- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (INTC): Evaluating Valuation After a 30% Share Price Surge

Reviewed by Simply Wall St

Intel (INTC) has caught the attention of investors lately, with its stock showing significant movement over the past month. Shares have climbed by 30%, prompting renewed interest in the semiconductor giant’s outlook and valuation trends.

See our latest analysis for Intel.

Intel’s recent run has certainly turned heads, with a remarkable 30% share price return over the past month that has pushed returns sharply higher. Momentum is clearly building, especially considering the 88.7% year-to-date share price return and a 70.8% total shareholder return over the past year. This signals renewed optimism about the company’s prospects.

If you’re looking to explore more tech and AI-driven opportunities after seeing Intel’s surge, check out See the full list for free..

With such strong gains already posted, the key question becomes whether Intel is now undervalued based on its future prospects or if the market has already factored in all the expected growth. This could mean limited upside for new buyers.

Most Popular Narrative: 34.3% Overvalued

Compared to Intel's most widely followed narrative, the stock's last closing price of $38.16 sits well above the implied fair value. This signals a material disconnect between market optimism and the narrative’s model. This sets the tone for a deeper dive into what is driving the valuation models behind prevailing analyst sentiment.

Intel is focusing on flattening its organizational structure to enhance agility, make swifter decisions, and foster innovation, which could lead to improved product development and competitive advantage, positively impacting future revenue and earnings growth.

What assumptions are baked into this bold narrative? Unpack the astonishing calculations, including aggressive growth in profitability and the expectation of a hefty rebound from today’s earnings. The secret lies in future projections and margin upgrades that could surprise many investors. Discover whether the numbers truly justify the current share price.

Result: Fair Value of $28.42 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, continued operational complexity or slow adoption of AI workloads could present challenges to Intel’s turnaround and could impact growth expectations in the coming years.

Find out about the key risks to this Intel narrative.

Another View: What Does the DCF Model Suggest?

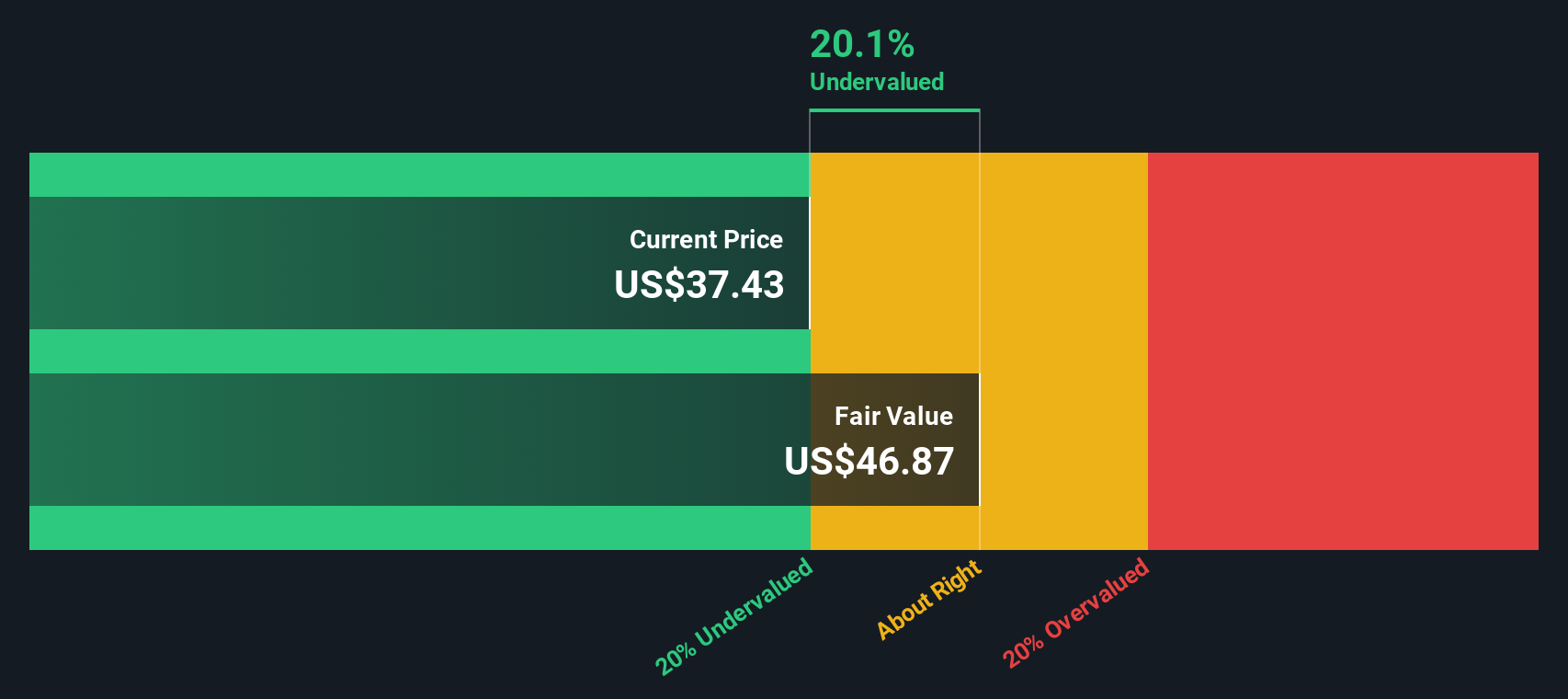

While some may see Intel as overvalued using traditional price targets, our SWS DCF model points in a different direction. It estimates Intel's fair value at $46.83, which is about 18.5% above its current price. Could the market be underestimating long-term cash flow potential even with the current near-term excitement?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Intel Narrative

If you have a different outlook, or want to dig into the numbers on your own terms, you can craft an Intel narrative in just minutes using Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intel.

Looking for more investment ideas?

Don’t let opportunity pass you by. Find your next winning stock among emerging themes. Smart investors always keep their watchlists fresh with the best prospects.

- Unlock the excitement of high-upside opportunities by snapping up these 3571 penny stocks with strong financials on the move before the crowd catches on.

- Target future growth with conviction by checking out these 27 AI penny stocks powering breakthroughs in artificial intelligence and automation.

- Boost your portfolio with income potential by browsing these 17 dividend stocks with yields > 3% that deliver yields above 3% and help you stay ahead.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion