- United States

- /

- Biotech

- /

- NasdaqCM:GLYC

US Penny Stocks To Watch In February 2025

Reviewed by Simply Wall St

As the U.S. stock market navigates a mixed trading environment, with indices like the S&P 500 retreating slightly from record highs, investors are keeping an eye on smaller opportunities that might offer potential value. Penny stocks, though often associated with higher risk due to their smaller size and less-established nature, can still present intriguing investment possibilities when backed by strong financials and growth prospects. In light of current market conditions, we explore three penny stocks that stand out for their financial robustness and potential for long-term success.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.8625 | $6.39M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2698 | $9.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.4389 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.46 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.10 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.89 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.69 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 708 stocks from our US Penny Stocks screener.

Let's explore several standout options from the results in the screener.

GlycoMimetics (NasdaqCM:GLYC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GlycoMimetics, Inc. is a biotechnology company focused on discovering and developing therapies for cancers and inflammatory diseases in the United States, with a market cap of $18.71 million.

Operations: GlycoMimetics, Inc. currently does not report any revenue segments.

Market Cap: $18.71M

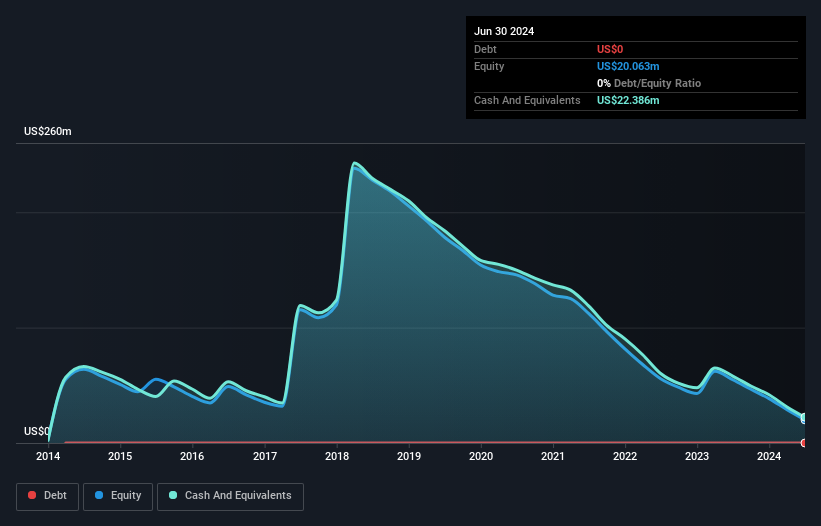

GlycoMimetics, Inc., a biotechnology company with a market cap of US$18.71 million, is currently pre-revenue and faces significant challenges. The company reported a net loss of US$37.88 million for 2024, and its auditor expressed doubts about its ability to continue as a going concern. Recent executive departures coincide with plans for a merger with Crescent Biopharma, Inc., which may impact stability. GlycoMimetics has received an extension from Nasdaq to comply with listing requirements but risks delisting if it fails to meet the minimum bid price by June 2025. Despite being debt-free and having experienced leadership, financial uncertainties remain prominent factors for investors considering this penny stock.

- Jump into the full analysis health report here for a deeper understanding of GlycoMimetics.

- Evaluate GlycoMimetics' historical performance by accessing our past performance report.

GSI Technology (NasdaqGS:GSIT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GSI Technology, Inc. designs, develops, and markets semiconductor memory solutions for various sectors including networking, industrial, medical, aerospace, and military across multiple countries with a market cap of $88.58 million.

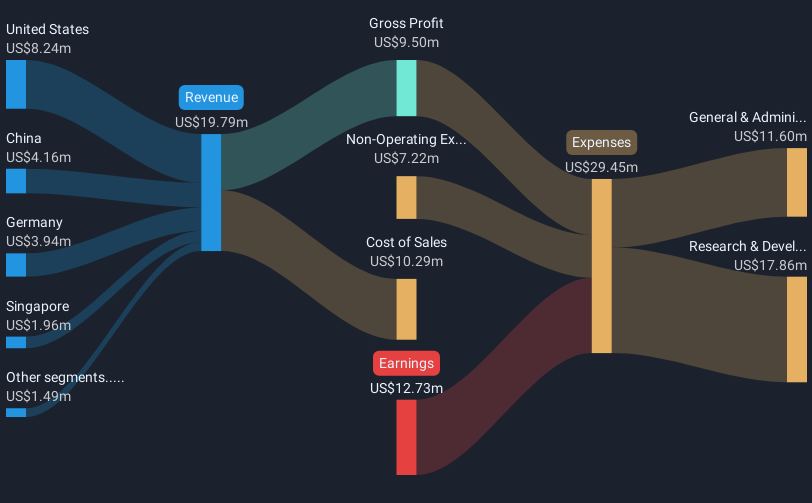

Operations: The company generates revenue primarily from the design, development, and sale of integrated circuits amounting to $19.79 million.

Market Cap: $88.58M

GSI Technology, Inc. operates in the semiconductor memory solutions sector with a market cap of US$88.58 million and recent quarterly sales of US$5.41 million, slightly up from the previous year. Despite being unprofitable with a net loss of US$4.03 million for the quarter, it remains debt-free and has seasoned management and board members with extensive tenure. The company's short-term assets exceed its liabilities, providing some financial stability despite having less than a year's cash runway based on current free cash flow trends. A potential contract award from the U.S. Army highlights its innovative Gemini-II technology's promising applications in military edge computing AI solutions.

- Get an in-depth perspective on GSI Technology's performance by reading our balance sheet health report here.

- Understand GSI Technology's track record by examining our performance history report.

Butler National (OTCPK:BUKS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Butler National Corporation, with a market cap of $116.25 million, operates in the aerospace industry by designing, manufacturing, and servicing aerostructures and aircraft components globally.

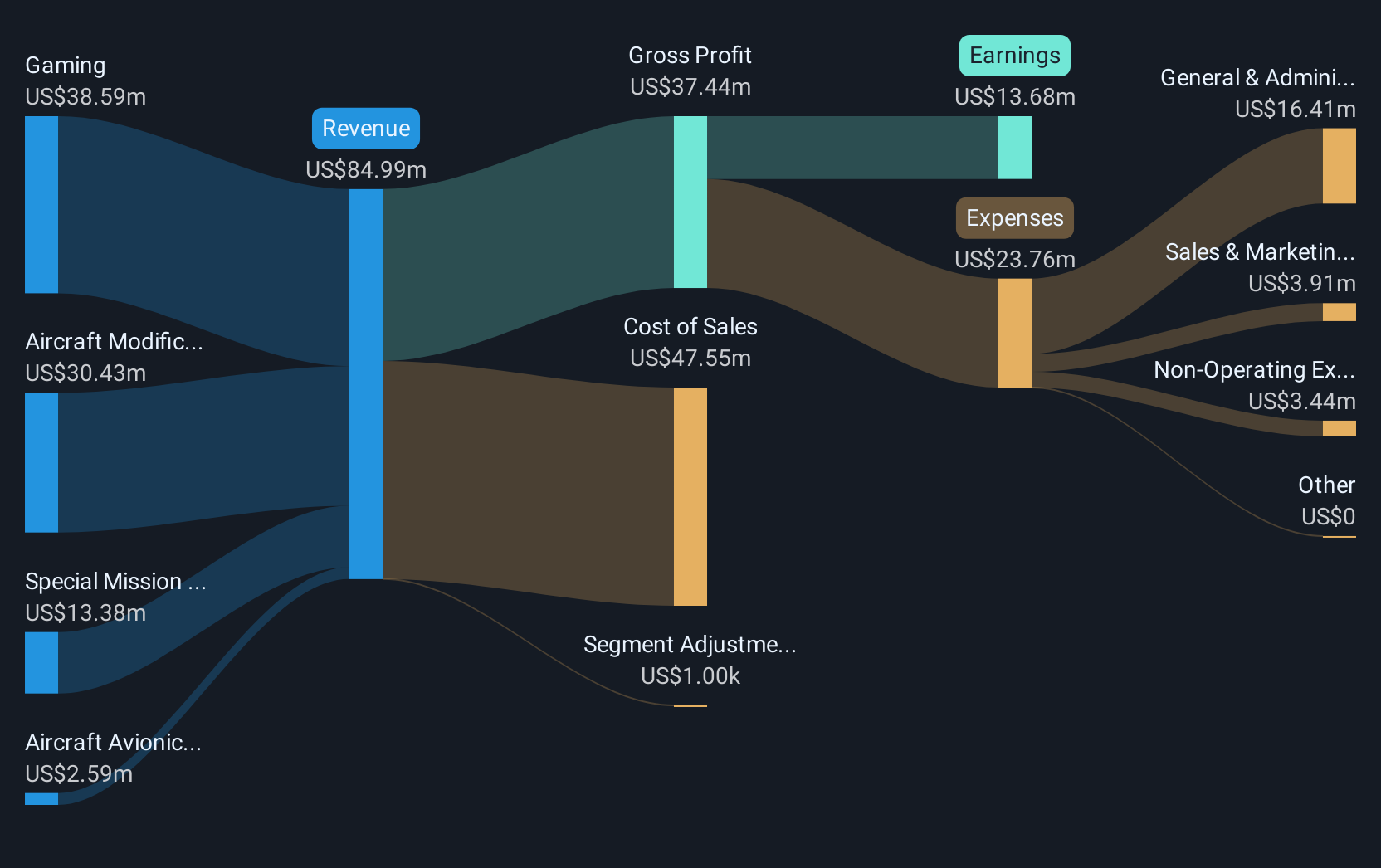

Operations: The company's revenue is primarily derived from its Gaming segment ($38.71 million), followed by Aircraft Modifications ($27.77 million), Special Mission Electronics ($13.81 million), and Aircraft Avionics ($2.49 million).

Market Cap: $116.25M

Butler National Corporation, with a market cap of US$116.25 million, shows promising financial metrics in the aerospace sector. Its short-term assets of US$37.8 million exceed both its short and long-term liabilities, indicating solid liquidity management. The company has achieved robust earnings growth of 79.4% over the past year, outpacing industry averages and reflecting high-quality earnings with a strong return on equity at 21.5%. Recent executive changes include Jeff Yowell's appointment as Executive Chairman to guide strategic growth alongside CEO Chris Reedy, following the termination of CFO Tad M. McMahon's employment earlier this year.

- Click here and access our complete financial health analysis report to understand the dynamics of Butler National.

- Learn about Butler National's historical performance here.

Summing It All Up

- Navigate through the entire inventory of 708 US Penny Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GLYC

GlycoMimetics

Engages in the discovery and development of therapies for cancers and inflammatory diseases in the United States.

Medium-low with adequate balance sheet.

Market Insights

Community Narratives