- United States

- /

- Semiconductors

- /

- NasdaqGS:GFS

GlobalFoundries (GFS) Advances in Photonics and Sensing: Are Its Specialization Bets Reshaping the Competitive Landscape?

Reviewed by Sasha Jovanovic

- In late September 2025, Applied Materials and GlobalFoundries announced a collaboration to establish an advanced waveguide fabrication facility in Singapore aimed at accelerating the use of photonics in AI-driven applications, while GlobalFoundries revealed a separate partnership with Egis Technology to deliver direct time-of-flight sensors on its 55nm platform for mobile, IoT, and automotive markets.

- These alliances reflect GlobalFoundries' growing presence in high-growth segments such as photonics and intelligent sensing, tapping into the increasing need for specialized semiconductor solutions to power next-generation digital experiences.

- We'll examine how GlobalFoundries' expansion into photonics manufacturing could reinforce its investment narrative and long-term competitive positioning.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

GlobalFoundries Investment Narrative Recap

To be a GlobalFoundries shareholder, you need to believe that the company’s expanding presence in automotive, IoT, and differentiated semiconductor manufacturing can offset the industry’s strong bias toward leading-edge process nodes. While the new photonics and sensing partnerships strengthen GlobalFoundries’ technology roadmap and customer appeal, they are not expected to meaningfully shift the near-term earnings catalyst, which remains tied to automotive and communications chip demand; the limited exposure to sub-7nm technology nodes continues to be the biggest risk.

The recent partnership with Applied Materials to build a waveguide fabrication facility is most relevant here. By investing in photonics for AI applications, GlobalFoundries may attract new revenue streams, but its impact on the company’s short-term prospects is likely limited compared to the scale of potential risks tied to lagging advanced node capabilities.

Yet, in contrast to rising optimism about new technology alliances, the issue of GlobalFoundries’ limited access to advanced process nodes is something investors should pay close attention to...

Read the full narrative on GlobalFoundries (it's free!)

GlobalFoundries is projected to reach $8.6 billion in revenue and $1.4 billion in earnings by 2028. This outlook assumes annual revenue growth of 8.0% and a $1.515 billion increase in earnings from the current level of -$115.0 million.

Uncover how GlobalFoundries' forecasts yield a $39.43 fair value, a 10% upside to its current price.

Exploring Other Perspectives

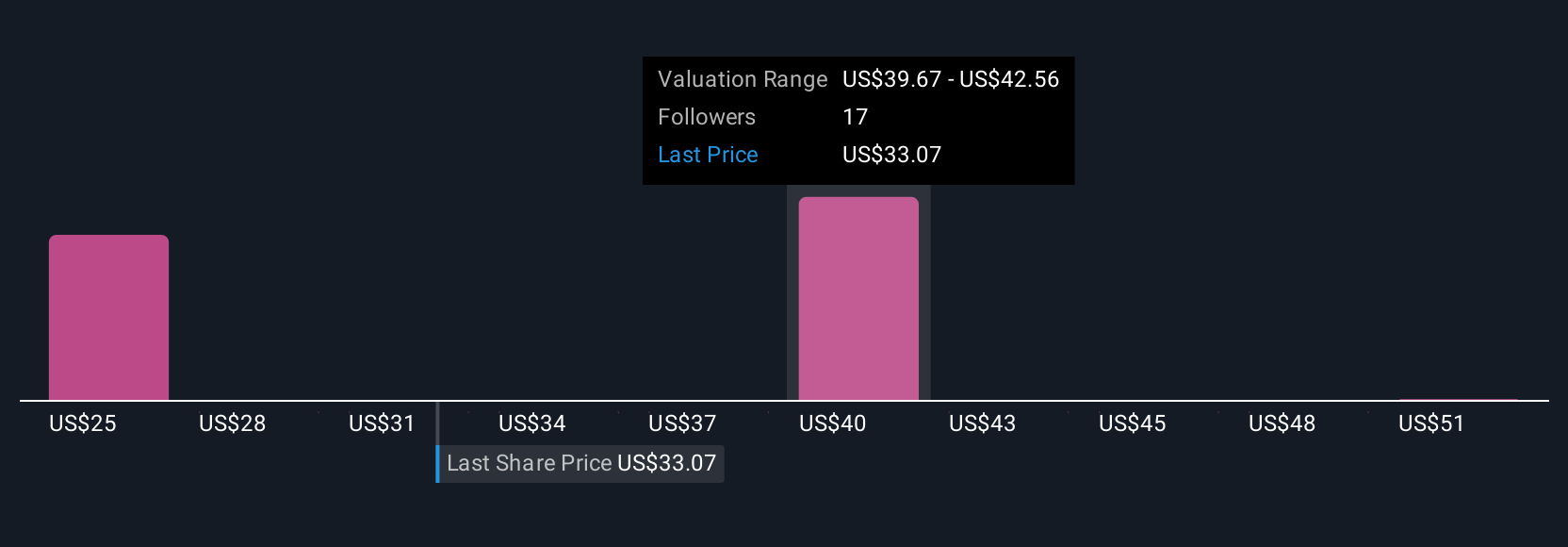

Simply Wall St Community members offered five fair value estimates, ranging from US$25.20 to US$54.13 per share. While opinions differ widely, many still focus on GlobalFoundries’ reliance on growth in automotive and communications infrastructure chips as a central performance driver, inviting you to explore a variety of alternative viewpoints.

Explore 5 other fair value estimates on GlobalFoundries - why the stock might be worth as much as 51% more than the current price!

Build Your Own GlobalFoundries Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your GlobalFoundries research is our analysis highlighting 1 key reward that could impact your investment decision.

- Our free GlobalFoundries research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate GlobalFoundries' overall financial health at a glance.

Want Some Alternatives?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:GFS

GlobalFoundries

A semiconductor foundry, provides range of mainstream wafer fabrication services and technologies worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives