- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (NasdaqGS:INTC) Nears Stake Sale in Altera Unit to Silver Lake

Reviewed by Simply Wall St

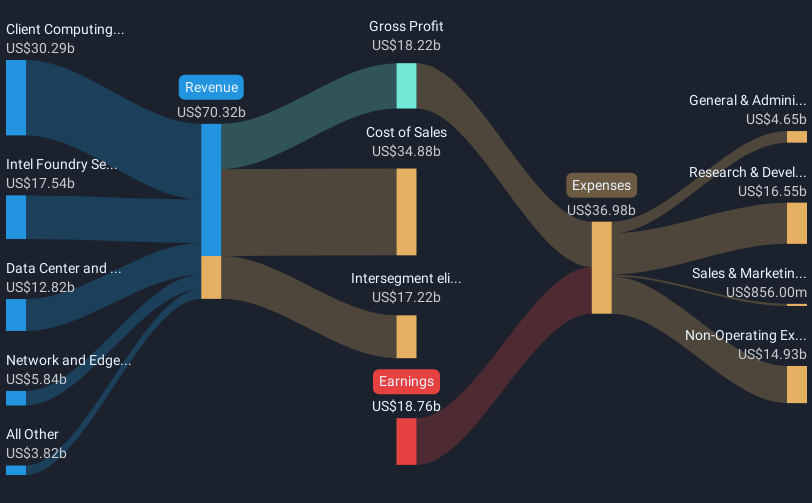

Intel (NasdaqGS:INTC) has been in the spotlight with reports of its deal to sell a majority stake in its programmable chips unit, Altera, to Silver Lake Management. This sale is part of a strategic realignment to focus on core operations, amidst a market influenced by tariff exemptions benefiting technology stocks broadly. Although market volatility marked the last quarter, Intel's price move of 3% paralleled general market trends, which were buoyed by positive developments, including exclusion from new tariffs. Executive changes and product announcements like the Xeon 6 processors release supported Intel's performance, aligning it with the broader tech sector's trajectory.

Intel has 1 risk we think you should know about.

The recent announcement of Intel's plan to divest a majority stake in its Altera unit to Silver Lake Management may significantly influence its ongoing strategic realignment. This realignment is intended to refocus on core operations, potentially boosting operational efficiency. In terms of total shareholder return, Intel's shares have seen a decline of 45.07% over the last year, reflecting significant challenges in value preservation compared to broader market trends. Within the past year, Intel has underperformed the US market and the Semiconductor industry, both of which showed more modest returns.

The divestiture news could lead to adjustments in revenue and earnings forecasts, as Intel redirects focus and resources toward its core segments. Although Intel faces competitive pressures in AI and data centers, strategic investments in new products like Granite Rapids aim to revitalize revenue streams and improve profit margins. The current share price stands at US$21.53, well below the consensus fair price target of US$22.90, suggesting an evaluation of future performance risks and opportunities by analysts. However, it's crucial to consider the difference between this price and the more bearish target of US$19.60, reflecting market uncertainty and the potential impacts of Intel's strategic efforts and market conditions on stock performance.

Explore Intel's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion