- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Will Enphase Energy's (ENPH) European Virtual Power Plant Expansion Shift Its Investment Narrative?

Reviewed by Sasha Jovanovic

- Earlier this month, Enphase Energy announced an expansion of its virtual power plant and energy management capabilities across Europe, introducing real-time data streaming and broader control over devices like heat pumps, EV chargers, and electric water heaters through new partnerships and advanced software features.

- This move dramatically increases the number of connected homes participating in smart grid programs, potentially unlocking new revenue streams and supporting grid stability amid Europe's increasing focus on renewable energy solutions.

- We’ll examine how Enphase’s rapid scaling of virtual power plant deployments in key European markets could reshape its investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Enphase Energy Investment Narrative Recap

To own shares of Enphase Energy, you need to believe in the continued electrification of global energy systems and in Enphase’s ability to diversify its revenue through international and software-driven growth, offsetting U.S. solar market risks. The recent expansion of virtual power plants across Europe is a positive step for long-term market diversification and grid service opportunities, but may not materially change short-term catalysts such as U.S. market contraction or inventory risks.

Of the recent announcements, the upgrade enabling real-time data streaming and broader device integration for virtual power plants directly ties to Enphase's effort to grow its recurring software revenue and participate in new value streams from grid services. By connecting more households and energy devices across Europe, Enphase builds a broader foundation for revenue sources that are less sensitive to U.S. policy changes or hardware oversupply.

In contrast, investors should also keep in mind the concentration risk stemming from a possible 20 percent decline in the U.S. residential solar market in 2026 if...

Read the full narrative on Enphase Energy (it's free!)

Enphase Energy's outlook anticipates $1.6 billion in revenue and $232.0 million in earnings by 2028. This is based on a projected annual revenue growth rate of 3.0% and represents a $57.3 million increase in earnings from the current $174.7 million.

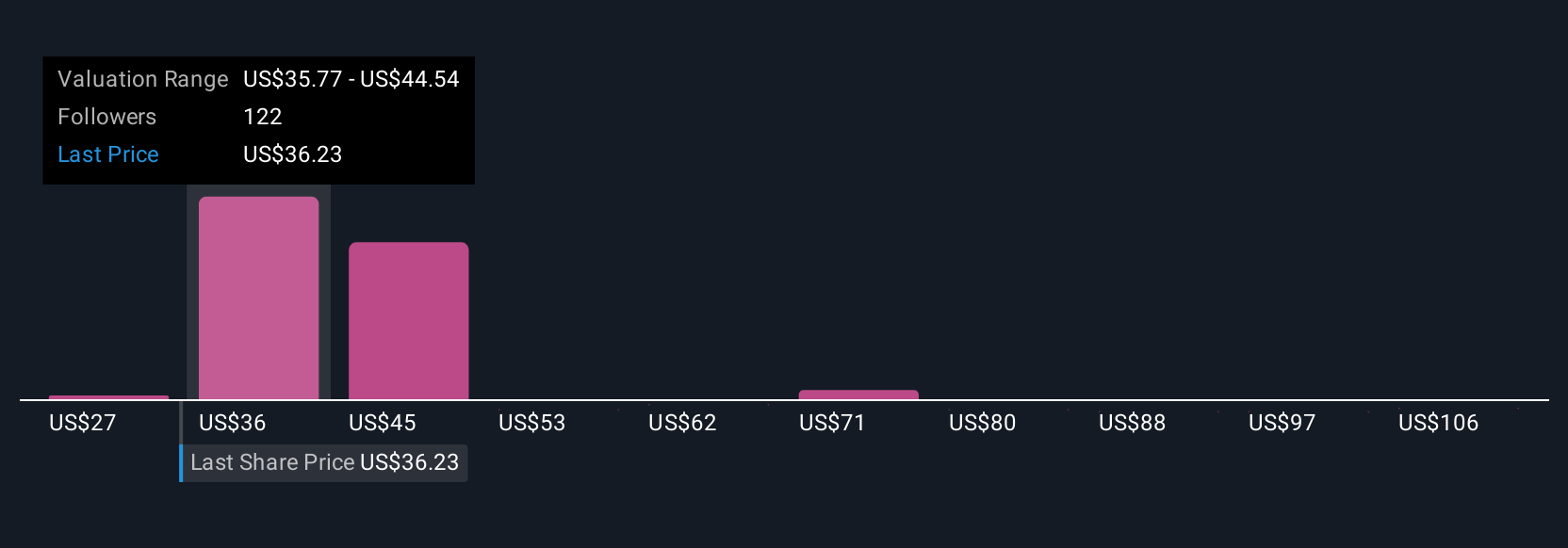

Uncover how Enphase Energy's forecasts yield a $42.79 fair value, a 15% upside to its current price.

Exploring Other Perspectives

Seventeen individual fair value estimates from the Simply Wall St Community range broadly from US$28.32 to US$76.86 per share. While many see long-term opportunity in global electrification, your view on policy risks could have a major influence on future returns.

Explore 17 other fair value estimates on Enphase Energy - why the stock might be worth 24% less than the current price!

Build Your Own Enphase Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enphase Energy research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Enphase Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enphase Energy's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives