- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Could Early SambaNova Talks Reveal a New AI Strategy for Intel (INTC)?

Reviewed by Sasha Jovanovic

- In recent developments, Intel has entered early discussions to potentially acquire AI chip startup SambaNova Systems, with sources indicating the talks are at a preliminary stage and no deal is certain.

- Reports suggest any acquisition of SambaNova would likely value the startup below the US$5 billion it fetched in its 2021 funding round, highlighting evolving valuations in the AI chip sector.

- We'll explore how these early-stage M&A talks in AI chips could affect Intel's investment narrative and its evolving role in AI innovation.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Intel Investment Narrative Recap

To be a shareholder in Intel today, you need to believe that Intel can reposition itself as a leader in AI and advanced semiconductor manufacturing, driving growth through innovation and operational efficiency. The recent early-stage talks to potentially acquire SambaNova Systems indicate a continued push into AI, but at this stage, they do not materially impact the current short-term catalyst, which remains Intel’s execution in rolling out next-generation AI-enabled products. The biggest risk continues to be Intel’s ability to execute quickly on its AI and foundry strategies, with organizational complexity and manufacturing constraints as persistent challenges.

Among recent announcements, Intel’s collaboration with TurinTech to deliver the Artemis AI engineering platform optimized for Intel’s Core Ultra processors is highly relevant. This effort highlights Intel’s intent to strengthen its AI portfolio and bring tangible performance improvements across its hardware, which supports its broader catalyst of accelerating AI adoption and capturing new workloads beyond traditional computing.

By contrast, investors should be aware of how Intel’s reliance on older product lines and potential delays in advanced process nodes could present unexpected challenges for the company’s...

Read the full narrative on Intel (it's free!)

Intel's outlook anticipates $58.1 billion in revenue and $5.2 billion in earnings by 2028. This scenario assumes 3.1% annual revenue growth and a $25.7 billion increase in earnings from the current level of -$20.5 billion.

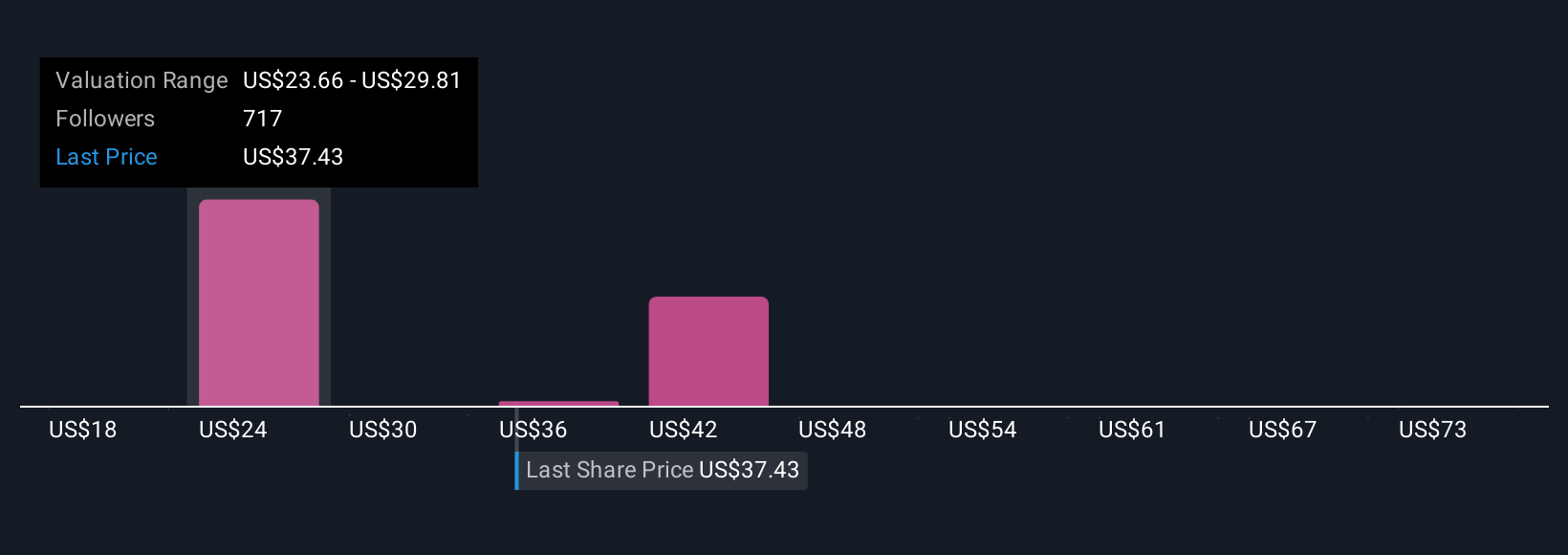

Uncover how Intel's forecasts yield a $28.42 fair value, a 26% downside to its current price.

Exploring Other Perspectives

Some of the most optimistic analysts were forecasting Intel’s revenue to grow by 5.4 percent annually, with earnings potentially reaching US$8.7 billion by 2028. That outlook emphasizes Intel’s aggressive pivot into full-stack AI and higher-margin foundry services. Compared to the consensus, these analysts focus more on Intel’s ability to quickly adapt and gain manufacturing leadership, so it is worth considering how new developments like the SambaNova talks could shift those expectations.

Explore 29 other fair value estimates on Intel - why the stock might be worth less than half the current price!

Build Your Own Intel Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Intel research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Intel research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Intel's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- Find companies with promising cash flow potential yet trading below their fair value.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Q3 Outlook modestly optimistic

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion