- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Does Intel’s 18A Panther Lake Breakthrough Reshape the Bull Case for INTC?

Reviewed by Sasha Jovanovic

- Last week, Intel announced it has begun high-volume production of its Panther Lake processors built on the advanced 18A process, marking a significant technological breakthrough with plans to ship the chips by year-end and achieve broad market availability in early 2026.

- This milestone is backed by substantial investments from the US government, Nvidia, and SoftBank, underlining government and industry commitment to restoring US semiconductor manufacturing capabilities and strengthening Intel’s future market relevance.

- We'll explore how Intel's transition to in-house 18A manufacturing, supported by major partnerships and federal investment, could reshape the company's investment story.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

Intel Investment Narrative Recap

For Intel shareholders, the main story hinges on the company's bold bet: that breakthroughs in cutting-edge chip manufacturing will translate into a sustainable turnaround and lasting relevance in global semiconductors. The recent leap to in-house 18A high-volume production is positive news, but whether it will address execution challenges or significantly boost near-term financials remains uncertain; critical risks like manufacturing scalability and the speed of Intel's AI transition are still very much in play.

Among several recent updates, the unveiling and immediate ramp of Panther Lake SoCs using 18A is especially relevant. This launch addresses demands for power efficiency and AI capability, directly relating to the catalyst of accelerated product innovation, even as the market weighs how much of an edge this confers over rivals in the short term.

Yet, investors should be aware that, despite this technological milestone, immediate headwinds remain, particularly around...

Read the full narrative on Intel (it's free!)

Intel's narrative projects $58.1 billion revenue and $5.2 billion earnings by 2028. This requires 3.1% yearly revenue growth and a $25.7 billion earnings increase from current earnings of -$20.5 billion.

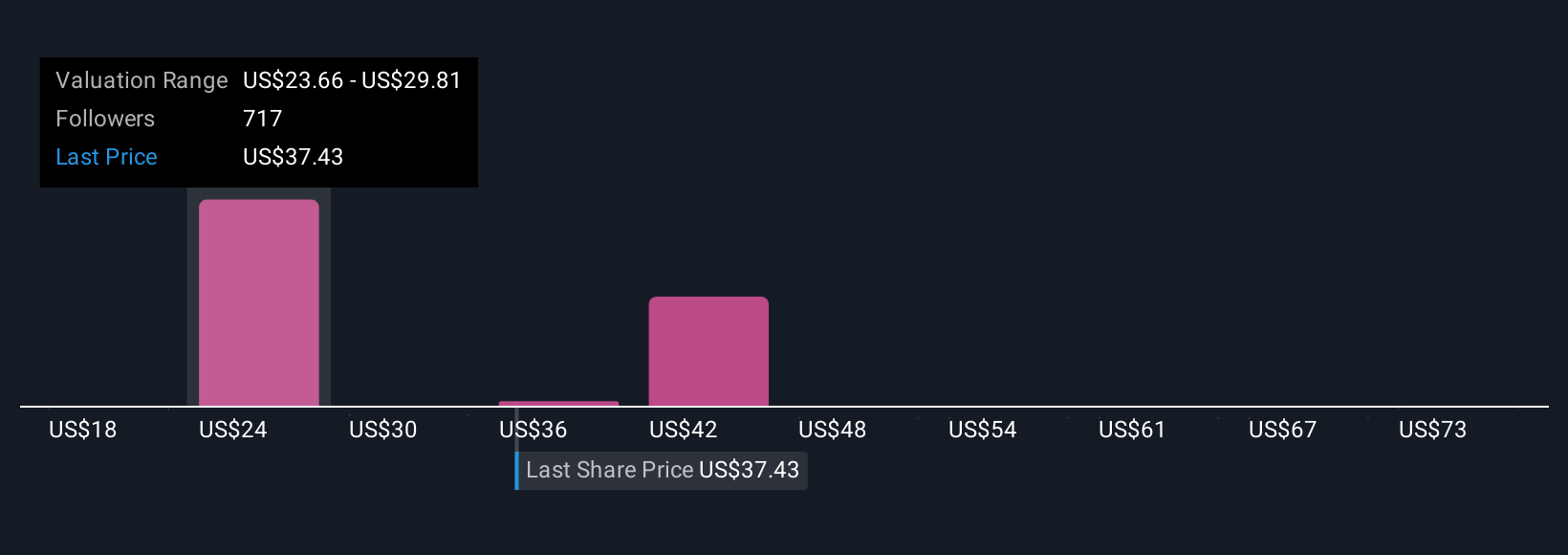

Uncover how Intel's forecasts yield a $25.95 fair value, a 30% downside to its current price.

Exploring Other Perspectives

Some of the most pessimistic analysts forecast Intel's revenue would fall to around US$52.3 billion and earnings to just US$2.2 billion by 2028. These estimates factor in challenges like ramping up new technologies and structural reform. It’s a reminder that analyst views can be widely different, so consider how new announcements could reshape expectations on both risks and potential rewards.

Explore 48 other fair value estimates on Intel - why the stock might be worth over 2x more than the current price!

Build Your Own Intel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intel research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Intel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intel's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion