- United States

- /

- Semiconductors

- /

- NasdaqCM:ICG

Intchains Group Limited's (NASDAQ:ICG) 26% Jump Shows Its Popularity With Investors

Those holding Intchains Group Limited (NASDAQ:ICG) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 43% over that time.

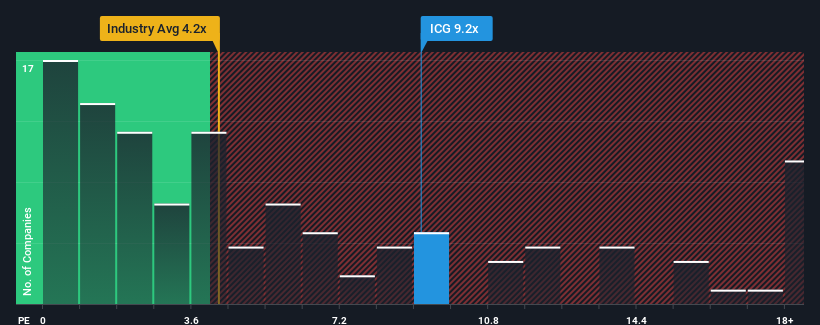

Following the firm bounce in price, Intchains Group's price-to-sales (or "P/S") ratio of 9.2x might make it look like a strong sell right now compared to other companies in the Semiconductor industry in the United States, where around half of the companies have P/S ratios below 4.2x and even P/S below 1.7x are quite common. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Intchains Group

What Does Intchains Group's Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Intchains Group has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. If not, then existing shareholders might be a little nervous about the viability of the share price.

Keen to find out how analysts think Intchains Group's future stacks up against the industry? In that case, our free report is a great place to start.Is There Enough Revenue Growth Forecasted For Intchains Group?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Intchains Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 202%. Still, revenue has fallen 29% in total from three years ago, which is quite disappointing. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 108% as estimated by the lone analyst watching the company. Meanwhile, the rest of the industry is forecast to only expand by 40%, which is noticeably less attractive.

With this in mind, it's not hard to understand why Intchains Group's P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Intchains Group's P/S?

The strong share price surge has lead to Intchains Group's P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Intchains Group maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Semiconductor industry, as expected. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Intchains Group that you need to take into consideration.

If these risks are making you reconsider your opinion on Intchains Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:ICG

Intchains Group

Engages in the provision of altcoin mining products in the People’s Republic of China.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives