- United States

- /

- Semiconductors

- /

- NasdaqGS:CSIQ

Canadian Solar (NasdaqGS:CSIQ) Valuation in Focus After Citigroup Downgrade and Shifting Analyst Sentiment

Reviewed by Simply Wall St

Citigroup’s recent downgrade of Canadian Solar (NasdaqGS:CSIQ) from Neutral to Sell set off some fresh debate among investors. The move adds to a series of rating changes across Wall Street, highlighting emerging caution about the company’s future prospects.

See our latest analysis for Canadian Solar.

After a robust stretch earlier this year, Canadian Solar’s share price momentum has clearly shifted. This week’s Citigroup downgrade arrived just as the stock dropped 7% in a day and 11% over the week, offsetting much of its recent 10% 30-day gain. Despite the pullback, long-term investors have seen a 17% total shareholder return over the past year. However, the longer-term track record remains challenging, with deep negative total returns over the last three and five years.

If solar’s shifting fortunes have your attention, it might be the perfect time to broaden your search and discover fast growing stocks with high insider ownership

With analyst sentiment turning increasingly cautious and shares now trading below recent price targets, the question for investors is clear: is the current dip an attractive entry point, or is the market rightly signaling tougher times ahead?

Most Popular Narrative: 13% Overvalued

Canadian Solar’s last close at $14 stands notably higher than the consensus fair value of $12.37, suggesting the market price is ahead of the narrative's estimated worth. Innovative expansion and international diversification have made this stock hard to ignore. However, shifting financial conditions mean investors are split on whether its next move will be up or down.

Geographic diversification and a large, flexible development pipeline (27 GW solar, 80 GWh storage), including safe harbored projects in multiple global markets, provide resilience against regional policy or tariff shocks and ensure revenue visibility and growth, as delayed projects are not lost but shifted forward.

Wondering what bold financial projections underpin this valuation? The narrative forecasts surging profits and revenue, but different analyst camps are locked in a battle over what happens next. One detail in their future earnings roadmap might shock you.

Result: Fair Value of $12.37 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intense competition and evolving U.S. policy risks could quickly undermine these upbeat forecasts. This may challenge Canadian Solar’s ambitious growth narrative.

Find out about the key risks to this Canadian Solar narrative.

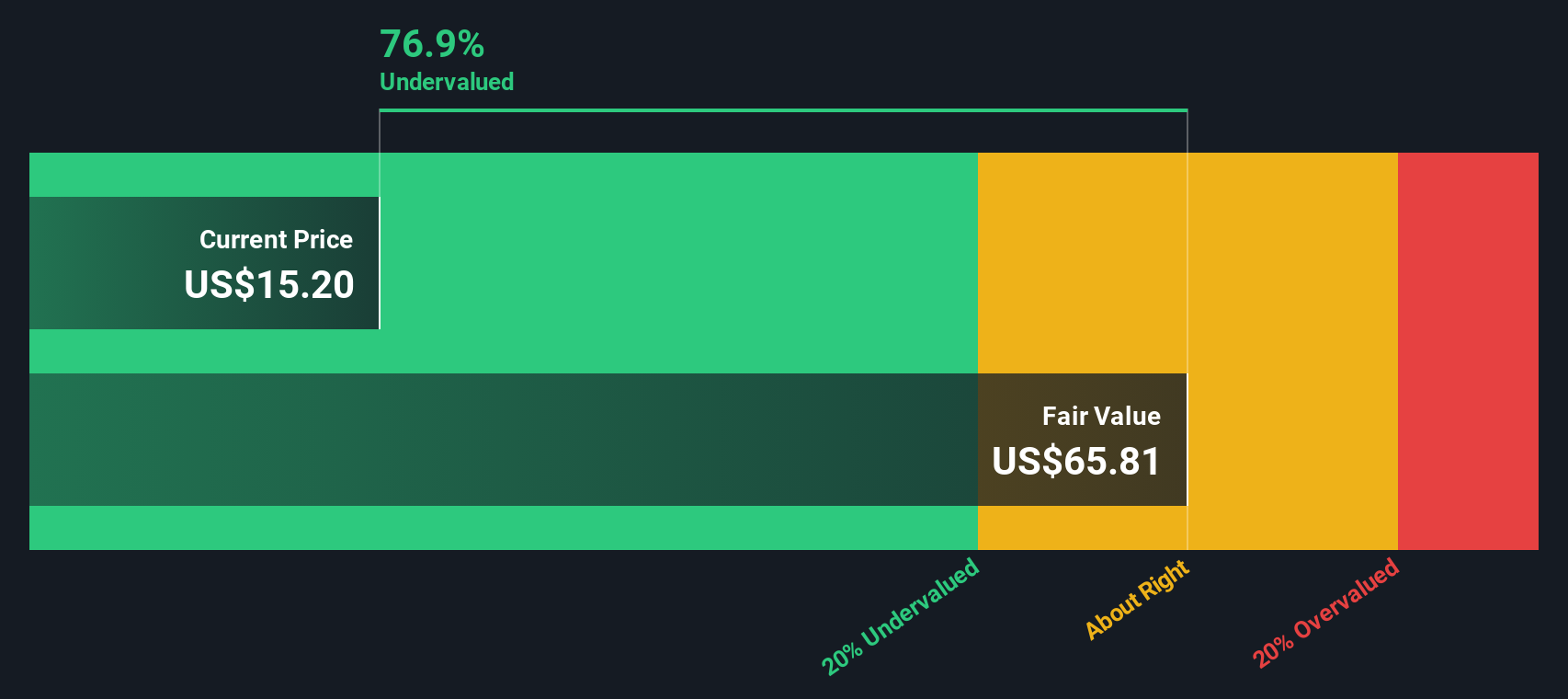

Another View: Discounted Cash Flow Tells a Different Story

While the market appears to be pricing Canadian Solar above the consensus narrative's fair value, our DCF model presents a much more optimistic picture. According to this approach, the shares are actually trading well below intrinsic value, indicating significant upside. Does this make the recent dip a buying opportunity, or do cash flow models overlook critical risks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Canadian Solar Narrative

If you see the story playing out differently, or want a deeper dive into the numbers yourself, you can craft your own view in just minutes. Do it your way

A great starting point for your Canadian Solar research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Moves?

Don’t settle for just one opportunity. Take charge of your financial goals by zeroing in on ideas you might otherwise miss using our powerful stock screeners.

- Capture income potential and pursue financial stability with these 17 dividend stocks with yields > 3%, featuring companies delivering yields above 3%.

- Stay at the forefront of innovation by targeting breakthroughs with these 26 AI penny stocks, set to transform tomorrow’s industries.

- Strengthen your portfolio by tapping into real value with these 874 undervalued stocks based on cash flows, which present opportunities based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CSIQ

Canadian Solar

Provides solar energy and battery energy storage products and solutions in Asia, the Americas, Europe, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives