- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Is Enphase Energy’s (ENPH) Custom Battery Launch in Australia a Sign of Shifting Global Strategy?

Reviewed by Simply Wall St

- Enphase Energy recently launched its IQ Battery 5P with FlexPhase in Australia, offering configurable backup solutions for both single-phase and three-phase homes, with support for capacities from 5 kWh to 70 kWh and a 15-year warranty.

- This introduction, which aligns with Australia's Cheaper Home Batteries Program and similar efforts in Europe, provides homeowners significant upfront rebates and showcases Enphase’s commitment to flexible, region-specific energy solutions amid shifting policy landscapes.

- We'll explore how Enphase’s entry into Australia’s battery market, backed by government incentives, could influence its global expansion narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

Enphase Energy Investment Narrative Recap

To own a piece of Enphase Energy, you need to believe in the company’s ability to convert the global shift toward electrification and distributed energy into sustained business growth, amidst ongoing worldwide policy and competitive pressures. The launch of IQ Battery 5P with FlexPhase in Australia, while strengthening Enphase’s regional presence and benefiting from government rebates, does not materially change the most important near-term catalyst, the stabilization of U.S. residential solar demand, or address the biggest risk, which is the looming contraction of Enphase’s core market if U.S. tax credits expire as expected.

Among recent announcements, the IQ Meter Collar's rapid approval by San Diego Gas & Electric stands out as it streamlines battery installations and enables faster adoption in a key U.S. utility market, making it more relevant to short-term shifts in domestic policy and market activity than the Australia news. This development could influence how effectively Enphase addresses U.S. policy headwinds, which remain central to the near-term outlook.

In contrast, investors should also be aware of the possible impact if channel inventory excess worsens...

Read the full narrative on Enphase Energy (it's free!)

Enphase Energy's narrative projects $1.6 billion in revenue and $229.1 million in earnings by 2028. This requires 3.0% yearly revenue growth and a $54.4 million earnings increase from today's $174.7 million.

Uncover how Enphase Energy's forecasts yield a $42.20 fair value, a 21% upside to its current price.

Exploring Other Perspectives

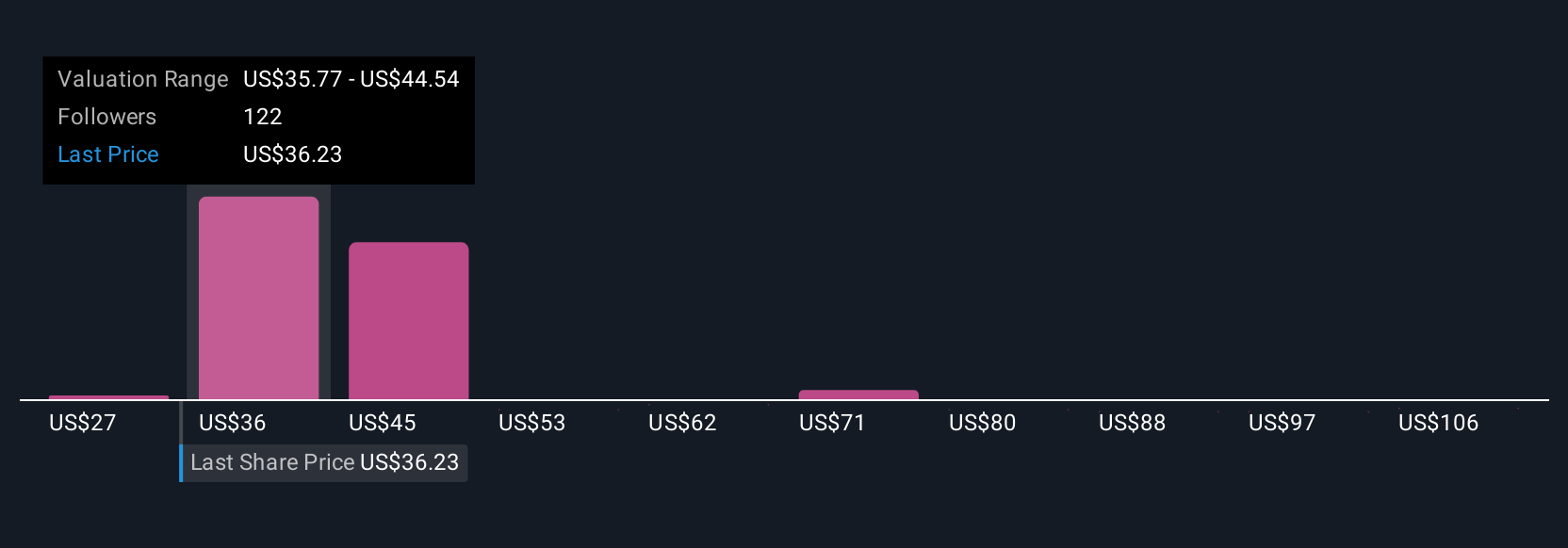

Eighteen retail investors in the Simply Wall St Community estimate Enphase's fair value across a wide range from US$27 to US$114.69. While many see upside, others highlight ongoing uncertainty about U.S. tax incentives and the challenge of scaling global demand, making it vital to weigh multiple viewpoints.

Explore 18 other fair value estimates on Enphase Energy - why the stock might be worth 23% less than the current price!

Build Your Own Enphase Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Enphase Energy research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Enphase Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Enphase Energy's overall financial health at a glance.

Contemplating Other Strategies?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives