- United States

- /

- Biotech

- /

- NasdaqCM:GNTA

Genenta Science Leads The Charge With 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. market navigates through trade uncertainties and fluctuating indices, investors are increasingly exploring diverse investment opportunities. Penny stocks, a term often associated with smaller or newer companies, continue to offer intriguing prospects for those willing to look beyond the mainstream. By focusing on firms with robust financials and potential for growth, these stocks can present valuable opportunities without some of the typical risks associated with this segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.42 | $506.33M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.77 | $278.15M | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (MAPS) | $0.8841 | $154.72M | ✅ 4 ⚠️ 1 View Analysis > |

| Talkspace (TALK) | $2.65 | $463.46M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $95.78M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.43 | $36.49M | ✅ 4 ⚠️ 4 View Analysis > |

| Cardno (COLD.F) | $0.1701 | $6.64M | ✅ 2 ⚠️ 4 View Analysis > |

| BAB (BABB) | $0.84718 | $6.17M | ✅ 2 ⚠️ 3 View Analysis > |

| TETRA Technologies (TTI) | $3.24 | $452.45M | ✅ 4 ⚠️ 2 View Analysis > |

| Tandy Leather Factory (TLF) | $3.15 | $26.81M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 423 stocks from our US Penny Stocks screener.

We'll examine a selection from our screener results.

Genenta Science (GNTA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genenta Science S.p.A. is a clinical-stage biotechnology company in Italy focused on developing hematopoietic stem cell gene therapies for solid tumors, with a market cap of $69.50 million.

Operations: Currently, there are no reported revenue segments for this clinical-stage biotechnology company.

Market Cap: $69.5M

Genenta Science, a clinical-stage biotechnology company, is pre-revenue with a market cap of US$69.50 million and no significant revenue streams. Despite being unprofitable, the company's short-term assets (€14.5M) cover its liabilities, and it remains debt-free with sufficient cash runway for nearly two years. Recent developments include enrolling patients in studies for glioblastoma multiforme and genitourinary tumors using Temferon, which has shown promising safety results in early trials. A collaboration with Anemocyte aims to enhance production capabilities for immuno-oncology therapies while further research on Temferon's potential continues to gain traction in scientific circles.

- Navigate through the intricacies of Genenta Science with our comprehensive balance sheet health report here.

- Evaluate Genenta Science's historical performance by accessing our past performance report.

GSI Technology (GSIT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: GSI Technology, Inc. designs, develops, and markets semiconductor memory solutions for various industries including networking and aerospace, with a market cap of $98.67 million.

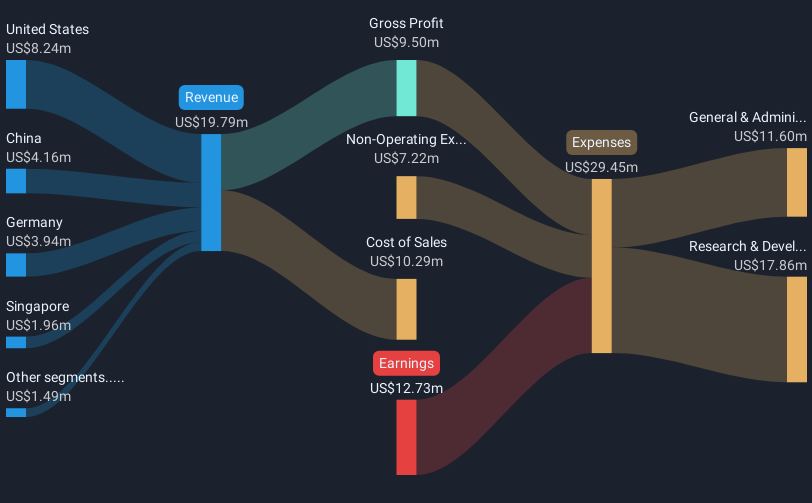

Operations: The company's revenue is primarily derived from the design, development, and sale of integrated circuits, totaling $20.52 million.

Market Cap: $98.67M

GSI Technology, with a market cap of US$98.67 million, focuses on semiconductor memory solutions for sectors like networking and aerospace. Despite being unprofitable, the company has reduced losses by 4% annually over five years. Recent earnings show sales of US$5.88 million for Q4 2025, with a net loss of US$2.23 million—an improvement from the previous year’s loss. The firm remains debt-free and its short-term assets cover liabilities comfortably, although it faces less than a year of cash runway if cash flow trends persist. Notably, GSI completed a significant share buyback program recently without diluting shareholders' equity further.

- Get an in-depth perspective on GSI Technology's performance by reading our balance sheet health report here.

- Examine GSI Technology's past performance report to understand how it has performed in prior years.

