- United States

- /

- Semiconductors

- /

- NasdaqGM:CYBE

Here's Why I Think CyberOptics (NASDAQ:CYBE) Might Deserve Your Attention Today

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. Unfortunately, high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson.

So if you're like me, you might be more interested in profitable, growing companies, like CyberOptics (NASDAQ:CYBE). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for CyberOptics

CyberOptics's Improving Profits

In business, though not in life, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS). So like a ray of sunshine through a gap in the clouds, improving EPS is considered a good sign. It is therefore awe-striking that CyberOptics's EPS went from US$0.11 to US$0.80 in just one year. When you see earnings grow that quickly, it often means good things ahead for the company. Could this be a sign that the business has reached an inflection point?

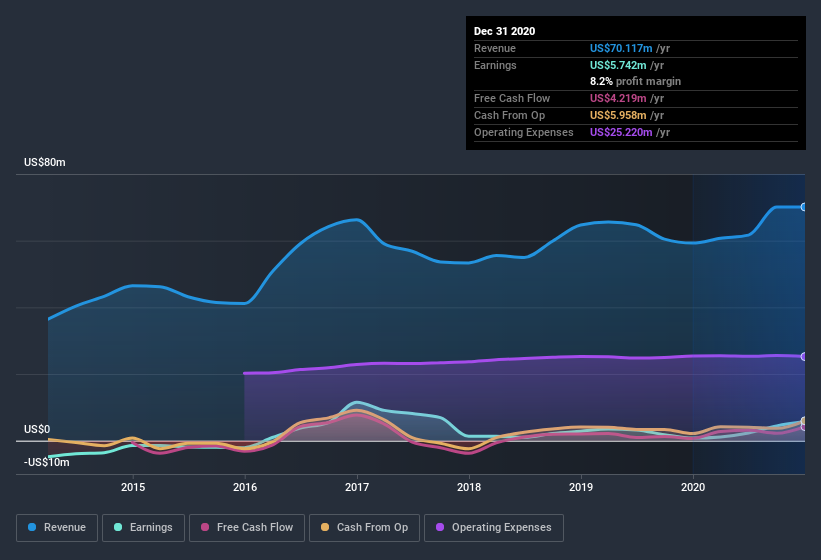

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. CyberOptics shareholders can take confidence from the fact that EBIT margins are up from 1.6% to 8.6%, and revenue is growing. That's great to see, on both counts.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of CyberOptics's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are CyberOptics Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The good news for CyberOptics shareholders is that no insiders reported selling shares in the last year. So it's definitely nice that President Subodh Kulkarni bought US$12k worth of shares at an average price of around US$23.10.

I do like that insiders have been buying shares in CyberOptics, but there is more evidence of shareholder friendly management. I refer to the very reasonable level of CEO pay. For companies with market capitalizations between US$100m and US$400m, like CyberOptics, the median CEO pay is around US$934k.

CyberOptics offered total compensation worth US$764k to its CEO in the year to . That comes in below the average for similar sized companies, and seems pretty reasonable to me. While the level of CEO compensation isn't a huge factor in my view of the company, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of a culture of integrity, in a broader sense.

Is CyberOptics Worth Keeping An Eye On?

CyberOptics's earnings have taken off like any random crypto-currency did, back in 2017. Better yet, we can observe insider buying and the chief executive pay looks reasonable. The strong EPS growth suggests CyberOptics may be at an inflection point. For those chasing fast growth, then, I'd suggest to stock merits monitoring. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if CyberOptics is trading on a high P/E or a low P/E, relative to its industry.

The good news is that CyberOptics is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading CyberOptics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:CYBE

CyberOptics

CyberOptics Corporation designs, develops, manufactures, and markets high precision sensing technology solutions and system products for inspection and metrology worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives