- United States

- /

- Semiconductors

- /

- NasdaqGS:INTC

Are Intel’s New Foundry Partnerships Enough to Justify Its 2025 Rally?

Reviewed by Bailey Pemberton

Trying to figure out whether now is the right time to buy, hold, or sell Intel? You aren’t alone. Investors have watched Intel’s stock bounce back impressively over the last year, up 72.5%, with a massive 95.5% gain year to date. Even just in the last month, it posted an 11.4% rise. These price moves have come alongside news of Intel securing new partnerships for its foundry business and ramping up investments in domestic chip production, a strategic shift that Wall Street seems to favor for long-term growth. As a result, market sentiment around the risk and reward profile of Intel’s shares has clearly shifted.

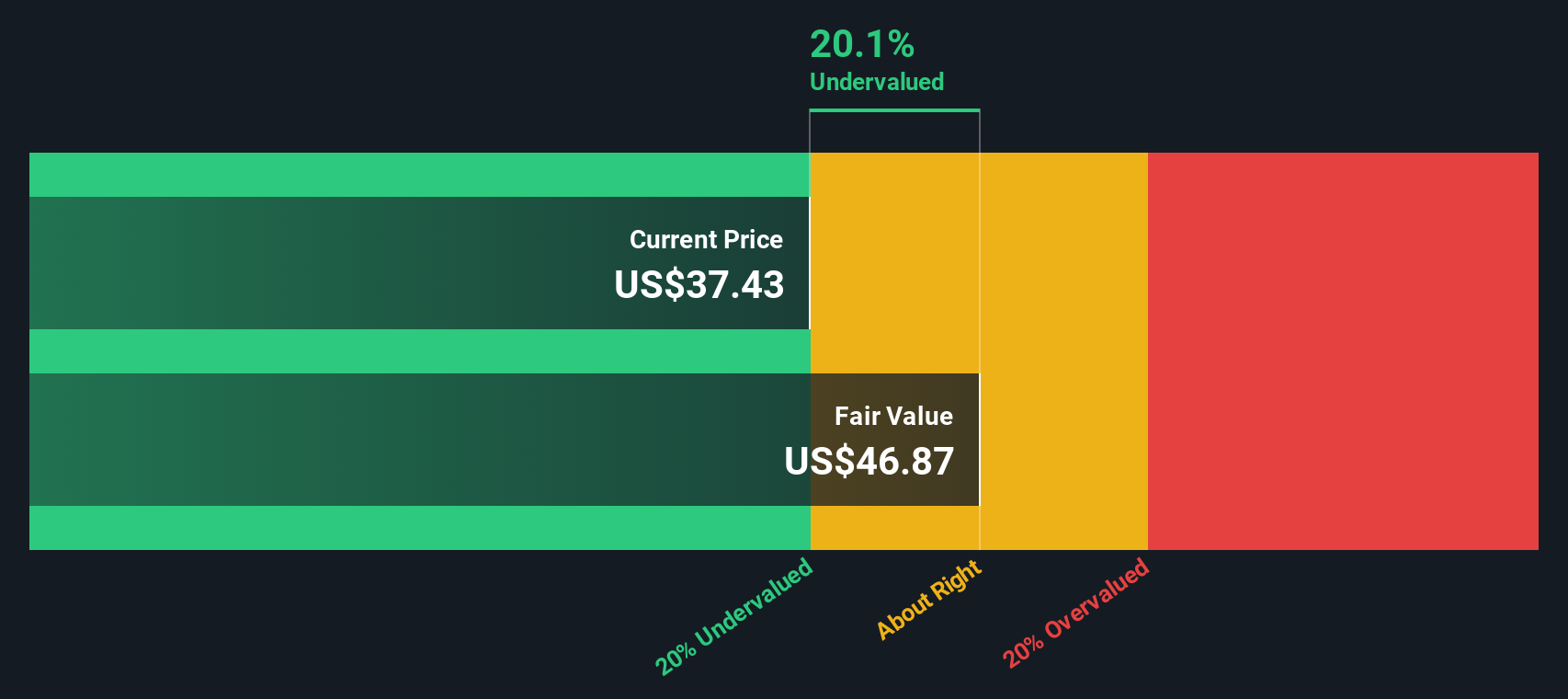

But is this rally justified from a valuation perspective? To help frame that question, I ran Intel through six classic valuation checks—things like price-to-earnings, price-to-book, and others that analysts rely on. Intel scores a 3 out of 6, meaning it currently looks undervalued on half of these key measures. What does that really mean for investors as they choose what to do next?

Let’s dig into each of those valuation approaches in detail, and after that, I’ll reveal a perspective for judging value that goes beyond the usual checklist and could matter even more in the current chip industry landscape.

Approach 1: Intel Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) approach estimates the fair value of a company by projecting how much cash it will generate in the future and then discounting those expected cash flows back to today's dollars. This gives investors a sense of what Intel should be worth if future expectations play out as predicted.

Looking at Intel specifically, the DCF model uses a 2-Stage Free Cash Flow to Equity method. The company’s latest reported Free Cash Flow (FCF) sits at negative $13.65 billion, reflecting heavy investment right now. Analysts expect FCF to turn positive over the next decade, reaching approximately $10.89 billion by 2035. For context, the projections call for some volatility and gradual improvement, rising from negative $1.95 billion in 2026, swinging to positive $676 million in 2027, and then building steadily to $4.32 billion by 2029 and further beyond. These beyond-year-five estimates rely on extrapolation methods rather than firm analyst forecasts.

Based on this flow of numbers, the resulting intrinsic value for Intel is $15.60 per share. This is sharply below where the stock currently trades, indicating that, according to this model, Intel's shares are about 153.5% overvalued right now. The takeaway is that Intel’s current price assumes much more optimistic cash flows than the model’s base scenario supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Intel may be overvalued by 153.5%. Find undervalued stocks or create your own screener to find better value opportunities.

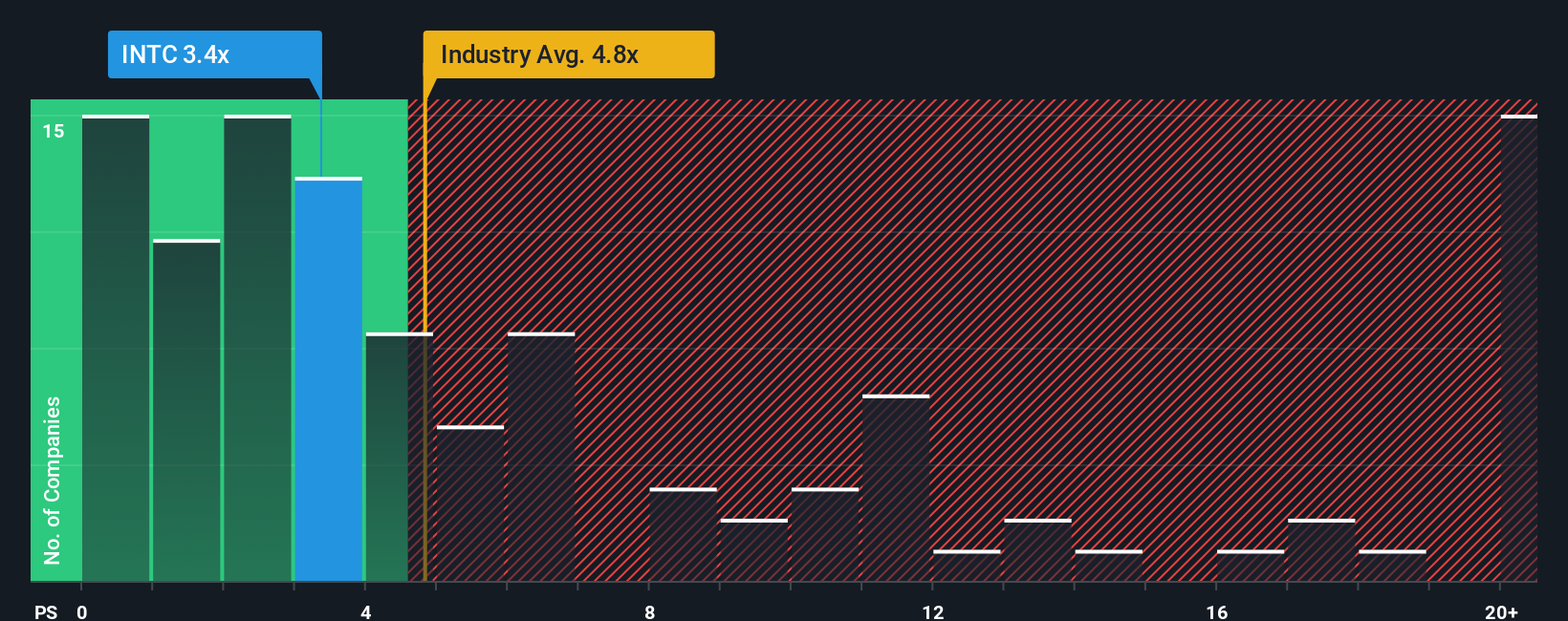

Approach 2: Intel Price vs Sales (Price-to-Sales Ratio)

The Price-to-Sales (P/S) ratio is a common valuation metric. It is especially useful for companies in cyclical or rapidly evolving industries like semiconductors, where profits can fluctuate due to heavy investment or market shifts. The P/S ratio lets investors quickly gauge how the market values each dollar of revenue, which can be more stable than earnings in transitional periods.

Generally, a "normal" or "fair" P/S ratio takes into account not just how fast a company is growing revenue, but also the risks it faces and how it compares with peers. Higher expected growth and lower risk usually justify a higher P/S multiple, while slower growth or more uncertainty push it lower.

Currently, Intel’s P/S ratio is 3.53x. For context, the industry average is 5.27x, and comparable peers trade at an even higher 17.74x. This range reflects both the market’s assessment of Intel’s growth prospects and the transitional phase the company is in. Rather than just comparing these numbers, Simply Wall St’s “Fair Ratio” combines factors such as Intel’s earnings growth, profit margins, industry trends, and market cap. This produces a data-driven target of 5.45x for the stock. This holistic approach gives a more nuanced picture of what Intel’s ratio should be, grounded in its actual fundamentals and environment, not just broad category comparisons.

Comparing the Fair Ratio of 5.45x to Intel’s current P/S of 3.53x, Intel appears attractively valued on this metric, with the stock trading noticeably below its fair value range given the company’s fundamentals.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Intel Narrative

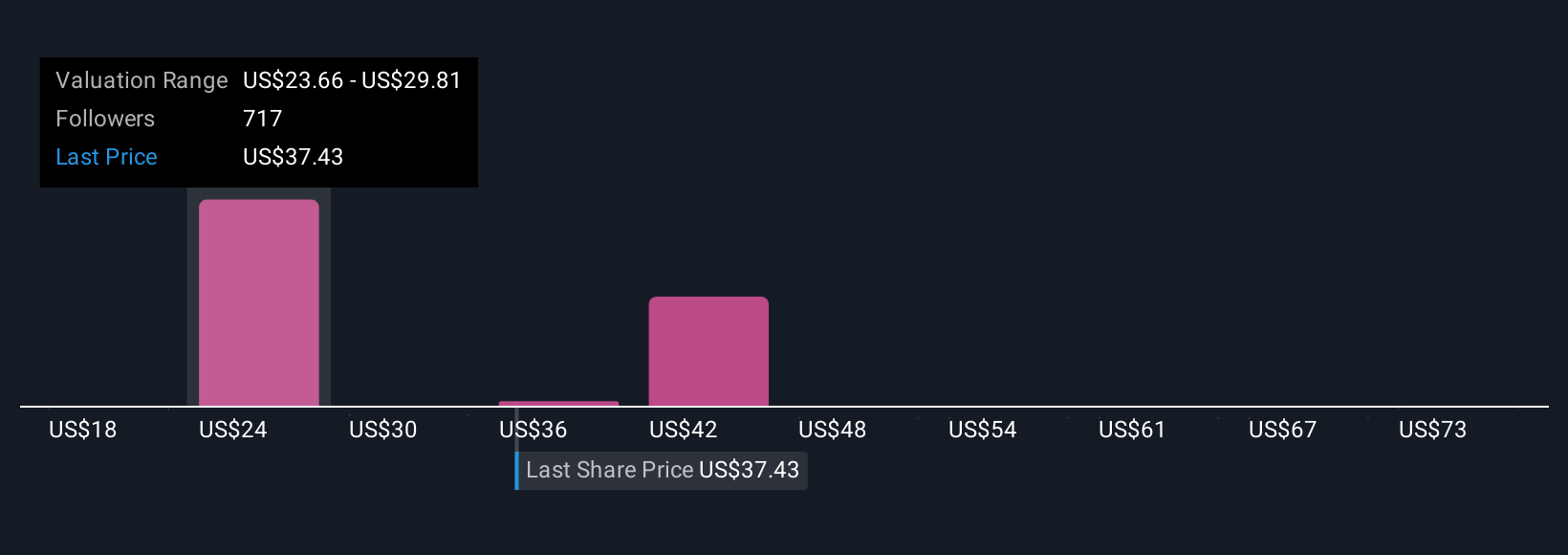

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your story and perspective behind a company, combining the facts, projections, and your own expectations for things like Intel’s future revenues, margins, and risk. Instead of sticking to rigid checklists, Narratives let you link Intel’s unfolding business story to a specific financial forecast and a fair value estimate, making your investment view tangible and actionable.

Narratives are designed to be easy and accessible, available on Simply Wall St’s Community page, where millions of other investors are already using them to refine their approach. You can instantly see if your fair value, driven by your assumptions, makes Intel look like a buy or sell at today’s price, and Narratives update automatically as new company news, earnings, or events come in, keeping your view current.

For example, at the moment, the most optimistic Narrative on Intel sees a fair value of $28.42 per share, while the most cautious expects just $14.00 per share, clearly showing how investor perspectives can diverge, all with transparent logic behind the numbers.

Do you think there's more to the story for Intel? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:INTC

Intel

Designs, develops, manufactures, markets, and sells computing and related products and services worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Automotive Electronics Manufacturer Consistent and Stable

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion