- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Sees CEO Transition As Lip-Bu Tan Steps In

Reviewed by Simply Wall St

Intel (NasdaqGS:INTC) is navigating significant executive shifts with Lip-Bu Tan stepping in as CEO amid a backdrop of investor activism and innovative AI product developments. The company's on-market total return remained flat over the last quarter amidst tumult in broader markets, where global trade tensions have led to a significant drop in major indices like the Nasdaq, which slipped into bear market territory. While Intel faced pressure from the overall chip sector decline, its recent AI-focused partnership with HCLTech and leadership changes suggest a strategic positioning amidst industry-wide challenges.

Buy, Hold or Sell Intel? View our complete analysis and fair value estimate and you decide.

Outshine the giants: these 23 early-stage AI stocks could fund your retirement.

The executive changes and AI developments at Intel, alongside the recent partnership with HCLTech, have the potential to influence the company's positioning within the competitive tech landscape. These strategic moves may help mitigate the effects of recent market declines and sector pressures, possibly stabilizing revenue and earnings forecasts. The ramp-up of Granite Rapids and upcoming launches, as noted in the analysis, aim to strengthen Intel's data center market position and potentially bolster revenues.

Looking at the longer-term performance, Intel's shares experienced a significant total return decline, registering a 48.19% drop over the period of the last year. This stands in contrast to the relatively smaller performance decline of 3.4% seen in the broader US market over the same one-year timeframe, highlighting challenges specific to Intel.

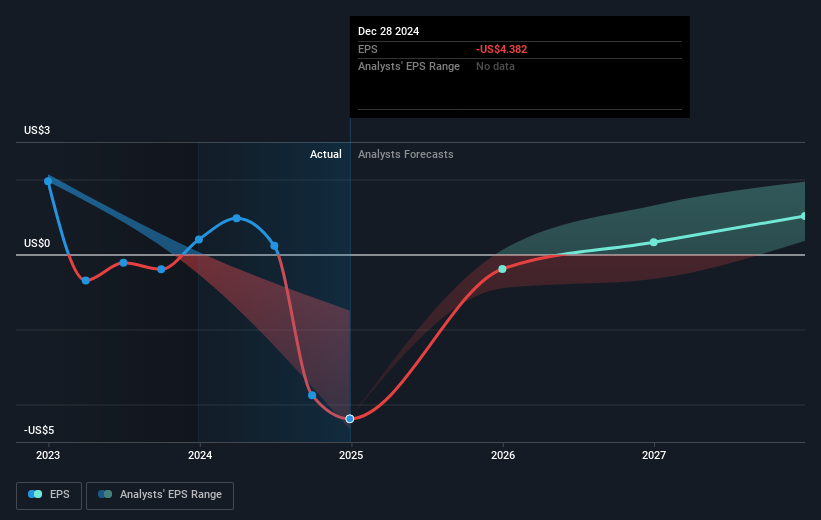

The company's current share price of US$22.05 is close to the consensus analyst price target of US$22.9, indicating a modest expected appreciation of 3.7%. However, significant volatility due to ongoing industry competition and market uncertainties could affect this outlook. Analysts project a shift from current negative earnings to a forecasted profit by 2028, contingent on successful execution of AI initiatives and advanced technology integration.

Evaluate Intel's prospects by accessing our earnings growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives