- United States

- /

- Semiconductors

- /

- NasdaqCM:DVLT

Datavault AI (DVLT) Partners with Wellgistics: Will Blockchain Boost Healthcare Recurring Revenue Potential?

Reviewed by Sasha Jovanovic

- Datavault AI Inc. and Wellgistics Health, Inc. recently announced they entered a non-binding letter of intent to integrate blockchain-enabled smart contracts and AI-driven prescription tracking into Wellgistics’ infrastructure for the U.S. prescription drug industry, aiming to digitize and optimize drug logistics, safety, and fulfillment using the PharmacyChain platform.

- This collaboration seeks to improve patient outcomes and operational efficiency through revenue-sharing opportunities, advanced compliance, and the integration of machine learning within a trusted network of over 6,500 independent pharmacies and Wellgistics' physical and digital assets.

- We'll explore how Datavault AI's expansion into healthcare blockchain solutions could reshape its investment outlook and recurring revenue potential.

We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Datavault AI Investment Narrative Recap

To consider Datavault AI as a potential investment, it is essential to believe in the company's ability to deliver meaningful recurring revenue by commercializing its innovative AI and blockchain platforms across emerging sectors. The Wellgistics Health announcement introduces new technology and revenue-sharing opportunities in healthcare, but does not materially shift the company’s biggest short-term catalyst, which is the successful launch and monetization of its various data exchange platforms; major risks remain tied to revenue recognition and integration of new ventures.

Of Datavault AI’s recent updates, the planned acquisition of NYIAX is particularly interesting in this context, as it would further expand the company’s licensing and exchange infrastructure, potentially solidifying recurring revenues if integration is managed effectively. However, similar to the Wellgistics collaboration, execution and realization of these benefits still depend on complex negotiations, regulatory compliance, and integration across partnerships and new technologies.

Yet, in contrast to the promise of new partnerships, investors should be aware that unresolved revenue recognition risks may...

Read the full narrative on Datavault AI (it's free!)

Datavault AI's narrative projects $94.2 million revenue and $13.3 million earnings by 2028. This requires 176.9% yearly revenue growth and a $81.9 million increase in earnings from current earnings of -$68.6 million.

Uncover how Datavault AI's forecasts yield a $3.00 fair value, a 33% upside to its current price.

Exploring Other Perspectives

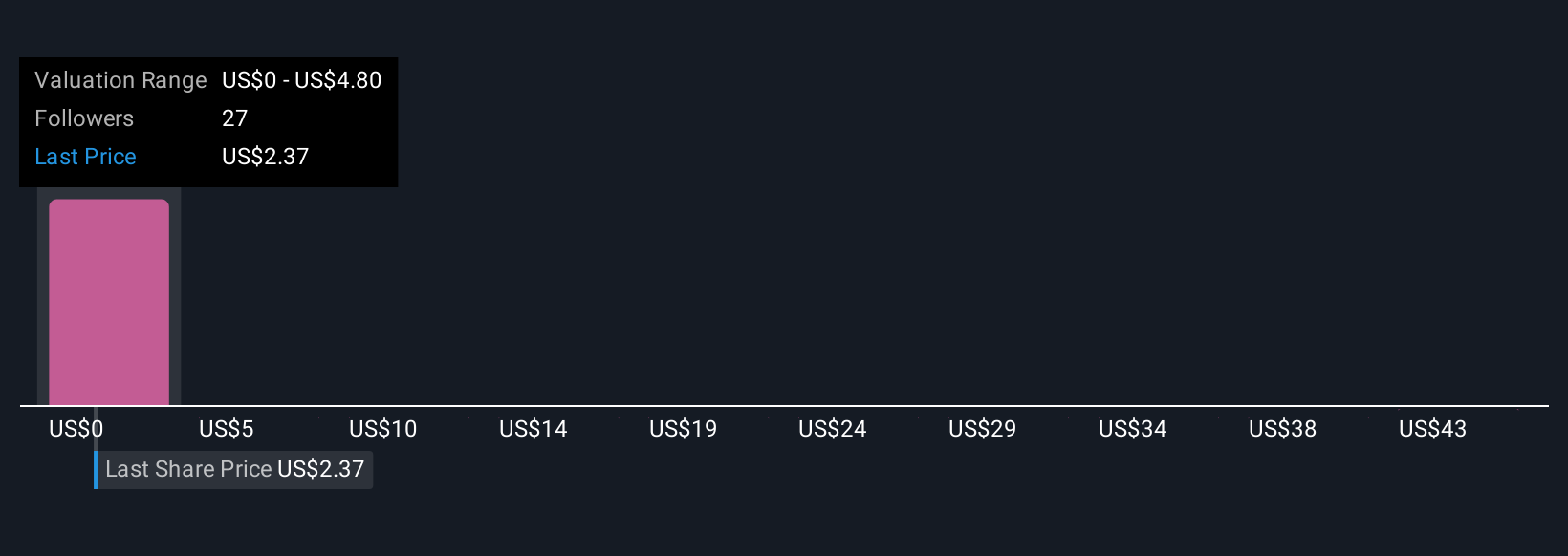

Eight different fair value estimates from the Simply Wall St Community range from US$4.80 to US$48.01 per share. While many expect revenue growth to accelerate, you may want to consider how execution and integration challenges could limit Datavault AI’s results, explore these perspectives for broader context.

Explore 8 other fair value estimates on Datavault AI - why the stock might be a potential multi-bagger!

Build Your Own Datavault AI Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Datavault AI research is our analysis highlighting 1 key reward and 5 important warning signs that could impact your investment decision.

- Our free Datavault AI research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Datavault AI's overall financial health at a glance.

Ready For A Different Approach?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:DVLT

Datavault AI

A data sciences technology company, owns and operates data management platforms by supercomputing capabilities in the North America, Asia Pacific, Europe, and internationally.

Moderate risk with limited growth.

Similar Companies

Market Insights

Community Narratives