- United States

- /

- Semiconductors

- /

- NasdaqGS:ENTG

Entegris (ENTG): Reassessing Valuation After Recent Share Price Rebound

Reviewed by Simply Wall St

Entegris (ENTG) has been quietly reshaping its role in the semiconductor supply chain, and the stock’s recent ups and downs give investors a useful entry point to reassess its trajectory.

See our latest analysis for Entegris.

The recent jump in Entegris’ share price, including an 8.08% 1 day share price return and 14.90% 7 day share price return to about $86, contrasts with its weaker year to date share price performance and negative 1 year total shareholder return. This suggests sentiment may be stabilizing after a tougher stretch.

If this kind of rebound has you wondering what else might be setting up for the next leg higher, it could be worth exploring high growth tech and AI stocks as potential peers and alternatives.

With earnings still growing, a pullback this year, and shares trading below analyst targets, the key question now is whether Entegris is quietly undervalued or if the market already reflects its next leg of growth.

Most Popular Narrative Narrative: 14.2% Undervalued

With Entegris last closing at $86.27 against a narrative fair value of $100.50, the current share price sits below the story this valuation is telling.

Entegris is set to benefit from the long term acceleration in semiconductor demand driven by proliferating AI, high performance computing, and increased digitalization and IoT adoption, underpinning robust multi year revenue and earnings growth potential.

Curious how steady, mid single digit revenue growth can still underpin a premium multiple and a double digit upside case? Want to see the earnings and margin roadmap this narrative is banking on, and how long it assumes Entegris can outrun the broader semiconductor pack? The full breakdown reveals the specific profit profile that is meant to justify that higher valuation bar.

Result: Fair Value of $100.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated leverage and ongoing operational inefficiencies at new facilities could constrain Entegris’ flexibility, especially if AI-driven demand normalizes more slowly than expected.

Find out about the key risks to this Entegris narrative.

Another Angle On Valuation

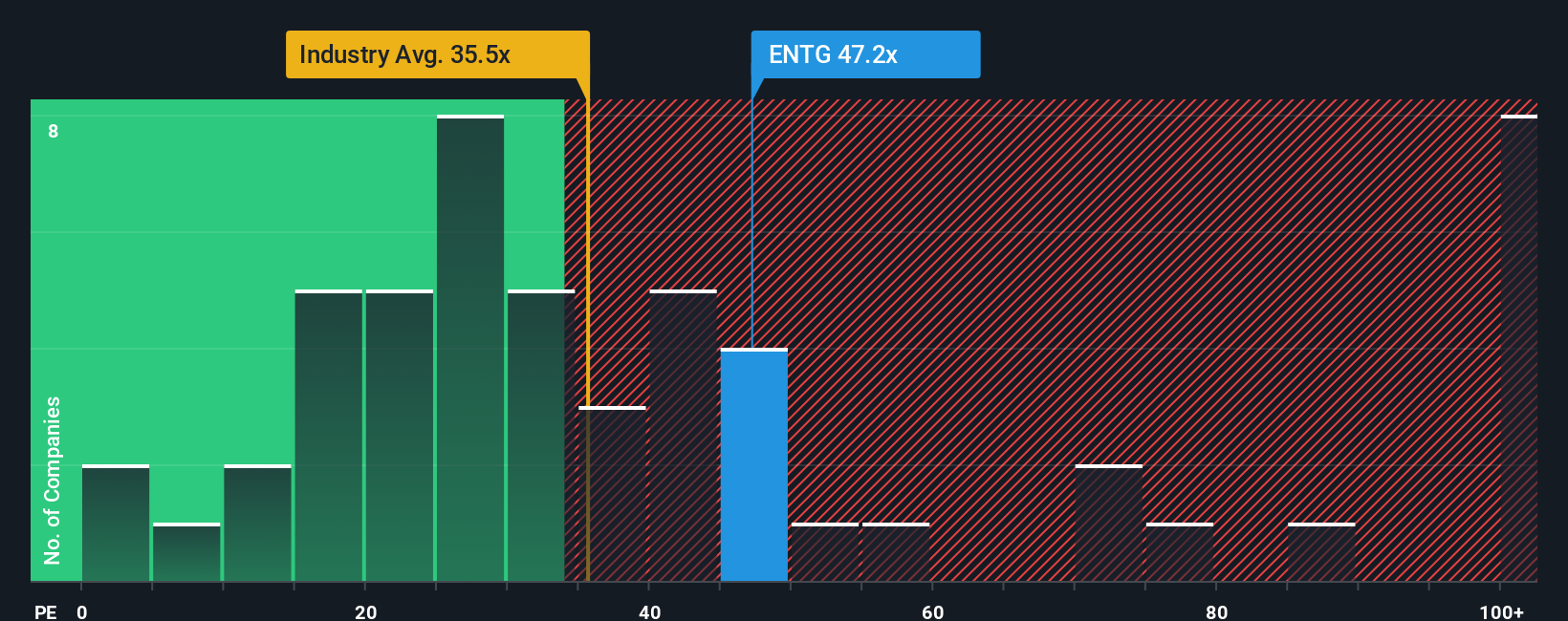

Analyst narratives point to upside, but a simple earnings lens tells a different story. Entegris trades on a P/E of 45.3 times versus 36.2 times for the US semiconductor industry and 35.1 times for peers, well above a fair ratio of 35 times, which suggests meaningful valuation risk if sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Entegris Narrative

If you see things differently, or would rather dig into the numbers yourself, you can shape a personalized view in minutes: Do it your way.

A great starting point for your Entegris research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next smart idea?

Use the Simply Wall St Screener to lock in your next move today, or risk watching sharper investors act first on the opportunities you overlook.

- Capture potential mispricings early by scanning these 912 undervalued stocks based on cash flows that pair strong cash flows with attractive entry points.

- Capitalize on rapid innovation by targeting these 25 AI penny stocks positioned at the forefront of artificial intelligence adoption.

- Strengthen your income stream by focusing on these 14 dividend stocks with yields > 3% that combine reliable payouts with solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entegris might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ENTG

Entegris

Provides advanced materials and process solutions for the semiconductor and other high-technology industries in North America, Taiwan, South Korea, Japan, China, Europe, and Southeast Asia.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026