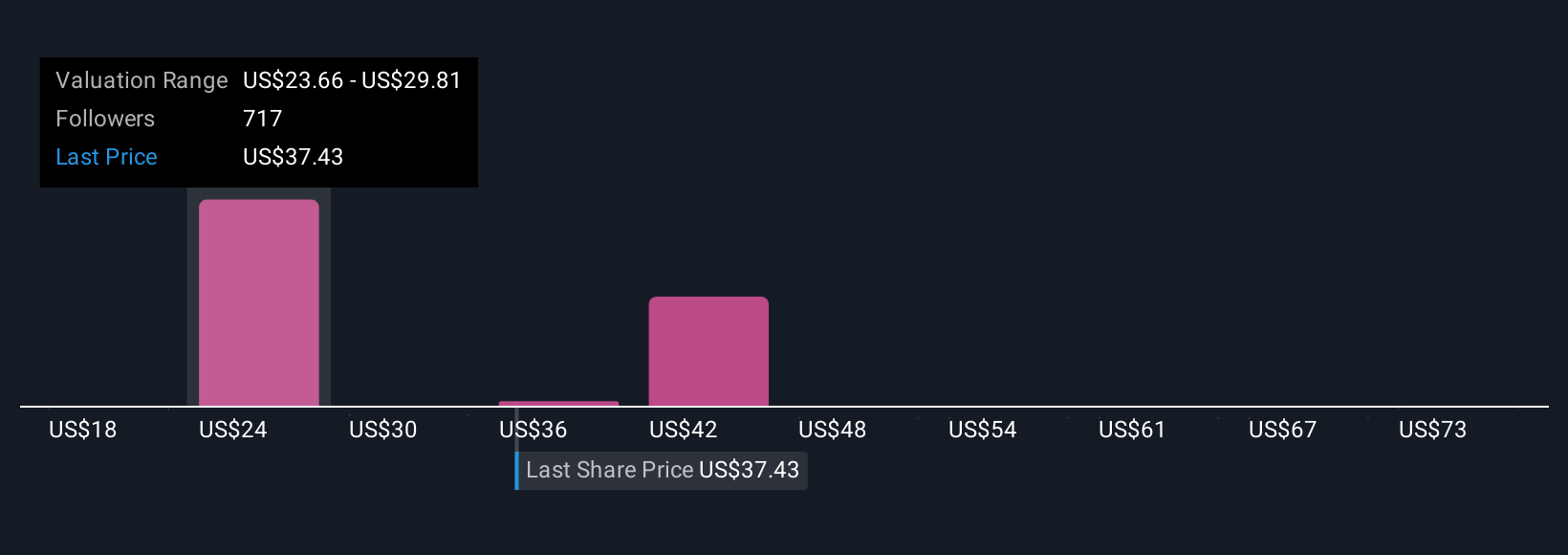

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story for a company, where you connect the numbers to a real-world point of view, explaining why you believe Intel is worth a certain amount based on your expectations for its future revenue, margins, and growth.

Narratives tie a company's business outlook to an explicit financial forecast, and then to a Fair Value estimate, making your investment thinking concrete and actionable. They are accessible to everyone on Simply Wall St's Community page, used by millions of investors to articulate and visualize their investment decisions, whether you are bullish, bearish, or somewhere in between.

By crafting your Narrative, you can compare your calculated Fair Value with the current market price, helping you decide if you think Intel is a buy, a hold, or a sell at any moment. Narratives also stay up to date, automatically adjusting to new information such as earnings results or news updates.

For example, one investor's optimistic Narrative assumes Intel rebounds with stronger AI and foundry execution, resulting in a Fair Value of $37.27. Another sees ongoing competitive pressures and slower recovery, yielding a Fair Value of just $16.15.

Do you think there's more to the story for Intel? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives