- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Shares Jump 21% After CEO Appointment News

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) has experienced a notable 21% share price increase over the past week, largely spurred by significant executive changes and positive market sentiment. The appointment of Lip-Bu Tan as the new CEO starting March 18, 2025, brings renewed optimism due to his extensive industry experience and successful track record. This leadership change, coupled with the recent launch of the Intel Xeon 6 processors, highlights the company's focus on innovation in the semiconductor space. The broader market backdrop has been challenging, with the tech-heavy Nasdaq Composite slipping 0.3% amid volatility. However, Intel's shares have defied the trend, continuing their upward trajectory while other major technology stocks have struggled. Amid overall mixed market conditions, Intel's strategic developments and leadership announcements have bolstered investor confidence, setting the stage for a remarkable week of growth.

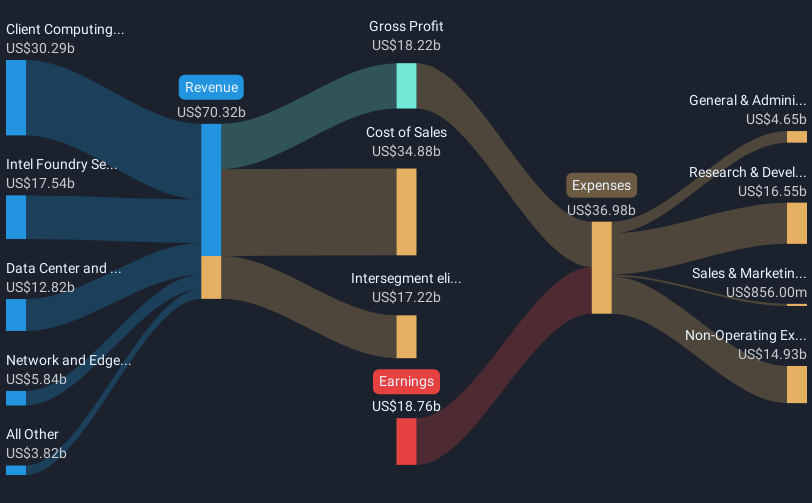

Over the past year, Intel's total shareholder return, including share price and dividends, was a 43.10% decline, underperforming both the broader US market, which returned 9%, and the US Semiconductor industry, which saw a 16.3% return. Several factors may have contributed to this decline. Notably, the company's Q4 2024 earnings report, released on January 30, 2025, showed net losses of US$126 million, contrasting significantly with a net income of US$2.67 billion from the previous year. Additionally, Intel's announcement in August 2024 of a dividend suspension may have affected investor sentiment.

Furthermore, rumors of acquisition talks with Silver Lake Technology Management, reported in February 2025, indicated potential uncertainty about the company's direction. Another contributing factor could be Intel's ongoing securities class action lawsuit in May 2024 regarding its Foundry Services, which could have impacted investor confidence. Lastly, collaborations such as those with AWS and Karma Automotive in mid-2024 have yet to reflect positively in the company's performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives