- United States

- /

- Consumer Services

- /

- NYSE:TAL

US Stocks That May Be Priced Below Intrinsic Value In November 2024

Reviewed by Simply Wall St

As the U.S. stock market experiences slight upticks in futures amid anticipation of the presidential election and Federal Reserve's interest rate decision, investors are keenly observing potential shifts in major indices like the Dow Jones and S&P 500. In this context, identifying stocks that may be priced below their intrinsic value becomes crucial for those looking to capitalize on potential market inefficiencies amidst current economic uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | $18.55 | $36.67 | 49.4% |

| MVB Financial (NasdaqCM:MVBF) | $18.89 | $37.09 | 49.1% |

| California Resources (NYSE:CRC) | $52.86 | $104.55 | 49.4% |

| Cadence Bank (NYSE:CADE) | $33.02 | $64.54 | 48.8% |

| Range Resources (NYSE:RRC) | $30.56 | $60.18 | 49.2% |

| Enphase Energy (NasdaqGM:ENPH) | $87.46 | $171.07 | 48.9% |

| Constellium (NYSE:CSTM) | $11.19 | $21.86 | 48.8% |

| EVERTEC (NYSE:EVTC) | $33.02 | $65.79 | 49.8% |

| First Western Financial (NasdaqGS:MYFW) | $19.00 | $37.36 | 49.1% |

| Open Lending (NasdaqGM:LPRO) | $6.14 | $12.21 | 49.7% |

Let's review some notable picks from our screened stocks.

Enphase Energy (NasdaqGM:ENPH)

Overview: Enphase Energy, Inc. designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry globally and has a market cap of approximately $11.29 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of solutions for the solar photovoltaic industry, totaling $1.25 billion.

Estimated Discount To Fair Value: 48.9%

Enphase Energy is trading at US$87.46, significantly below its estimated fair value of US$171.07, suggesting it may be undervalued based on cash flows. Despite recent declines in sales and net income, the company is forecast to achieve revenue growth of 20.6% annually, outpacing the broader U.S. market's 8.8%. Enphase's strategic focus on M&A and product innovations like IQ Batteries and Microinverters could enhance its cash flow potential further.

- Our earnings growth report unveils the potential for significant increases in Enphase Energy's future results.

- Take a closer look at Enphase Energy's balance sheet health here in our report.

AECOM (NYSE:ACM)

Overview: AECOM, with a market cap of $14.53 billion, provides professional infrastructure consulting services globally through its subsidiaries.

Operations: The company's revenue is derived from three main segments: Americas ($12.26 billion), International ($3.58 billion), and AECOM Capital (ACAP) ($1.30 million).

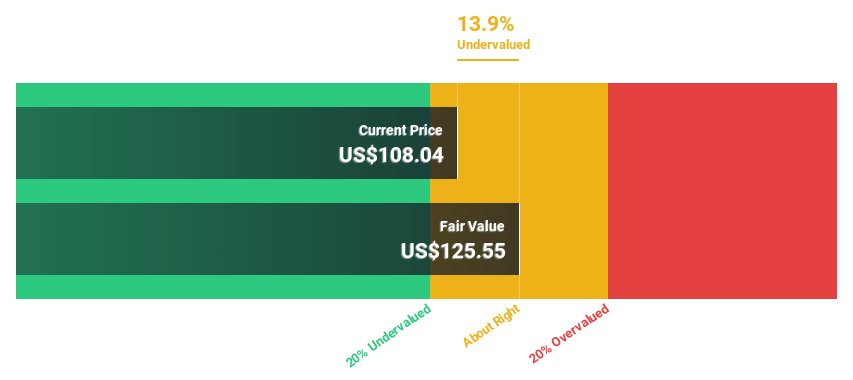

Estimated Discount To Fair Value: 13.9%

AECOM, trading at $108.04, is undervalued compared to its estimated fair value of $125.55. Although revenue growth is slower than the U.S. market's average, earnings are projected to increase significantly by 21% annually, outpacing market expectations. Recent contracts with USAID and a $1 billion sports complex project in Florida highlight AECOM's strategic positioning in infrastructure development, potentially enhancing future cash flows despite current valuation gaps.

- Our expertly prepared growth report on AECOM implies its future financial outlook may be stronger than recent results.

- Dive into the specifics of AECOM here with our thorough financial health report.

TAL Education Group (NYSE:TAL)

Overview: TAL Education Group offers K-12 after-school tutoring services in the People's Republic of China and has a market cap of $6.67 billion.

Operations: The company's revenue segment consists of after-school tutoring services, generating $1.84 billion.

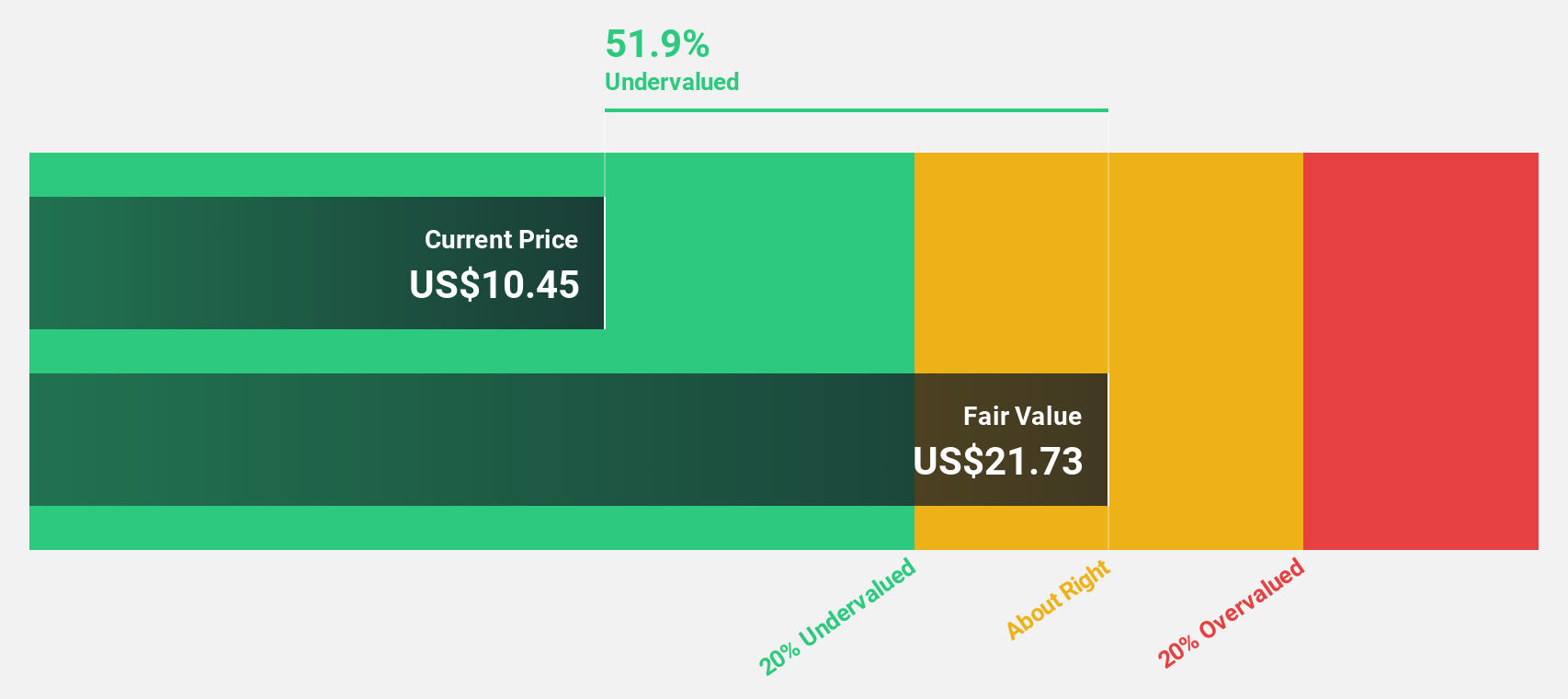

Estimated Discount To Fair Value: 26.6%

TAL Education Group's recent earnings report shows significant growth, with net income of US$57.43 million for the second quarter compared to US$37.9 million a year ago. The company has become profitable this year and is trading at US$11.5, below its estimated fair value of US$15.66, indicating it may be undervalued based on cash flows. However, its share price has been highly volatile recently despite forecasts of strong revenue and earnings growth outpacing the U.S. market.

- Our comprehensive growth report raises the possibility that TAL Education Group is poised for substantial financial growth.

- Click here and access our complete balance sheet health report to understand the dynamics of TAL Education Group.

Seize The Opportunity

- Reveal the 197 hidden gems among our Undervalued US Stocks Based On Cash Flows screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TAL Education Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TAL

TAL Education Group

Provides K-12 after-school tutoring services in the People’s Republic of China.

High growth potential with adequate balance sheet.