- United States

- /

- Semiconductors

- /

- NasdaqGM:CYBE

What Can We Learn About CyberOptics' (NASDAQ:CYBE) CEO Compensation?

Subodh Kulkarni became the CEO of CyberOptics Corporation (NASDAQ:CYBE) in 2014, and we think it's a good time to look at the executive's compensation against the backdrop of overall company performance. This analysis will also look to assess whether the CEO is appropriately paid, considering recent earnings growth and investor returns for CyberOptics.

Check out our latest analysis for CyberOptics

Comparing CyberOptics Corporation's CEO Compensation With the industry

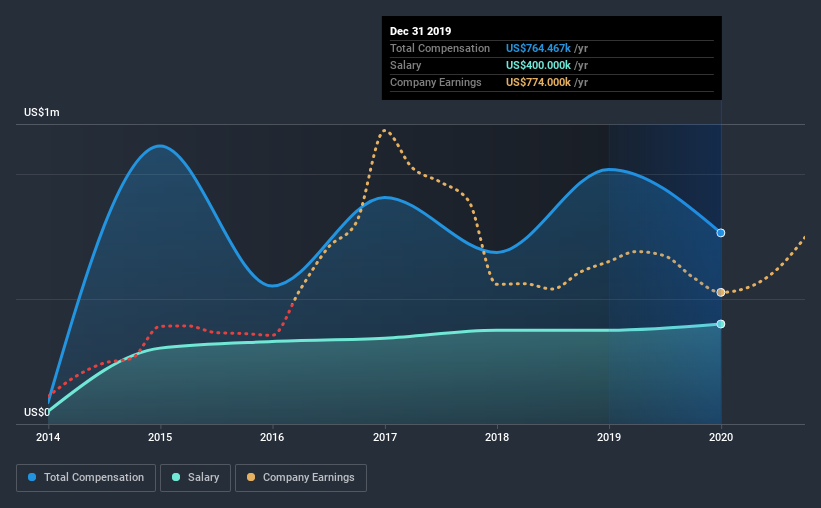

Our data indicates that CyberOptics Corporation has a market capitalization of US$205m, and total annual CEO compensation was reported as US$764k for the year to December 2019. That's a notable decrease of 25% on last year. In particular, the salary of US$400.0k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations ranging from US$100m to US$400m, the reported median CEO total compensation was US$843k. This suggests that CyberOptics remunerates its CEO largely in line with the industry average. Moreover, Subodh Kulkarni also holds US$2.9m worth of CyberOptics stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2019 | 2018 | Proportion (2019) |

| Salary | US$400k | US$375k | 52% |

| Other | US$364k | US$643k | 48% |

| Total Compensation | US$764k | US$1.0m | 100% |

On an industry level, around 15% of total compensation represents salary and 85% is other remuneration. CyberOptics is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

CyberOptics Corporation's Growth

Over the last three years, CyberOptics Corporation has shrunk its earnings per share by 15% per year. In the last year, its revenue is up 16%.

The reduction in EPS, over three years, is arguably concerning. But in contrast the revenue growth is strong, suggesting future potential for EPS growth. It's hard to reach a conclusion about business performance right now. This may be one to watch. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has CyberOptics Corporation Been A Good Investment?

We think that the total shareholder return of 84%, over three years, would leave most CyberOptics Corporation shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

To Conclude...

As we noted earlier, CyberOptics pays its CEO in line with similar-sized companies belonging to the same industry. Investors will be happy that CyberOptics has produced strong shareholder returns for the past three years. Meanwhile, revenues have been increasing recently However, on a concerning note, EPS is not growing. However, considering overall positive performance, we think Subodh, shareholders might not be too worried about the CEO's compensation.

CEO compensation can have a massive impact on performance, but it's just one element. That's why we did some digging and identified 1 warning sign for CyberOptics that you should be aware of before investing.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade CyberOptics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NasdaqGM:CYBE

CyberOptics

CyberOptics Corporation designs, develops, manufactures, and markets high precision sensing technology solutions and system products for inspection and metrology worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion