- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Entegris, Inc. (NASDAQ:ENTG) Investors Are Less Pessimistic Than Expected

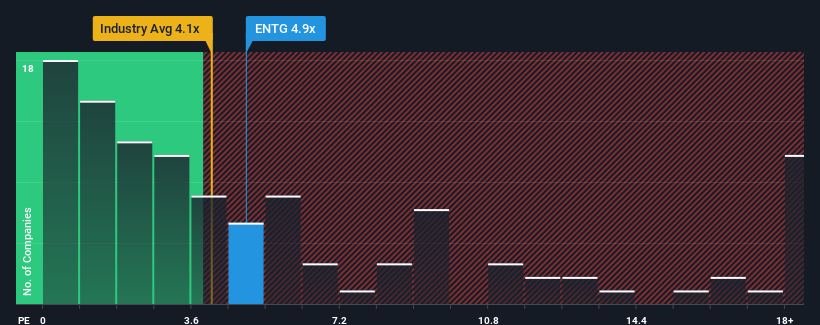

With a price-to-sales (or "P/S") ratio of 4.9x Entegris, Inc. (NASDAQ:ENTG) may be sending bearish signals at the moment, given that almost half of all Semiconductor companies in the United States have P/S ratios under 4.1x and even P/S lower than 1.6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for Entegris

What Does Entegris' P/S Mean For Shareholders?

Entegris hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Entegris' future stacks up against the industry? In that case, our free report is a great place to start.How Is Entegris' Revenue Growth Trending?

Entegris' P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 13%. Even so, admirably revenue has lifted 58% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been more than adequate for the company.

Looking ahead now, revenue is anticipated to climb by 7.0% during the coming year according to the twelve analysts following the company. With the industry predicted to deliver 40% growth, the company is positioned for a weaker revenue result.

With this information, we find it concerning that Entegris is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the growth outlook.

The Final Word

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Despite analysts forecasting some poorer-than-industry revenue growth figures for Entegris, this doesn't appear to be impacting the P/S in the slightest. When we see a weak revenue outlook, we suspect the share price faces a much greater risk of declining, bringing back down the P/S figures. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

You should always think about risks. Case in point, we've spotted 2 warning signs for Entegris you should be aware of, and 1 of them is potentially serious.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:ENTG

Entegris

Develops, manufactures, and supplies microcontamination control products, specialty chemicals, and advanced materials handling solutions in North America, Taiwan, China, South Korea, Japan, Europe, and Southeast Asia.

Reasonable growth potential with acceptable track record.