Dingdong (Cayman) (DDL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Dingdong (Cayman) Limited is an e-commerce company operating in China with a market cap of approximately $445.75 million.

Operations: The company generates revenue primarily through its online retail operations, amounting to CN¥23.52 billion.

Market Cap: $445.75M

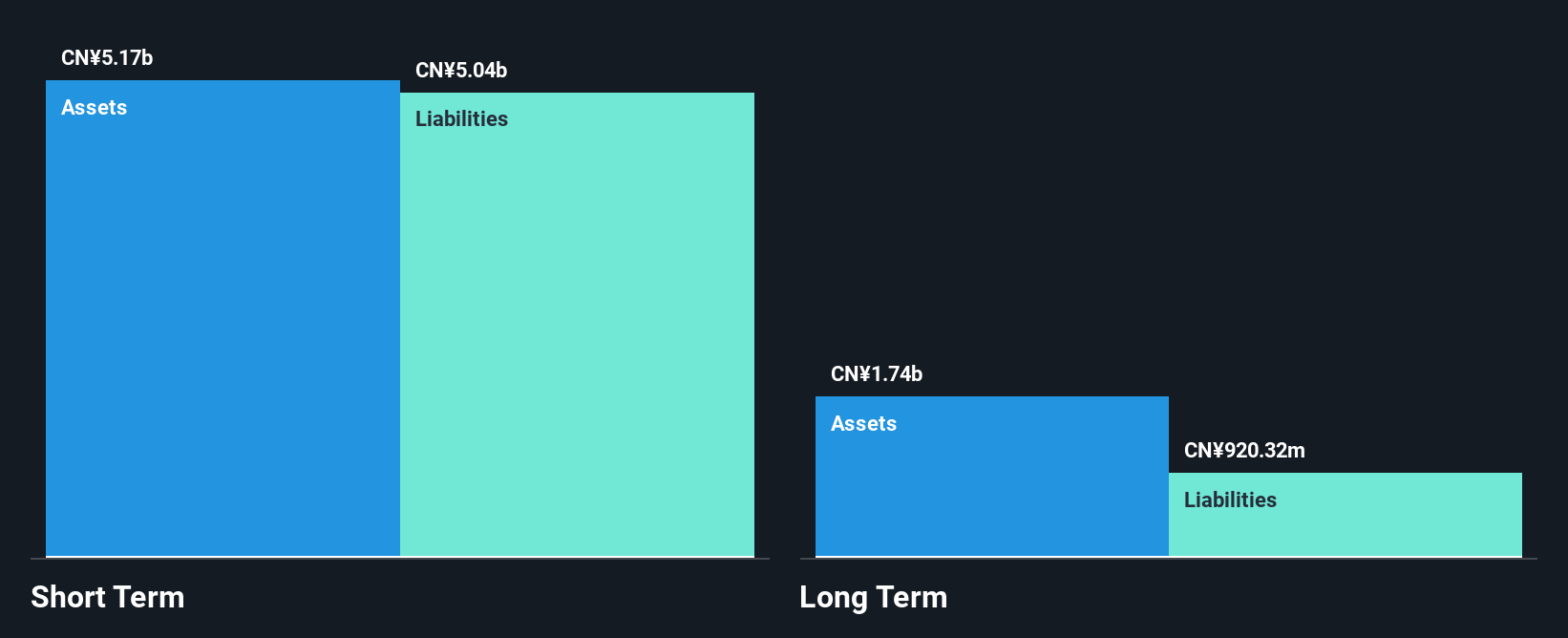

Dingdong (Cayman) Limited, with a market cap of approximately $445.75 million, has shown financial resilience in the e-commerce sector. The company reported first-quarter revenue of CN¥5.48 billion, up from CN¥5.02 billion the previous year, while net income decreased to CN¥5.62 million from CN¥10.02 million. Its strong cash position surpasses total debt and operating cash flow covers 65% of its debt obligations, indicating robust liquidity management. Dingdong's short-term assets exceed both short-term and long-term liabilities, showcasing solid balance sheet health amidst a stable earnings growth forecast of 17.71% annually despite recent profit fluctuations.

- Take a closer look at Dingdong (Cayman)'s potential here in our financial health report.

- Evaluate Dingdong (Cayman)'s prospects by accessing our earnings growth report.

Seize The Opportunity

- Reveal the 423 hidden gems among our US Penny Stocks screener with a single click here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 24 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:GNTA

Genenta Science

A clinical-stage biotechnology company, engages in the development of hematopoietic stem cell gene therapies for the treatment of solid tumors in Italy.

Adequate balance sheet with low risk.

Market Insights

Community Narratives