- United States

- /

- Semiconductors

- /

- NasdaqGS:HIMX

How Investors May Respond To Himax Technologies (HIMX) Gaining Acer AI Notebook Integration Momentum

Reviewed by Sasha Jovanovic

- Acer announced that Himax Technologies’ WiseEye ultralow power AI sensing solution has been integrated into the Swift Edge 14 AI notebook, which has entered mass production and features human detection, power-saving, and user experience enhancements.

- This milestone signifies increasing adoption of Himax’s energy-efficient AI technology by major global PC brands amid surging demand for AI-enabled devices.

- We’ll examine how WiseEye’s commercial deployment in a mass-produced AI notebook influences Himax’s investment narrative and long-term positioning.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Himax Technologies Investment Narrative Recap

To be a Himax shareholder, you need to believe that its innovation in ultralow power AI sensing, particularly WiseEye, translates into real, growing demand in consumer electronics and automotive markets, even as macroeconomic and supply chain headwinds cloud near-term visibility. The WiseEye integration in Acer’s mass-produced AI notebook helps reinforce the technology’s commercial potential, but the biggest catalyst remains broad customer adoption; by contrast, ongoing macro uncertainty and volatile order patterns among panel and auto clients still represent the biggest near-term risks. For now, this announcement offers incremental validation for the company’s AI ambitions, but does not materially change the immediate risk-reward profile.

Among recent developments, Himax’s comprehensive showing of its new automotive display innovations at the SID Vehicle Displays and Interfaces Symposium is particularly relevant, as automotive remains the growth engine underpinning market optimism and a primary source of revenue risk if demand fails to rebound. The momentum from WiseEye’s integration into top PC brands aligns with Himax’s push to diversify, but investor focus is likely to stay on any signs of improving visibility or pickup in orders among auto customers.

However, against these positive signals, investors should also be aware that if panel and automotive demand does not recover in coming quarters, especially amid uncertain global trade policies...

Read the full narrative on Himax Technologies (it's free!)

Himax Technologies' outlook anticipates $1.1 billion in revenue and $139.3 million in earnings by 2028. This scenario assumes a 7.4% annual revenue growth rate and an earnings increase of $65.1 million from the current earnings of $74.2 million.

Uncover how Himax Technologies' forecasts yield a $9.31 fair value, a 7% upside to its current price.

Exploring Other Perspectives

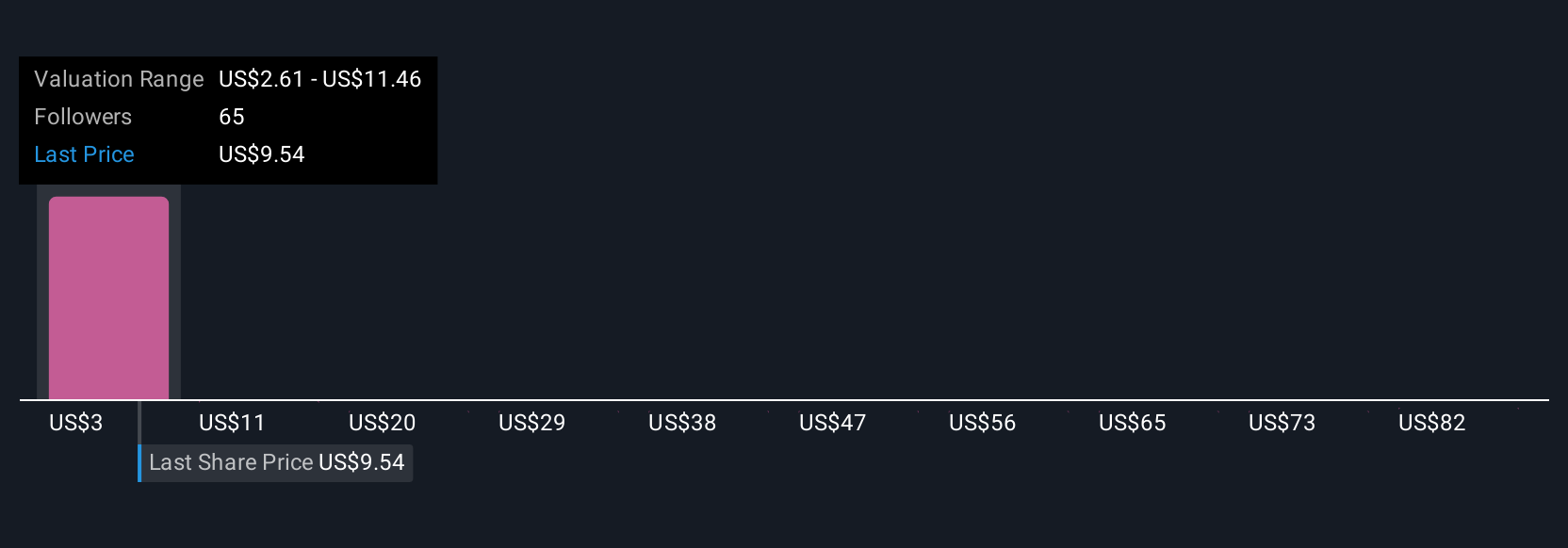

Eight fair value estimates from the Simply Wall St Community for Himax range from US$1.53 to US$91.18 per share. While opinions span a wide spectrum, continued weak visibility and delayed orders from major customers remain an ongoing concern with implications for future results.

Explore 8 other fair value estimates on Himax Technologies - why the stock might be worth less than half the current price!

Build Your Own Himax Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Himax Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Himax Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Himax Technologies' overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Himax Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:HIMX

Himax Technologies

A fabless semiconductor company, provides display imaging processing technologies in China, Taiwan, Korea, Japan, the United States, and internationally.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives