- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (INTC) Is Up 7.0% After Unveiling 2nm Panther Lake and Clearwater Forest Chip Architectures

Reviewed by Sasha Jovanovic

- Earlier this month, Intel previewed its upcoming Intel Core Ultra series 3 "Panther Lake" processors and Xeon 6+ "Clearwater Forest" server chips at a major industry summit, introducing new chip architectures built on the advanced Intel 18A manufacturing node.

- This marks Intel's first large-scale deployment of a 2-nanometer class process developed and produced in the United States, highlighting significant advancements in both client and data center technologies with a focus on AI and high-performance computing.

- We’ll explore how Intel’s unveiling of Panther Lake processors on the 18A node could influence its push for improved operational efficiency and AI leadership.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Intel Investment Narrative Recap

To own Intel stock, I believe you need confidence in its ability to regain technology leadership by executing on its manufacturing roadmap and delivering best-in-class AI chips across PCs, data centers, and edge devices. The recent reveal of Panther Lake and Clearwater Forest chips based on the advanced Intel 18A node could help address concerns around Intel’s short-term competitive position and operational efficiency, though the most important catalyst remains clear execution on promised products and manufacturing ramp-up. For now, the impact on immediate business risks, especially those around organizational agility and financial discipline, appears limited.

The October preview of Panther Lake processors stands out as especially important amid these developments. With Intel touting over 50% performance gains and AI acceleration, this announcement signals progress on the product and innovation side. However, the ultimate effect on market share and earnings will depend on how well Intel translates technological milestones into commercial momentum in 2026 and beyond.

By contrast, it’s worth knowing that ongoing financial strain and bureaucratic hurdles, such as slow reductions in OpEx and CapEx, still represent hurdles to Intel’s turnaround story...

Read the full narrative on Intel (it's free!)

Intel's narrative projects $58.1 billion revenue and $5.2 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $25.7 billion increase in earnings from the current -$20.5 billion.

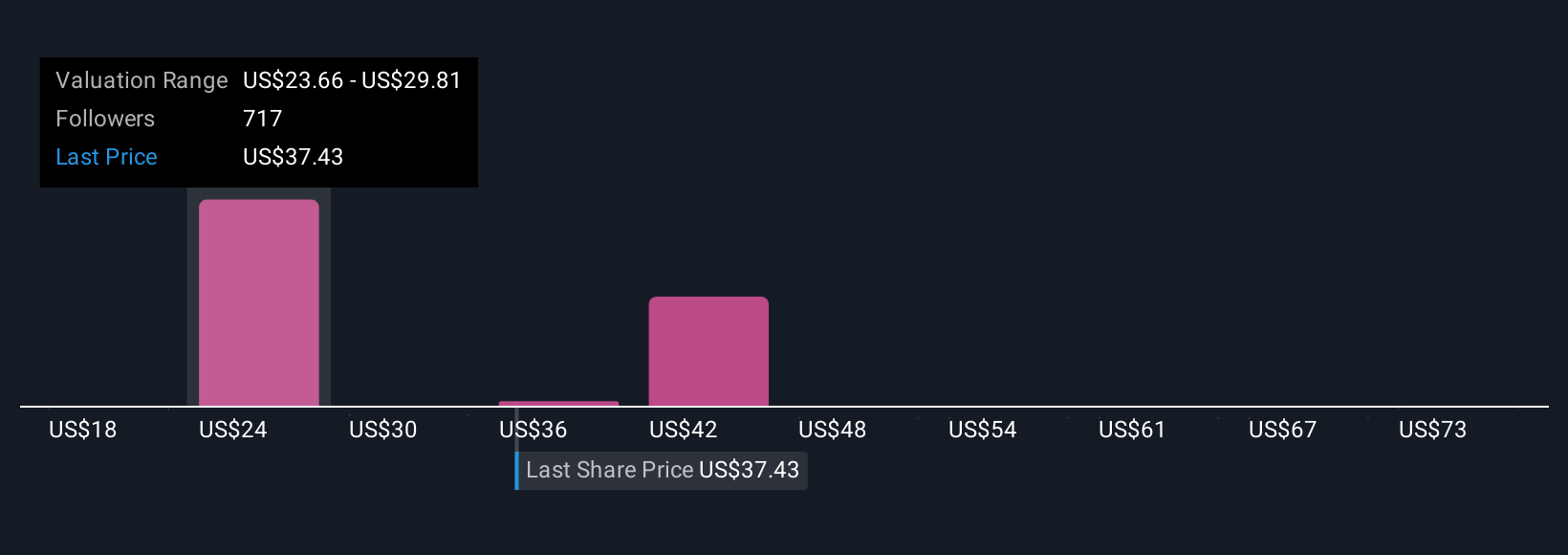

Uncover how Intel's forecasts yield a $25.95 fair value, a 32% downside to its current price.

Exploring Other Perspectives

While mainstream analysts expect Intel to recover, the lowest analyst forecasts have previously called for annual revenues of around US$52.3 billion and earnings of just US$2.2 billion by 2028. This group sees supply constraints and structural challenges as much bigger risks, reminding you that analyst outlooks can vary widely and may shift if product ramps or execution waver.

Explore 40 other fair value estimates on Intel - why the stock might be worth as much as 24% more than the current price!

Build Your Own Intel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intel research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Intel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intel's overall financial health at a glance.

Interested In Other Possibilities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Find companies with promising cash flow potential yet trading below their fair value.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion