- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Intel (INTC): Assessing Valuation as Potential AMD Chip Deal Signals Strategic Shift and Sparks Investor Interest

Reviewed by Kshitija Bhandaru

Intel (INTC) attracted fresh investor attention after news emerged that it is in early talks to manufacture chips for AMD, its long-time competitor, as part of a possible foundry partnership. This development increases discussion about Intel’s evolving growth strategy in the fiercely competitive chip industry.

See our latest analysis for Intel.

After weeks of high-profile headlines, including Nvidia’s $5 billion stake, a fresh $2 billion capital raise, and government backing, Intel’s stock has remained in the spotlight. Notably, share price rally fizzled somewhat after its rapid 20% surge last week, but the momentum reflects hopes that new partnerships will spark more upside. Over the past year, Intel’s total shareholder return edged up just 0.68%, suggesting investors are still weighing long-term progress against near-term optimism, even as buzz builds around strategic deals and manufacturing wins.

If you’re curious about other semiconductor leaders making waves, discover the latest movers, disruptors, and innovators in our high-growth tech and AI stocks screener: See the full list for free..

The stage is set for an intriguing debate: are Intel shares trading at a deep discount that underestimates its turnaround, or have upcoming growth prospects already been priced in, leaving little room for new buyers?

Most Popular Narrative: 48.1% Overvalued

Despite Intel’s last close of $37.30, the most popular narrative sees fair value at $25.18. This reflects a cautious stance on potential upside. Market excitement is present, but supporters of this narrative are weighing risks from competitive and operational challenges.

The anticipation is that follow-on investments (including from Softbank and the US government) and new industry partnerships will drive near-term stock price, despite lingering concerns about long-term fundamentals and Intel Foundry's sustainability.

Want to know what kind of growth and profit shift could justify such a valuation gap? This narrative leans on a handful of bold projections about Intel’s future, but the full financial drivers and assumptions are far from obvious. Dive in to find out which surprising numbers and strategic changes analysts believe could reshape Intel’s fair value before the market catches up.

Result: Fair Value of $25.18 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing manufacturing challenges and organizational complexity could hinder Intel’s turnaround, which could potentially derail hoped-for gains in efficiency and future profits.

Find out about the key risks to this Intel narrative.

Another View: Multiples Signal Value

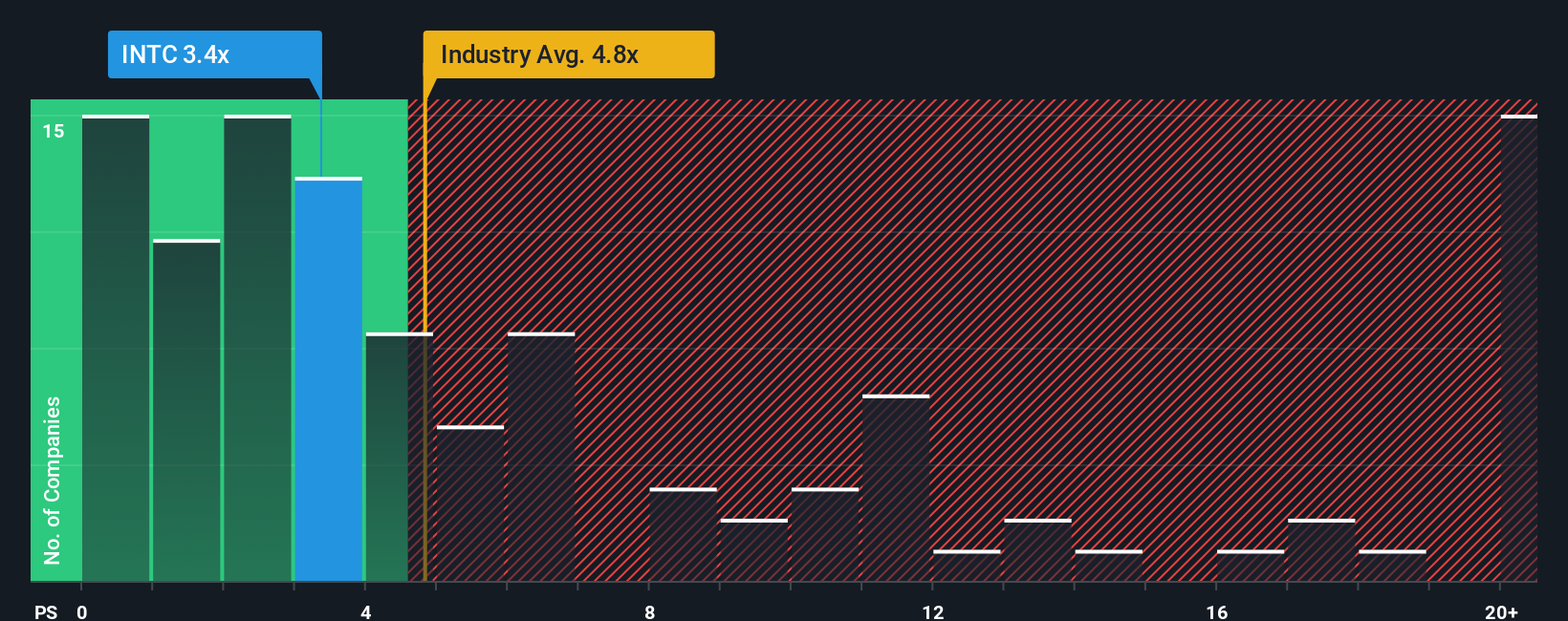

While the fair value narrative points to Intel being overvalued, a look at its price-to-sales ratio tells a different story. Intel currently trades at just 3.3x sales, well below the US semiconductor industry average of 4.8x and even further below the peer average of 16.2x. With the fair ratio standing at 5.2x, the market might be underestimating Intel’s potential if sentiment shifts. Could these strong multiples present a hidden opportunity, or is there a bigger risk investors are missing?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Intel Narrative

If you want to dig deeper or think you see things differently, you can analyze the numbers firsthand and shape your own perspective in just a few minutes with our tools. Then Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Intel.

Looking for more investment ideas?

Don't wait on the sidelines while others uncover top investment opportunities. Use the Simply Wall Street Screener to pinpoint unique stocks that fit your strategy in minutes.

- Explore the chance for outsized returns and big moves by checking out these 3568 penny stocks with strong financials with surprising financial strength and growth stories.

- Benefit from digital transformation and innovation when you browse these 24 AI penny stocks poised to disrupt their industries with leading-edge AI.

- Find income potential in your portfolio by reviewing these 19 dividend stocks with yields > 3% offering yields above 3% and established histories of rewarding shareholders.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion