- United States

- /

- Semiconductors

- /

- NasdaqGS:FSLR

First Solar (FSLR) Rises 32% in Last Quarter Amid Quantum Dot Tech Partnership

Reviewed by Simply Wall St

First Solar (FSLR) experienced a 32% price increase over the last quarter, likely bolstered by the news of its exclusive supply agreement with UbiQD. This partnership integrates innovative fluorescent quantum dot technology into First Solar's panels, positioning the company advantageously within the renewable energy sector. Meanwhile, First Solar's updated earnings forecast and revised guidance painted a mixed picture, reflecting challenges amid market optimism fueled by broader strong earnings and economic data. As major indices posted only modest fluctuations, First Solar's collaboration and technological advancements added positive momentum against the backdrop of a largely flat market environment.

First Solar's recent exclusive supply agreement with UbiQD could significantly impact the company’s outlook. By integrating fluorescent quantum dot technology, First Solar may enhance its competitive edge in the renewable energy sector, potentially increasing both revenue and earnings. Over the past five years, First Solar's total shareholder return, including share price appreciation and dividends, reached 186.43%, indicating substantial long-term growth.

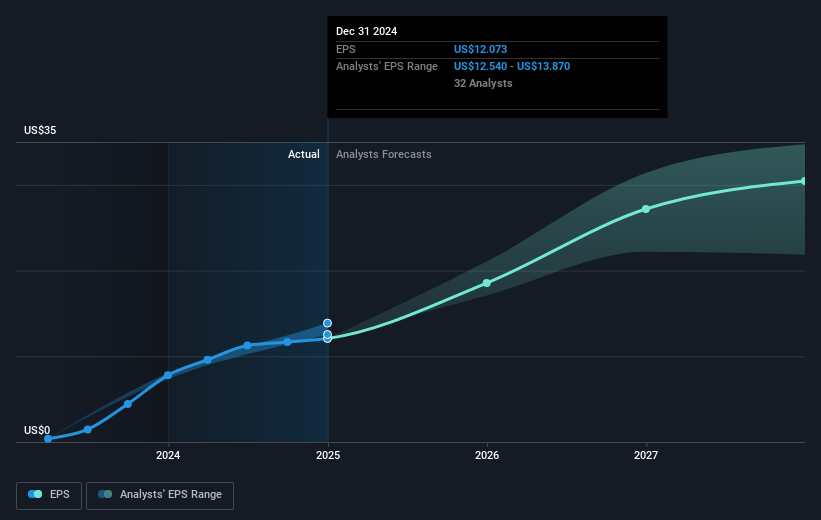

In the past year, First Solar's performance lagged behind the US Semiconductor industry, which returned 26.9%. However, the infusion of innovative technologies is anticipated to bolster revenue and output, aligning with analysts' revenue growth forecasts of 12.5% annually. The company’s earnings growth forecast of 22.5% per year suggests potential for improved profitability.

The recent share price increase of 32% over the last quarter brings First Solar closer to its consensus analyst price target of US$201.53, representing a discount of 13% from the target. This target implies an expectation for further growth, with analysts setting forecasts based on First Solar’s expansion plans and industry positioning. Investors may need to consider these growth projections and potential risks when evaluating First Solar’s financial outlook.

Examine First Solar's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:FSLR

First Solar

A solar technology company, provides photovoltaic (PV) solar energy solutions in the United States, France, India, Chile, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives